Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

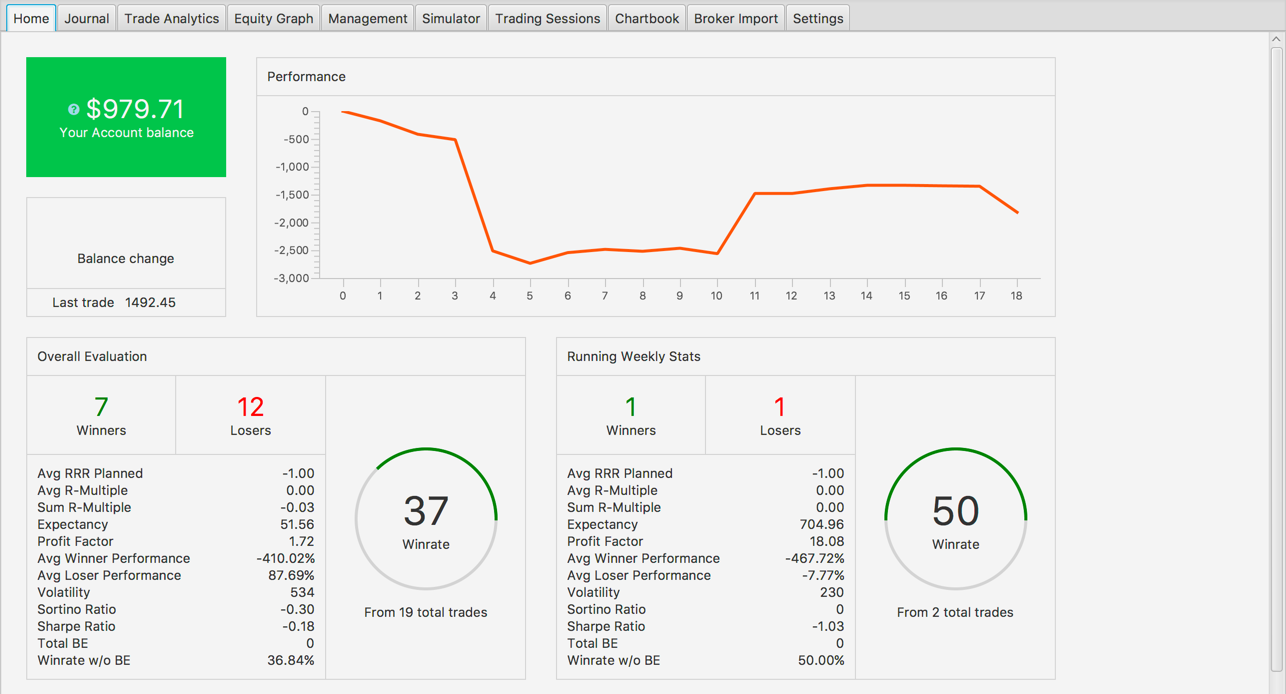

Edgewonk is much more than ‘just’ a regular trading journal. Most trading journals, especially the free alternatives on the web, are data graveyards where you just get a summary of all your trading data blended together into meaningless figures.

Disclaimer: Edgewonk is a trading journal developed by Tradeciety and modeled after our own trading journals.

Edgewonk is the first trader development suite where we combine the most important journaling features with our unique trader development tools: analyze trade management, review your emotions, simulate future account developments and actively improve the way you set trades and your orders.

Edgewonk comes with all the important statistics a trader needs to know, but then we take it one step further. By leveraging the tagging-function you can create a personalized journaling and review routine. Start by tagging all your trades based on the setup you took, but don’t stop there. Utilize the unique Custom Statistics and create personal categories and tag each trade with your own descriptions. Furthermore, the entry, exit and trade management functionality allows you to analyze each part of your trading separately. Only then, reviewing your performance and trading data provides real value.

To help you understand your trading data in Edgewonk better, we have compiled a list with all the metrics and statistics in your trading journal:

This metric measures the distance between the entry and your stop (potential risk) and compares it to the distance between the entry and the target order (potential reward). The ratio of those two numbers, potential risk and potential reward, is called the Reward:Risk Ratio and it’s an important metric.

How to use it in your trading: Use it as a first filter for your trades. Avoid trades that have a Reward:Risk Ratio that is too small – more on that later under (Traffic Lights). This way, you can potentially, improve the outlook of your trading significantly.

The R-Multiple is similar to the RRR planned but the R-Multiple measures the final outcome of your trade. The ‘R’ stands for Risk.

For example, a trade where the original stop loss got hit has an R-Multiple of -1. A trade where you closed the trade halfway to your stop loss has an R-Multiple of -0.5. A winning trade where the target was twice the size of the stop loss has an R-Multiple of +2.

