Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

There is an ongoing debate whether you have to follow news and fundamental data in order to succeed as a trader. And although there is no right or wrong when it comes to answer these questions, it can surely help to be aware of what is happening in the world on a day to day basis and, especially when you are a day trader, keeping track of upcoming news can be essential.

Fundamental data can, and certainly often is, the driver of the broad market direction in some markets. When an economy is in a crisis you don’t necessarily want to be long their equities market, when an oil rig explodes, you don’t want to have exposure to that company, when interest rates are changing dramatically, currencies can change direction, or when there is a shortage of any agricultural commodity, trading opportunities might present themselves.

Fundamental data can serve as a directional bias for trades. For example, when fundamental data indicates that markets might go up, you can decide to stay away from short trades and only look for buying opportunities. Avoiding counter trend trades can often help traders to stay out of whipsawing trades. If the news situation is uncertain and new fundamental data and news are being released frequently, markets are often more erratic and price movements can be volatile and short-lived. In such an environment, traders will do better if they avoid that market altogether until the dust settles. Remember, there is always another trade and a new opportunity.

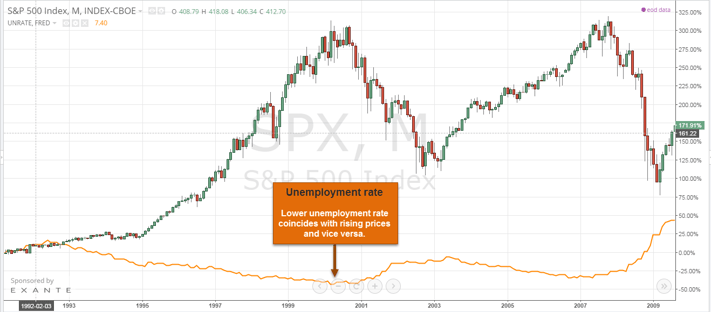

Unemployment rate is a very important number which often can set the tone for the market direction – click to enlarge

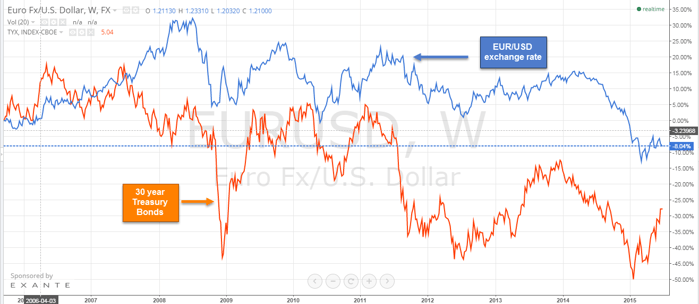

Interest rates are very important in forex markets and the EUR/USD and the 30 years Treasury bonds have a close relationsip – click to enlarge

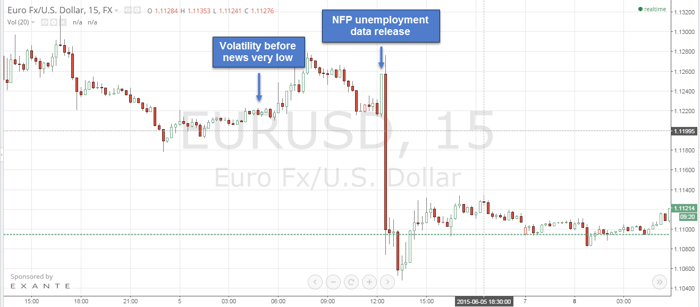

Especially day traders, who hold trades for a shorter amount of time and who are more vulnerable to sudden volatility spikes should be aware of upcoming news events at all times. High impact news releases or surprising economic data can cause significant price movements in financial markets. Traders can often avoid being caught in an extreme, but short-lived, price spike if they are aware of the news. You don’t even necessarily have to read all the news articles or make sense out of fundamental data if you are a purely technical trader, but checking the daily news calendar has to be a mandatory step on your daily trading routine.

Before high impact news releases, volatility often dries up when everyone is waiting for the news to come out. Entering a trade in such times, often does not provide profitable trading opportunities and you risk getting g caught off guard when the news come out. Traders often report that they avoid trading 30/60 minutes prior and after important and high impact news events. The chart below shows the EUR/USD currency pair before, during and after the release of new NFP unemployment data.

How important is it to understand the fundamentals and the market I am trading?

As we have indicated, it might not be ultimately necessary to ‘understand’ fundamental data, especially if you are a purely technical trader, but being aware of what is going on around you is essential can should not be blanked out. Additionally, most traders use the excuse that they are technical traders to skip the part of fundamentals because they, in their core, don’t want to put in the work. However, checking the news calender twice per day will take less than 10 minutes of your time and can help you avoid unnecessary losses.

In our tools and resource chapter, we provide a collection of the best news services and tools available.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...