3 min read

Scientist Discovered Why Most Traders Lose Money – 24 Surprising Statistics

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...

4 min read

Rolf

Feb 14, 2017 7:00:00 PM

I think it’s important to spend quality time thinking about the common knowledge that gets passed around. Those phrases are often meaningless and people have no real understanding of what they actually mean. Or, worst case, they misinterpret it completely wrong and it harms their trading.

Today, I want to share my view on the term “trade the probabilities” and why I think that most traders don’t do it, although they will tell you otherwise.

When traders say that they trade the probabilities or that you need to do that, they usually mean that as long as you have a ‘winning’ system, you will make money even if you have a few losing trades over the short term. In essence, that is a good approach and the right mindset to be in; just focus on making the best trades and, over the long term, you will come out ahead.

By the way, having a trading ‘edge’ means the exact same thing. An edge is an advantage or a skill that shifts the odds in your favor so that you can trade with a positive expectancy. An edge can come in different forms: from psychological resilience, to risk management skills, great understanding of technicals and price action, or being able to interpret fundamental data in a meaningful way.

The meaning is always the same: trading in a way that allows you to generate positive returns by following a repeatable process.

But what all this really boils down to is following a repeatable approach and process in your trading. The importance of this cannot be stressed enough and it will determine the success of your trading career.

Having a repeatable trading approach means that you have clear rules in place for your trading. And this goes all the way from scanning markets, to finding entries, sizing positions, managing trades, exiting trades and journaling them later on.

I have said it so often here before but let me repeat it one more time:

The amateur wants consistent profitable results BEFORE he will follow a consistent approach. The professional has a consistent approach before he expects to make positive returns.

Amateur and struggling traders jump from system to system, take random trades they shouldn’t be in, don’t have rules at all, listen to other people’s opinions and are all over the place. Following such an approach, it’s impossible to ‘trade the possibilities’ because you cannot reproduce the results and the results will be all over the place.

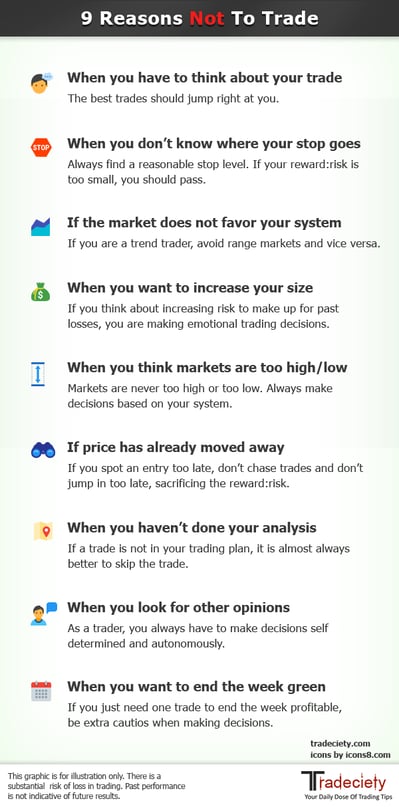

click to enlarge | Read more: When NOT to trade

For long-term success (or at least the chance for success), you have to create a structured trading environment for yourself that allows you to have consistent results. This does not mean that you will automatically have profitable trading results, but you will be able to make targeted adjustments and steady improvements over time.

Here are my top tips for creating a repeatable trading process:

There are a few more points, but you get the idea. The goal is it to create a professional trading environment that allows you to have a consistent approach and understand what is going on in your trading. Only then is it possible to improve as a trader over time.

You have to create a trading approach that allows you to take the exact same trade over and over and over and over again. This is especially true if you are a technical trader. Eliminate all the noise and trade your ONE system without distractions.

Now that we have a good understanding how to create a better surrounding for yourself, let’s take a look at a few Dont’s and things that make it impossible to ‘trade the probabilities’. But instead of beating yourself up, be honest to yourself and try to eliminate as much from your trading as you can:

Those are the cardinal sins in trading and you need to make sure you eliminate them. Any one of them will create meaningless trading results because you cannot interpret them.

Many traders believe that their system isn’t working when, in reality, they are not even following their system and just taking random trades. Those random trades need to be avoided at all costs because they mess up your mindset and the way you look at your trading results. You might have a promising trading strategy at your hands but all the trades you shouldn’t be in are erasing your profits. This is such a big problem in trading and it causes trading failure and problems for many traders even after years.

[bctt tweet=”Many traders believe that their system isn’t working when, in reality, they are not even following their system. Understand your trading!” via=”no”]

Always, always stay consistent when it comes to making trading decisions so that you have a chance to trade the probabilities.

Here is a webinar I gave where I talked about trading emotions and how to manage them with very practical tips.

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...

3 min read

Trendlines can be great trading tools if used correctly and in this post, I am going to share three powerful trendline strategies with you.

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...