Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

4 min read

Moritz

Aug 25, 2017 8:00:00 PM

Fundamentals…funnymentals. I remember a legendary trader saying that somewhere in the Market Wizards books, can’t think of who it was, though. The first known published stuff – to me – on technical analysis is Richard W. Schabacker’s work from the 1920’s.

The NYSE (New York Stock Exchange) was founded on the 8th of March in the year 1817, 200 years ago. The LSE (London Stock Exchange) was probably the first one in the world at its inception in 1773.

Trading has been around for much longer, however, just think about the Venetians in the 13th century, or a bit more relatable, the Japanese candlestick traders in the 1600’s – yes, those are THE candlesticks we are still looking at, today. They originate from the Japanese rice exchange.

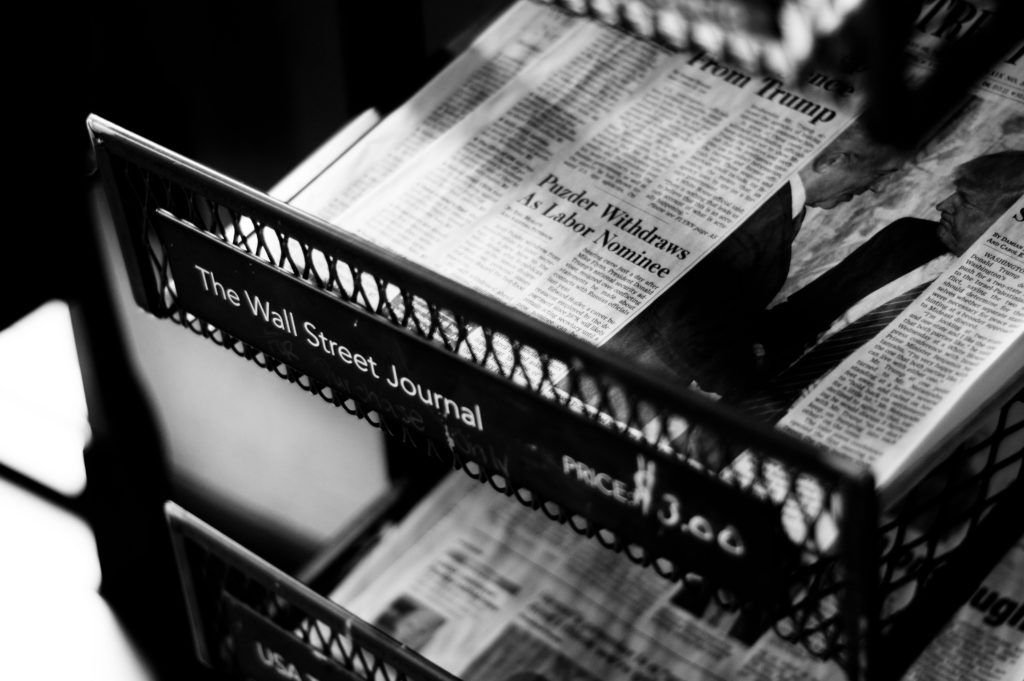

Information was and always will be key in trading. Whether that information is utilized by an electronic chart pattern trader of the 21st century or a Greece wine trader who was doing business years before Anno Domini. It’s always about supply and demand, supply and demand, supply and demand.

That’s what moves price in the end. Surely, some asset classes are more algo-driven than others, but even algos have to certain follow rules. Then again, most of us are not operating in the realm of HFT-trading, so we don’t really care about algos.

Whether you read a balance sheet and then decide it is a great time to go long a stock, or whether a certain pattern on your chart tells you that it is now time to go long, it doesn’t really matter – information is information. But there are some key differences between charting and fundamental analysis, of course.

Firstly, when new traders start out, I advise them to get started in charting before looking at fundamentals, because charting is easier to grasp. Notice I say easier, not easy. It is IMHO much easier to train our pattern recognition skills to always look for the same repeating pattern on a single chart and then trade that instead of looking for patterns in fundamentals which consist of tons of numbers and charts of those.

Even though nowadays computers can help us a lot with analyzing fundamentals, if you want to be a manual trader, go for technicals. On the other hand, if you want to be an algorithmic trader, go for fundamentals – quantitative analysis through “big data” is much easier than telling your algorithm how to recognize a pattern on a chart (and you still need to learn how to program, btw). Again, easier, but not easy.

Now there are two schools of chart traders that believe fundamentally different things. One school believes that supply & demand, market dynamics, mass psychology and so on are priced into the charts. So whenever a certain pattern happens, it happens for a reason, and thus the chart has predictive value – we do not need to look at the fundamentals because we can “see” them on the charts.

The other school, which I believe in, simply states that charts show us high reward:risk ratio (RRR) trade opportunities and their timing but have no predictive value. In other words, a chart tells me where to put my stop so I get a 3:1 or better RRR.

And even though charts have no inherent predictive value, you can absolutely trade them on their own, as for example technical chart trader legends like Peter Brandt and many of the stock market wizards have shown.

A chart also tells me whether trading activity in an instrument has been volatile or quiet and whether we are trending or ranging, two vital pieces of information for any trading strategy.

Now fundamentals tell me to go long or short, but they don’t tell me WHEN and how much to risk. That is a huge problem, and another reason why I tell everyone to get started in technicals first – you have to understand the correlation of Reward, Risk and winrate. Only then can you become a profitable trader.

If you then add fundamentals to your technical decision making process, you will call yourself a techno-fundamentalist and become one of the best traders there are. Because that’s simply the truth, the best traders know how to combine technicals and fundamentals.

William O’Neil, Mark Minvervini, Jesse Stine, Jesse Livermore, just to name a few. That being sad, it is certainly possible to be a strictly fundamental trader, but you will be an investor, not a trader, and trade longer-term overarching investment themes that don’t have a lot to do with trading.

Now what you should do when you start adding fundamentals to your system is simple – do it with a process. You still keep looking for the exact same technical setups that you are used to, but you start looking at volume, news items, earnings patterns, sector strength, whatever is important in the market you trade.

And you add those fundamental findings as a filter, not as a reason to enter a trade. I can trade 100% with a technical approach, as for example I do in my Forex/Futures daytrading and teach in our pro trading classes,, but adding fundamentals as a filter for my stock trading strategy (which can also be traded purely technical, by the way), does a few things for me.

Those are, for example, higher win rate, higher reward (because I know when to let the trade run beyond it’s chart target), higher conviction in my trade and actually a more enjoyable trade selection process because I KNOW what is moving price, I don’t simply see that it is moving.

Just always remember, look for the chart pattern first, then look for the fundamental reasoning to enter a trade. If you do it the other way round, you will get completely lost and make up chart patterns in your mind which don’t exist simply to find a justification to enter a trade.

So, do fundamentals or technicals make you more money? Well, whatever floats your boat, just know that a strictly fundamental approach will get you into the realm of investing, not trading, which is a completely different story. But if you learn to combine these two into one congruent trading strategy, you will have very high chances of succeeding.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...