Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

Time flies and we are almost half-way through March. How is your trading coming along? Are you making progress and following through on your New Year resolutions or have you forgotten them already? Don’t let more time pass and act NOW. One year from now you wish you’d listened to me and been more serious about trading.

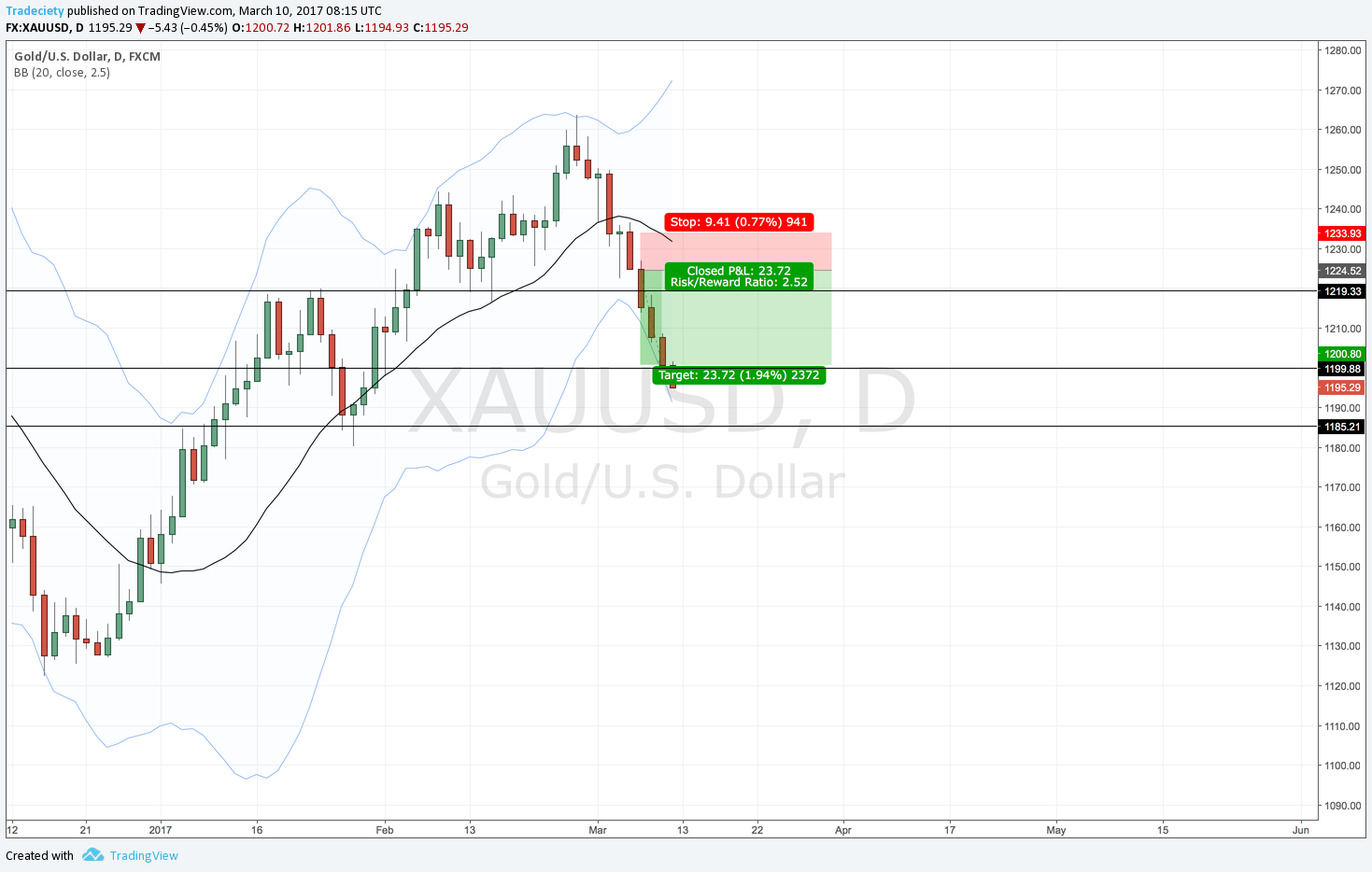

I also want to share one of my trades from last week: Gold short. It is a classic reversal with a momentum follow-through. I explained the concept of following and trading momentum last week and this Gold trade really follows all criteria.

The trade was a classic reversal: strong, multi-wave uptrend spiked into the Bollinger Bands and reversed. Then momentum shifted to selling and on the break of the 20 SMA, we transitioned into a downtrend.

Retests and trading retests is something many traders do, or at least try to do. There is lots of wrong tips and writing out there around trading retests. So let’s take a look at two examples and what defines a retest.

The chart below shows the current USD/CAD chart and many traders will believe that this is a retest. It’s NOT. Price is moving back into the 20 SMA and price is retesting the 20 SMA right now, but this is not a sucessful retest yet. This is the biggest misconception about retests. A retest does not happen when price touches a support/resistance, trendline or moving average. A retests is only a valid retest when price has moved away from the area again.

So in the example below, the retest will only be a retest once price as broken the previous support-resistance flipzone. Until then, this should not be traded.

Of course, you can argue that you could get in at a better price and create a larger reward:risk ratio but those setups will fail very often and avoiding losses and preserving emotional capital should be a top priority for traders.

Price broke the 20 SMA and then put in a range with a clearly defined support level. Price tested the 20 SMA multiple times but only once price broke the support with strong momentum (remember the momentum video from above) was the retest confirmed and price showed enough momentum that a high probability pattern existed.

The “problem” with the retest is that it requires a lot of patience and 99% of all traders will enter somewhere in the range and get whipsawed, lose a lot of money and are then not able to recover the losses on the real breakout and retest.

I hope this helps you understand a few important trading concepts in a better way: trading WITH momentum, staying patient and waiting for the confirmed retest will often make a huge difference for many taraders.

Have a good week 🙂

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...