Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

When a trader is just starting out he has to choose the market he/she wants to trade. Although most traders don’t make those decisions consciously, but rather trade the market that they first come across, it pays off to analyze the different characteristics of individual financial markets and evaluate the best fit for your objectives and goals.

Currency trading and the Forex market is by far the biggest financial market and the most amateur and retail traders are actively trading forex. A brief summary of the characteristics of forex markets and forex trading:

The combination of a market that is opened throughout the whole week, high liquidity, low costs, high volatility with lots of movements and high leverage makes forex trading very attractive and appealing to individual traders.

Read our guide to Forex pairs and what it means that currencies are traded in pairs

In the Forex market, currencies are always quoted and traded in pairs. For example, the most commonly traded Forex pair is the EUR/USD which is the EURO against the US-Dollar. Furthermore, traders differentiate between major Forex pairs, which are the most trades pairs and they include EUR/USD, USD/JPY (US-Dollar and Japanese Yen), GBP/USD (British Pound and US-Dollar) and the USD/CHF (US-Dollar and Swiss Frank) and minor Forex pairs which are more “exotic” and include less commonly used and trades currencies.

Further reading:

New York Stock Exchange – NYSE

Stocks and the stock market is often what people hear about first when they start developing an interest for financial markets and trading. Whenever you turn on the TV or read through the newspaper, the stock market always comes up and even mainstream media picks up stock market related topics from time to time. The following points characterize stock markets and stock market trading.

Stock trading follows stricter rules and a definite schedule which can be appealing for traders. The limitations of low leverage and short selling can be avoided by trading futures or other trading vehicles. Penny stocks (stocks that are traded below $5 a share) are very popular among less capitalized traders because they require smaller trading accounts and can be more volatile. The closing hours of stock markets are often seen as an advantage for individual traders because they provide some kind of schedule and the feeling of a ‘normal job’ and you don’t need to be infront of the screen all day long like in Forex trading. The influencing factors for stock trading are also limited, compared to the influencing factors of Forex markets.

Stocks represent equity shares of companies and the individual stocks of one country are combined together in a so-called stock index. By following the index of a certain stock market, investors can quickly identify the sentiment and the state of that economy.

Here is a list of the most comonly traded stock markets and which country thei are from:

| S&P 500 | 500 companies of the US economy |

| Dow Jones Industrial Index | The 30 largest companies of the US economy |

| Nasdaq | Includes technology stocks of the US |

| Euro Stoxx 50 | The 50 largest companies of the Eurozone |

| DAX | Index of German stocks |

| CAC40 | French stock index |

| FTSE100 | UK stock index |

| Shanghai Stock Index | Chinese stock index |

| Nikkei250 | Japanese stock index |

| Hang Seng | Hong Kong stock index |

| Stocks | Forex | Conclusion | |

| Trading hours | Opens locally plus after hours trading. | 24 hours a day, 5 days a week | Some people prefer local open hours because it gives them time away from the markets. |

| Instrument availability | Limited. Brokers often only cover certain exchanges. | Most forex brokers offer almost all types of currency pairs. | Most traders mainly trade one market which makes the limitations of stock availability not significant. |

| Volume analysis and DOM | Possible. DOM and level 2 available due to centralization. | Not possible. No central forex market exists. | Advantage for stock trading due to more information available. |

| Liquidity and execution | Unproblematic for the main indices. Liquidity can be restricted for other instruments. Execution not guaranteed to be flawless. Slippage more common. | Under normal market conditions high liquidity and fast execution. In case of an unexpected event, slippage can be significant. | Can be advantageous for forex traders. Stock traders have to be aware of these limitations. |

| Leverage | Max leverage of 2:1 | Very high leverage available | Especially less capitalized traders tend to choose forex because of high leverage. |

| Influencing factors | Often limited to local the economy, but with globalization also increasing | A wide variety of influencing factors from political to geopolicatical factors. | Forex trading definetly requires a broader perspective, but stocks are becoming more influenced by other factors as well. |

Commodities are another asset classe, besides the Forex and the stock market. Basically, commodities are raw materials that humans produce or use to produce and process other materials. Commodities include metals such as silver, copper or gold, oil and natural gas, or agricultural materials such as wheat, corn, rice or livestock.

Commodities are another asset classe, besides the Forex and the stock market. Basically, commodities are raw materials that humans produce or use to produce and process other materials. Commodities include metals such as silver, copper or gold, oil and natural gas, or agricultural materials such as wheat, corn, rice or livestock.

