Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

“What is a realistic return that is achievable in trading?” is among the most asked questions for new and aspiring traders. The trading industry wants you to believe that you can easily double your money week after week and with enough leverage, even the smallest accounts can generate substantial profits easily. But how true are such claims? We are going to take an honest look at what is possible, what to be aware of and how to plan your financial future in the trading business.

It is important that you start out with realistic expectations about potential profits and trading income. First, believing that you can earn a lot of money in a short time will put you in a mindset of a gambler and a risk taker. Believing that the next thousand Dollars are just a mouse click away is not a good starting point for a long term trading career. And second, if you start out with big goals and the belief that you will be able to quit your day job within the next year or two will negatively impact your mindset and psychology when you notice that after a few years of trading you are still far away from becoming a full-time trader. Traders who have the get rich quick mindset are more likely to quit early when they find out that trading is not the easy way from rags to riches.

Especially when new traders do not have the possibility to fund a decent trading account, they try to make up for it by taking bigger positions. Growing a small account is psychologically challenging because your average winning trade will be very small and usually not meaningful which will lead to overtrading and the abandonment of trading rules. But what will actually happen when you increase your risk with the goal to grow your account faster?

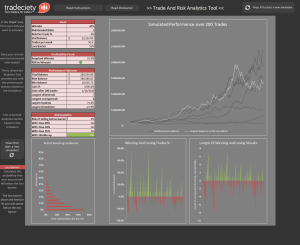

The following slideshow illustrates trade simulations and account growth based on a trading strategy with a 50% winrate, an average risk:reward ratio of 1.5 and a $10,000 starting account. All the different slides are based on the same trading performance statistics, the only variable that changes is the percentage risked per trade. It starts with 1% per trade and goes up to 15%.

[metaslider id=1157]

It is important to note here that, whereas the simulations from lower risk levels show smoothly rising equity curves that cluster around the same mean, the higher the risk per trade, the more volatility you will see in your trading account. Additionally, the risk of a margin-call rises significantly when using higher risk which you can see nicely by the simulated equity curves that fluctuate around $ 0. Another important thing to keep in mind is that the greater the swings in your account, the harder it will be psychologically to recover from a big drawdown of several tens of thousands of Dollars.

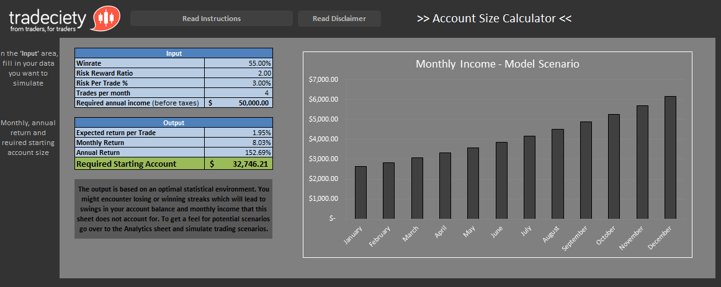

In order to know how big your trading account needs to be to generate a certain amount of money over a fixed timeframe, you should use the approach of backwards engineering. For many traders, this will be an eye opener and the first step towards a steady and stable trading career rather than approaching trading with a gambler-like mindset.

In order to precisely calculate the correct trading account size that you need to have to generate a specific annual income, you have to define 5 figures: (1) How many trades do you have per month, (2) What is your average Risk:Reward ratio, (3) How much do you risk per trade, (4) What is your actual winrate and (5) How much money do you have to make per year?

However, if you withdraw all your profits on an annual basis, you will hardly be able to grow your trading account beyond the starting account balance and therefore limit income potential. And second, the model is based on an optimal statistical environment – it does not account for long losing or winning streaks. In the following you can see 3 random scenarios and how the variables change the required account size.

| Winrate | 55% | 60% | 50 |

| Risk:Reward | 2.0 | 1.5 | 1.75 |

| Risk / Trade | 1.0% | 1.5% | 2.0% |

| Trades / month | 10 | 12 | 8 |

| Desired annual income | $ 50,000.00 | $ 50,000.00 | $ 50,000.00 |

| Required account size | $ 42,517.00 | $ 25,868.00 | $ 47,668.00 |

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...