The expectancy is a long-term metric and it says how much, on average, each trade is worth. For example, let’s say you made 100 trades and won $5,000 over those 100 trades. The expectancy, in that case, is $50 ($ 5,000 / 100). This means that each trade is worth $50 over the long-term.

How to use it in your trading: The expectancy, for one, is a confidence builder. If you see that your system has a positive expectancy, it tells you that, all things being equal, you have a high likelihood of coming out ahead even though you might experience losing streaks and drawdowns.

Furthermore, by leveraging the tagging function in Edgewonk, you can identify parts of your trading, specific setups or situations, where your expectancy is negative or low. Then, you can either eliminate those or work on them targeted.

The Profit Factor compares the average losing and winning trade and builds a ratio. For example, if your winning trade is on average $100 and your average loser is $50, your Profit Factor is 2 ($100 / $50).

In the home tab, you see two metrics for the performance of the average winning and the average losing trade. As the name already says, this gives you the average return figure for winning and losing trades.

This metric can be used to compare your trades and if you see major deviations between the two, it could signal problems in your risk management. This is especially true if your average losers are much larger than your average winners.

Volatility, or Standard Deviation, shows how much your returns fluctuate. If your risk management is in point and your winners and losers usually have roughly the same size over the long term, the volatility will be low. On the other hand, a trader whose returns per trade fluctuate a lot will have a higher volatility.

The Sortino Ratio measures the risk-adjusted return. What this means is that the Sortino ratio compares the returns of your trades to the volatility. Basically, the higher the Sortino Ratio, the ‘better’ your performance because it means that the return is higher while the risk (volatility) is fairly low. A trader who has small returns and a high risk (high volatility) has a low Sortino Ratio.

We added the Sharpe Ratio for the sake of completeness but essentially it is very similar to the Sortino Ratio with a few drawbacks. When it comes to risk-adjusted returns, we recommend that you stick to the Sortino Ratio.

Those two metrics measure how far price went against you and how far price went in your favor.

For example, if you entered a long (buy) trade at $100 and price went down to $98 before reversing, this trade had a MAE of $2. The MFE does the opposite.

How to use it in your trading: The MAE and MFE are typically used to adjust trade exits and profit taking because they provide information about how much, on average, price moves around your entries.

The MAE and the MFE is a good starting point when it comes to getting a better understanding of how price behaves around your trades, but we will see, the Edgewonk unique Updraw and Drawdown are superior for traders who use hard targets and stops.

Edgewonk comes with a set of unique performance metrics and features that will help any trader gain completely new insights into their trading performance and behavior.

The Updradw and Drawdown are similar to the MAE and MFE but they measure how close price came to your target (Updraw) and your stop loss (Drawdown).

For example, if you see that your average Drawdown on your winning trades is 40% or lower, it means that price does not come close to your stop loss and that you might set them too conservative. Experimenting with tighter stops could improve the Reward:Risk Ratio and the general expectancy of your system.

The traffic lights visualize the Reward:Risk Ratio. If you see red traffic lights it means that your RRR is too small for the overall expectancy of your trading and you should avoid those.

The traffic lights are easy to understand and provide direct feedback about the way you set your orders.

The Tiltmeter is one of Edgewonk’s most popular and powerful tools. It analyzes the discipline and how well the trader respects his rules and follows his trading plan. A red Tiltmeter shows that the trader repeatedly broke his trading rules and mad bad decisions.

How to use it in your trading: In our trader development program, the Tiltmeter challenge is at the very beginning because it often has the biggest impacts on a trader’s performance. Always try to keep the Tiltmeter green and you will usually see a big improvement in your overall trading.

The Simulator takes your current trading performance and performs a random simulation over 500 trades based on your own performance figures. It shows you potential account development scenarios for your account balance based on your data.

How to use it in your trading: The Simulator is ideal when it comes to understanding drawdowns, losing streaks and account growth. It can be a big eye opener for traders once they realize that drawdowns are naturally and evitable, but you will still come out ahead if you follow the rules.

The Trade Management tab measures potential performance based on your trade input. It analyzes whether you cut losing trades too late, should ride winning trades longer or make any other trade management mistakes.

How to use it in your trading: If you see that the potential performance is larger than your actual performance, it shows that you are mismanaging trades. All you need to do is stop interfering with your trades – the set and forget approach.

Many traders want to test different ways to manage trades, stops or how they exit trades. So far, this was only possible if you opened a second account and then tried your ideas there. This is very time consuming and tedious.

How to use it in your trading: With the Alternative Strategies, you can test your ideas right in Edgewonk and compare it to your actual performance. Simply note the potential outcome of your trades using different approaches next to your real trades and then see which approach works best.

And that’s the summary for almost all metrics and statistics you find in your Edgewonk trading journal. Do you miss a metrics and would like us to include a new one? Then just email us and we will see if we can add it in the future.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...