Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

I love price action trading because once you understand how to read charts correctly, they tell you a real story about the buyers, the sellers and the powers between them. Trading price action then becomes like a game of chess where you have to set up your move, wait patiently and then execute once you see that your ideas are playing out – or pass on the opportunity if your plan didn’t work out.

In my trading, I keep it super simple and although it might look complicated, I limit my chart analysis to a few key principles:

Now I want to show you how simple it can be to read a chart and we’ll go through a chart from left to right together and I will point out what to pay attention to.

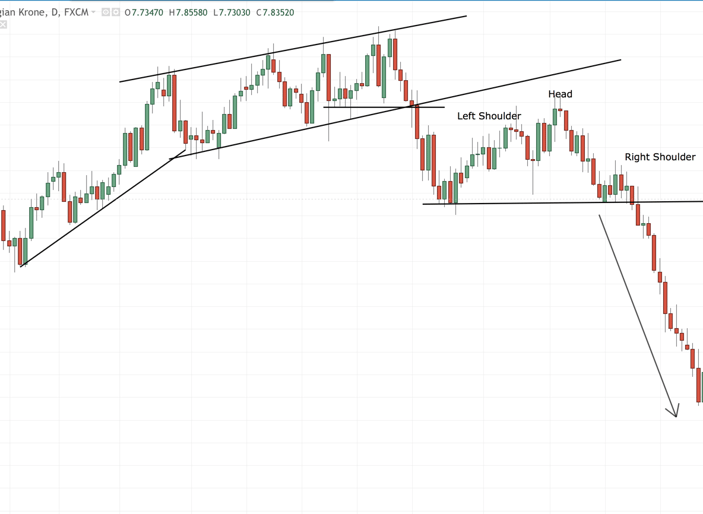

The case study is the current chart scenario you are seeing on the USD/NOK on the Daily timeframe and we’ll go through the chart step by step. This type of reading charts is applicable to any market and any timeframe because it focuses on the underlying principles that drive charts.

We’re starting with a bullish trend upwards, but we can already see that the trend is slowing down by looking at the trendlines. The lower trendlines show that the lows are not moving much higher on the pullbacks. At the same time, the price is also showing that the highs are barely pushing higher; this is not a healthy uptrend. It’s NOT a sign yet that price is going to reverse, but it’s a first warning.

Now price has confirmed what we have seen before and the uptrend is coming to an end as price is breaking lower. The price is not only breaking the trendline, but also the last areas of lows (horizontal line) and, thus, confirming the first lower lows during the entire uptrend.

This is the foundation of Dow Theory and whenever you see a series of higher highs and higher lows violated, you need to pay attention.

The downtrend doesn’t just take off but we see another transition pattern after the uptrend has ended. The Head & Shoulders is maybe my favorite pattern and so versatile with high predictive power. The Head & Shoulders shows a transition from an uptrend to downtrend as the highs are slowly turning around.

If you’d extend the previous support, you’d also see that the Head is retesting it now as resistance.

The hardest part of the Head & Shoulders is waiting for a confirmed break of the neckline – the support level.

In hindsight, the trend looks super easy to trade after the Head & Shoulder breakout. The problem here usually is that many traders will prematurely have shorted the market before and accumulated losses and got so frustrated that they’ll not trust the neckline breakout.

Looking at clean charts and applying patience is not easy, but it will transform your trading. Once you feel comfortable spotting those simple patterns, you can approach your charts differently and you understand where the big moves happen: once those key levels have been broken and you can stay away from prematurely trying to predict the next big move.

Everyone who missed the major downtrend move is now frustrated and eagerly waiting to make some money on this chart. Many traders will then start calling early reversals, hoping that they can make up for what they have missed.

A good rule of thumb is that, as a reversal trader, you should not go against trends that thave only one trendwave. Single wave trends usually continue and do not turn as easily.

Here we saw a small consolidation, but at no point did we ever see any signs of bullishness. This is a key observation. Reversals are usually preceded by a change in candle size and momentum.

Now, things started to look a little different. After the consolidation, price didn’t continue as strong and the following trendwave was relatively short, compared to what has happened before. Then we also start seeing a double bottom where price struggled to break lower, followed by larger bullish candles – the thing we were missing during the previous consolidation.

Again, this is not enough yet to get long, but it’s a heads up that something is changing here and the bears are not in full controll anymore.

Price is now showing a new trend sequence and the price is making higher lows and once it broke the dotted horizontal resistance, we’re also pushing into a fresh area where price does not face any resistance on the way up.

Now it does look like an obvious long and everyone is thinking the same. Such patterns are often followed by a shakeout or a retest that will scare out the already long positioned traders. Remember the Head & Shoulders pattern from the start? It already looked like price was ready to start a new downtrend after the trendline break but the Head & Shoulders made it harder to hold on to those early shorts.

You can see that such a way of reading charts can be very simple. Of course, it doesn’t mean that it’s going to be easy and there are still lots of variables you need to consider before taking a trade, but it’s a great start to declutter your charts and read price action effectively.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...