Commodity trading can be subjected to great geopolitical risks and the supply demand factor plays a very big role, since commodities have to be explored and exported from different countries around the world. Politics are very important for commodity trading and political unrest and actions can have significant impacts on how commodities move.

Further reading: What does a strong Dollar mean for commodities and other asset classes?

Commodity markets are also closely watched by traders and investors who participate in other markets and commodity prices also influence other financial markets.

For example, copper, which is used in constructions, can provide insights about the state of the economy. When copper prices start rising, it could signal that demand is increasing and that the economy is growing which could lead to an appreciation in equity markets (although this relationship can, and has, changed over time).

The relationship between Gold and equity markets is also very popular. In times of uncertainty and when stock prices fall, Gold prices tend to rise as investors are looking for “safe alternatives” where they can store their capital.

But also Forex traders often pay close attention to commodity markets. The Australian Dollar, for example, is closely linked to the price of Gold because Australia is a large Gold producer and exporter. When Gold prices fall, the Australian economy and the Australian Dollar are heavily impacted.

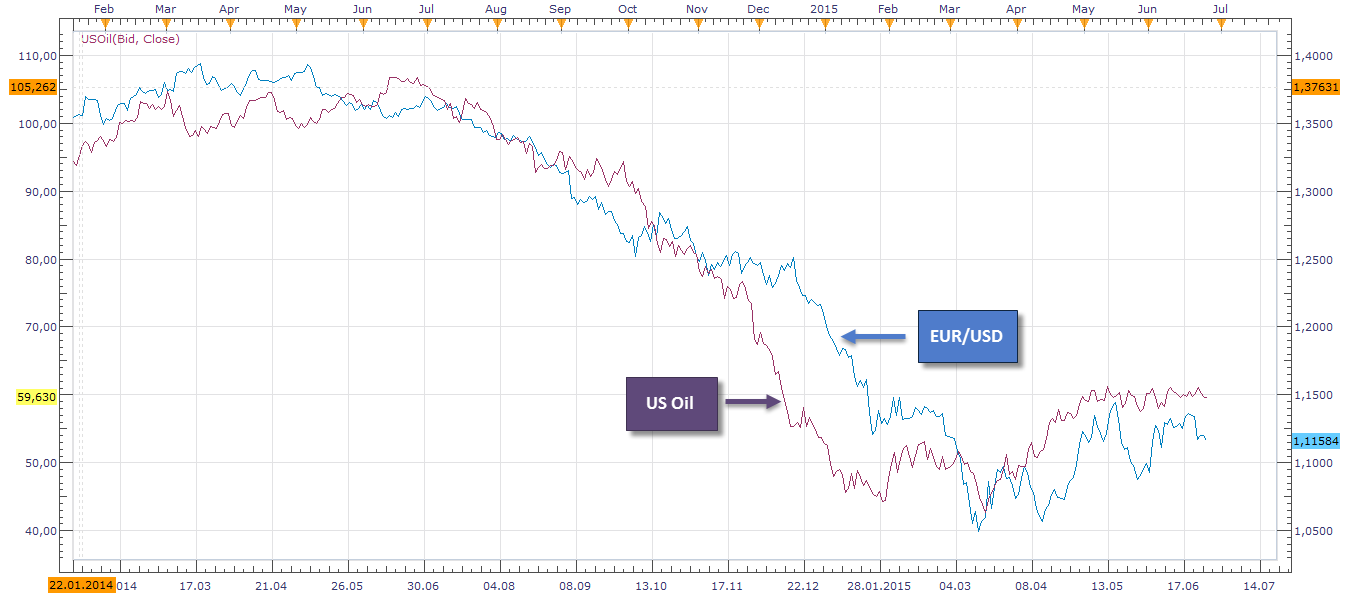

The screenshot below shows how closely linked financial markets can be. The chart shows the EUR/USD currency pair and US Oil and it is apparent at first glance that those two markets aver very connected and often move in lock-step.

As you can see, financial markets are closely interconnected and the differences between trading the individual markets can be quite significant at times. The Forex market is definetely the financial market where most amateur traders start out, but we also see a growing interest in trading the local stock market because of the familiarities with the local companies and the economy.

In the end, it’s a personal choice and as long as you understand the differences between the different markets and what are the drivers of the individual markets, you can make an educated decision and start your trading carreer on the right foot.

And if you still got questions and are unsure, just leave a comment below and we are happy to provide more specific help.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...