Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

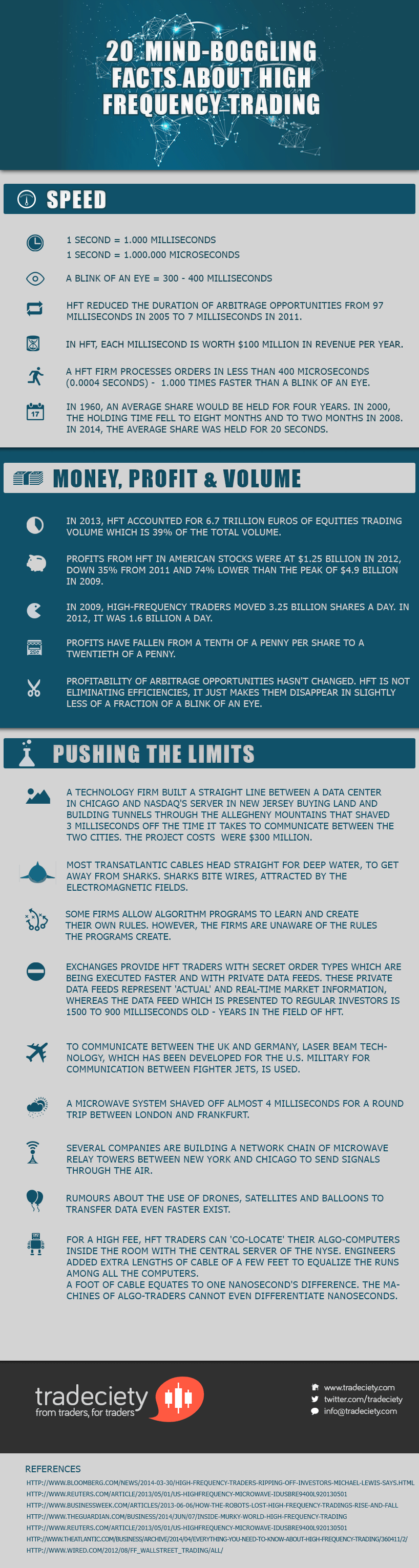

In the last few years High Frequency and algorithmic trading has been used as an excuse by traders when they found themselves in losing positions or failed to find explanations for market moves. However, the world in which HFT and algo-traders operate, is nothing but perplexing and impossible to imagine for the average trader and human-being. We collected 20 of the most mind-boggling facts about high frequency trading. Or did you know that HFT traders are scared of sharks because they bite their deep-water wires? Whether or not HFT is a good or bad thing is another matter altogether.

For further information, please visit the references and sources used in this graphic.

http://www.bloomberg.com/news/2014-03-30/high-frequency-traders-ripping-off-investors-michael-lewis-says.html

http://www.reuters.com/article/2013/05/01/us-highfrequency-microwave-idUSBRE9400L920130501

http://www.businessweek.com/articles/2013-06-06/how-the-robots-lost-high-frequency-tradings-rise-and-fall http://www.theguardian.com/business/2014/jun/07/inside-murky-world-high-frequency-trading

http://www.reuters.com/article/2013/05/01/us-highfrequency-microwave-idUSBRE9400L920130501 http://www.theatlantic.com/business/archive/2014/04/everything-you-need-to-know-about-high-frequency-trading/360411/2/

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...