Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

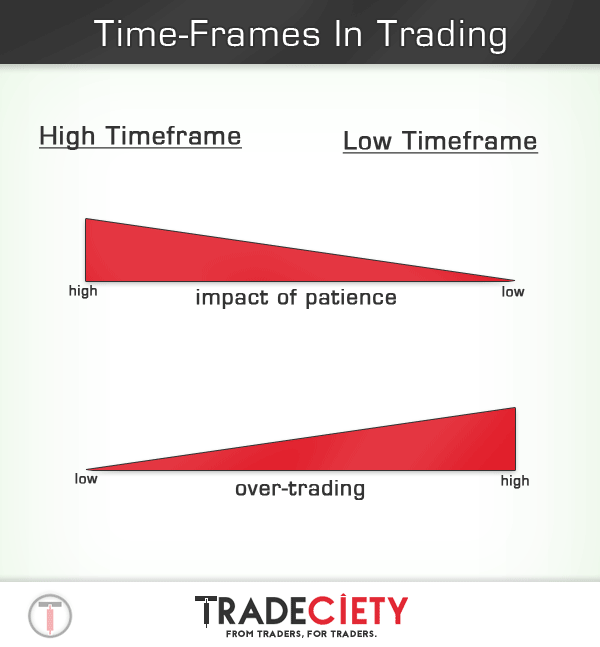

Although the type of trading style impacts the choice of time-frames to some degree, it is worth highlighting the differences and nuances of the individual time-frames explicitly to enable traders to make a conscious decision about which time-frame to use for their trading based on their objectives, personal needs and character traits.

These are usually the monthly, weekly and daily time-frames. Whereas day traders use these time-frames to get a broad overview of the market and to identify the general market direction, swing traders rarely go any lower than the 4 hour time-frame and spend most of their time on these time-frames. Trading the higher time-frames might also be more suited if you are still working in a regular job where time for trading is limited.

Although, the myth exists that trading higher time-frames is easier, this is not entirely true. Trading the higher time-frames is a whole other game and requires a very different skillset. Traders who struggle with patience, will often find it even harder to trade the higher time-frames where waiting for entry signals can take days or weeks. Furthermore, managing trades on the higher time-frames requires emotional stability because traders have to accept and deal with frequent retracements during their trades.

These are mainly the 4 hour, 1 hour, 30 minute and 15 minute time-frames. These time-frames are used by most day traders. Patience plays a smaller role on these time-frames, because trade signals occur more frequently. However, traders who tend to over-trade and engage in revenge-trading often have more problems on these lower time-frames because more potential trading opportunities exist and volatility is higher on the lower time-frames, creating more opportunities as well.

The choice of time-frames is, therefore, more than just picking the first best that comes to your mind or something other traders suggest, but a factor that has to be aligned to your personality and your emotional state.

Further reading: Why higher timeframes are not easier to trade

The top-down approach is used by many traders and performing a top-down analysis can be very helpful when it comes to determining trade opportunities and creating a trading plan.

At least once a week, a trader should take a look at his Monthly and Weekly time-frames to understand where current price is in relation to the bigger picture or whether price is approaching important support and resistance levels.

Further reading: How to perform a multiple timeframe analysis

Using the higher time-frame as a directional filter can also improve the quality of your trades. For example, a trader can only choose to trade in the direction of the trend that he can identify on the higher time-frames. The lower time-frames are then used to time the entries and to find trade signals based on the trading methodology. By going with the overall market direction, a trader can often realize much smoother trades and avoid getting whipsawed in counter-trend situations.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...