Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

The term ‘Black Swan’ was coined by Nicholas Taleb, a finance professor, author and former Wall Street trader. A Black Swan event describes an unexpected event that shocks the world by its impact and the magnitude. For example, the 9/11 attacks or the Tsunami in Japan with the subsequent nuclear power plant accidents can be considered Black Swan events.

By definition, a Black Swan event cannot be predicted and, therefore, no precautions can be made, or otherwise the occurrence of the Black Swan wouldn’t be a Black Swan anymore, because the impacts would only be of small scale (if we knew that a Tsunami could have caused an accident in a nuclear plant, it would have been build in a different way and no accident would have happened; hence, no Black Swan).

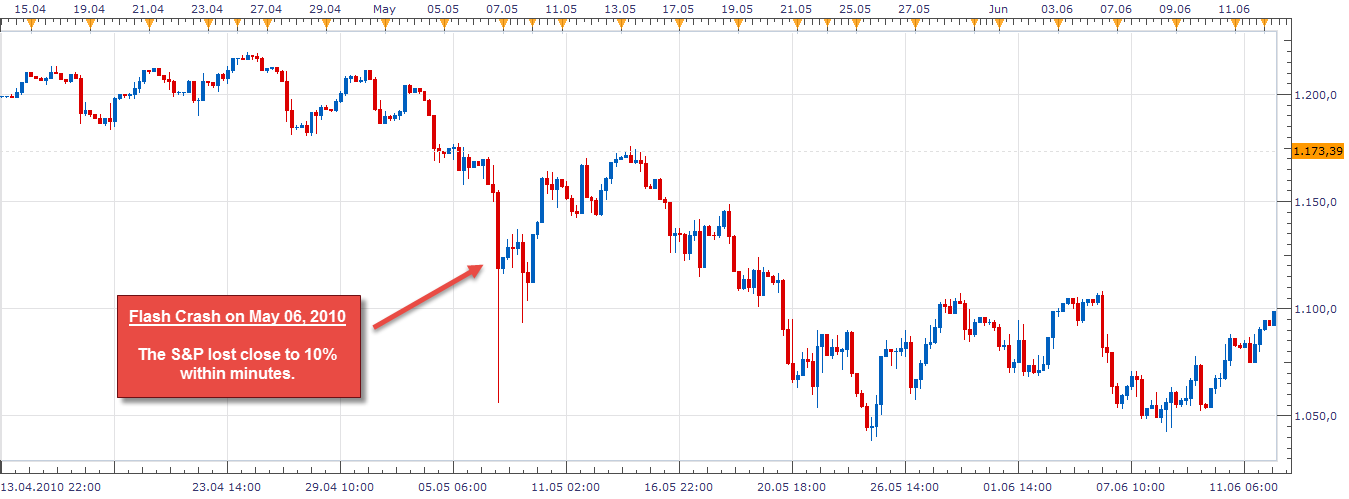

The two most recent examples of Black Swans in the capital markets were the 2010 Flash Crash (top) and the release of the peg of the EURO and the Swiss Frank (bottom).

In both cases, the market shock was significant and the price movements exceeded all regular boundaries, with the SP500 losing close to 10% and the EUR/CHF dropping 20% within minutes. Traders who were positioned on the wrong side of the markets under such conditions could easily lose their whole trading account and even end up owing their broker money because, getting an order fill and exiting positions under such circumstances is almost impossible due to the unilateral liquidity.

You might say that such Black Swan events are very rare and you are right. But it is enough to be on the wrong side of such an event only once. In the course of a trading carreer, such events are likely to happen multiple times and being exposed to such a market shock can lead to losses that exceed all previously made profits over years and decades. It is therefore important to take precautions to protect your trading capital and your savings.

Have you ever read the fine print in your broker’s terms and conditions? It usually says something like this:

A regular stop loss does not protect you and does not eliminate trading risk. When price reaches your stop loss, your order is closed. In case of slippage and price gaps, the price your stop loss is executed at can be substantially worse than the actual stop loss order.

What this means is that under ‘normal’ circumstances, your stop loss order will work just fine. But when an unexpected piece of news hits the market and price gaps, your broker cannot guarantee that your stop loss is actually being executed at the price level where you set it. During Black Swan events, it is likely, and almost guaranteed, that your stop loss order will be executed hundreds or even thousands of points later, after the trade has wiped out your whole account. As we have mentioned, losses can even exceed the initial capital and you can end up owing your broker money (another reason why reading the fine print of the terms is important).

Some brokers offer guaranteed stop loss orders where they will always execute your order at the price you set it to.

Segregation of funds means that brokers offer a protection of your trading capital and that customer funds are kept separated from the assets and the capital of the broker itself. In case of insolvency, or bankruptcy, the segregated accounts and customer funds have a preference. However, your funds will usually not be protected 100% – different brokers offer different levels of recovery amounts. Therefore, before choosing a broker you should first check whether the broker offers segregated accounts at all and to which extent you can get your money back in case of financial turmoil. Black Swan events in particular can be the cause for solvency problems when suddenly the majority of clients loses a big stake of their capital or even loses more than their initial deposit.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...