Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Rolf

Oct 19, 2015 8:00:00 PM

The following article is a guestpost by JB Marwood. JB Marwood is an experienced trader with a passion for financial analysis and trading systems. Check out his blog at http://jbmarwood.com

The world is full of forex traders.

Every day, $5 trillion worth of transactions take place around the globe. Yet, despite this, millions of forex traders approach the market in exactly the same way.

They all watch price action or use technical indicators; moving averages, MACD, RSI, trend lines, pivot points, support and resistance lines. By following these technical indicators and patterns, traders hope to find a trend and predict where the market will go next.

But the problem with this approach is that it involves only one component of what really moves the market. It ignores fundamentals, ignores the news, ignores market sentiment and ignores any other market dynamic.

As a trader myself, I realize that technical indicators are useful. But to get more out of the market it’s important to look at other components.

Admittedly, it is not easy to see inside of the market but there are two tools developed by OANDA that I like to keep an eye on, which might help you to make better trading decisions as well.

The first tool I like to look at is the forex open positions ratios which is a summary of all open positions held by OANDA clients.

This data shows the percentage of traders who are long a currency pair and the percentage who are short. Although the data is restricted to OANDA customers only, since OANDA are a large broker, I’ve found that the data is fairly representative of the forex market as a whole.

What you will find when looking at this data is that there is normally a fairly healthy balance between longs and shorts. Most currency pairs will have a long/short ratio that sits in between the 35% – 65% range.

However, when there has been a very strong move in one direction, the open position ratio can become extremely one-sided. And it’s during these extremes that good reversal trades can be found.

| Specifically, I’ve found that whenever a forex pair has an open position ratio of 35% or less, (long or short), it’s often been a good time to go against the crowd and trade in the opposite direction. |

This is not a short-term thing. Trades often need to be held for several days in order to give the ratios time to re-balance and for the market to experience a reversal. However, I’ve found that these are good trades to take on, particularly when other factors line up.

One thing to be aware of is that this technique doesn’t work with gold versus the dollar or with currencies that are being propped up by domestic monetary policy.

For example, not so long ago EUR/CHF position ratios revealed that 90% of open positions were long. But this was simply because the Swiss National Bank had pegged the currency to the euro and everyone knew it. So going against the market in this situation was not effective.

Until of course, the peg was taken away.

The second tool to look at is the OANDA Order Book and this has to be one of my favourite trading tools for the forex market. Again, this is a really useful tool for looking inside the dynamics of the market, instead of just looking at price action alone.

Together with the historical order book these charts show collections of buy and sell orders in the market. So these areas are likely to offer really strong support and resistance levels to take note of.

And what’s also clear is that a large majority of orders are often clustered around round numbers, as Tradeciety already demonstrated here.

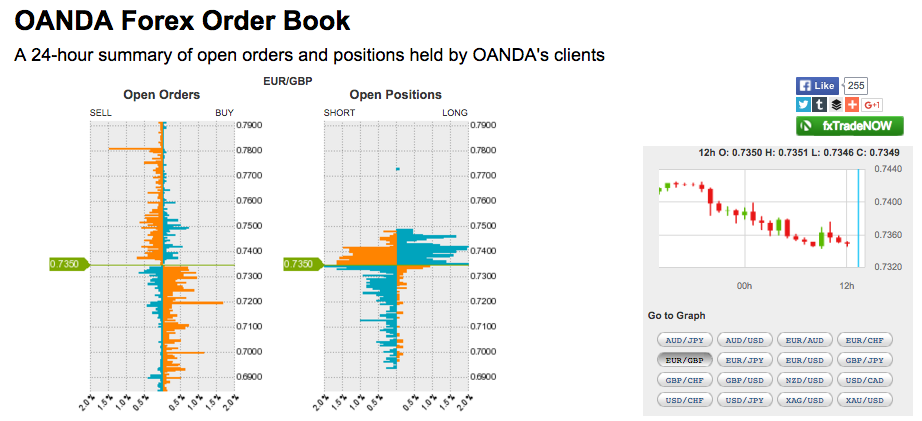

So, below you can see the order book for EUR/GBP for the morning of 15 October 2015. On the left shows all the open orders and you can see that there was a large cluster of blue, open sell orders right underneath the 0.7400 level.

A lot of these orders will have been stops, and some will have been break-out orders. At this point, EUR/GBP was trading at 0.7421.

So we know from looking at the order book that this 0.7396 – 0.7400 area is going to be key for traders.

If the market stays above this level then we are probably going to stay higher and trade upwards. But once the market touches this level, we are going to see a lot of sell orders come in and overpower the buys. That could easily lead to a strong downward move.

So the following graphic shows the order book and the price chart, around 22 hours later. And at this point EUR/GBP is trading around 0.7350.

You can see that the cluster of blue sell orders have disappeared.

Once the key 0.7400 level was broken, the market dropped quickly and continued to fall.

A trader who sold EUR/GBP as the 0.7400 level cleared, would have been able to capture at least 30 – 40 pips on the downside if they were sharp.

Overall, it’s important to consider the other components that make a market and not stick only to price action and technical patterns.

The two tools described here are useful for picking reversals and finding strong support and resistance levels in the market.

They require some skill to identify and they should not be used on their own. But every now and then, these tools show great insight and can help traders find an edge in their forex trading.

Image Credit:

The screenshots have been obtained using OANDA‘s trading web tools. Tradeciety does not have any affiliating relationship with Oanda.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...