Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

So you want to be a professional trader? Have you made up your mind what exactly that entails, how your day will look like, and what style you are going to be trading? Daily charts, 4-Hour charts, tickcharts? How much time are you going to invest, what will your preparation and postprocessing look like? Where will you do it, when will you do it, what tools are you going to use?

How do you ensure keeping up your mental health and a sufficient work-life balance? Are you going to do sports, how much time will you spend with your family and friends? What will your office look like? There are TONS of questions you have to answer before even thinking about making the step to full-time trading. These questions can usually be categorized in a) what do you want out of trading? and b) how do you organize yourself to get what you want?

You have to have a very clear picture in your mind of how your life as a trader is going to look like, just as you need to have a very clear picture of what your trading is going to look like.

I think many people have a romantic view of what life as a full time trader looks like, whereas if you don’t bring the discipline you will simply drown in panic and swallow all your savings in a few weeks. This job is not for the faint-hearted. You have to know yourself very well, as you are entering a relationship with the markets that will impact your daily life from social relationships to how you feel in general in both good or negative ways, depending on how you take on this task. It will change you as a person, and it will teach you a lot about yourself. If you let it, the market will swallow you. If you tame it, the market will make enable you to do and feel things you never even dreamed of before.

You have to be willing to go into this 100%, your whole life has to be aligned towards success in the markets, or you are indeed wasting your time. That does not mean that you won’t have time for other things. You just need to be very organized, and incredibly disciplined. There is NO time for aimless laziness, bumming around on Youtube or social media, or whatever. You have to be able to say NO to ANYONE when it comes to your main trading times. These 3-4 hours a day are HOLY and NO ONE can interfere with that. Close the door, put on your headphones, and forget about the rest of the world. There is NO multi-tasking. Only you and the markets. Do ONE thing at a time, but do it RIGHT. When you hang out with your friends, don’t look at your crappy phone. And when you hang out with the markets, don’t talk to your crappy friends (;-)). Just because you are at home does not mean you are ready to socialize. This is YOUR JOB. Take it serious, and make it clear to everyone else that if they interfere, you will throw them out. They have to respect that. And you absolutely need to play your strengths while avoiding your weaknesses. Know yourself.

Over the years, I have learned to structure my day in away that allows me to reach absolute peak performance during every single trading session I take. If in a way before starting to trade I feel that I am not at my peak, I simply won’t trade and I will make sure that whatever happened during the day, won’t happen again. With that being said, here is my daily routine.

The early morning routine: always the same

The late morning routine: switching it up

Lunchtime: Eat, watch, sleep

Afternoon: creative time!

Dinner time: light and full of energy

Trading time: preparation and full focus

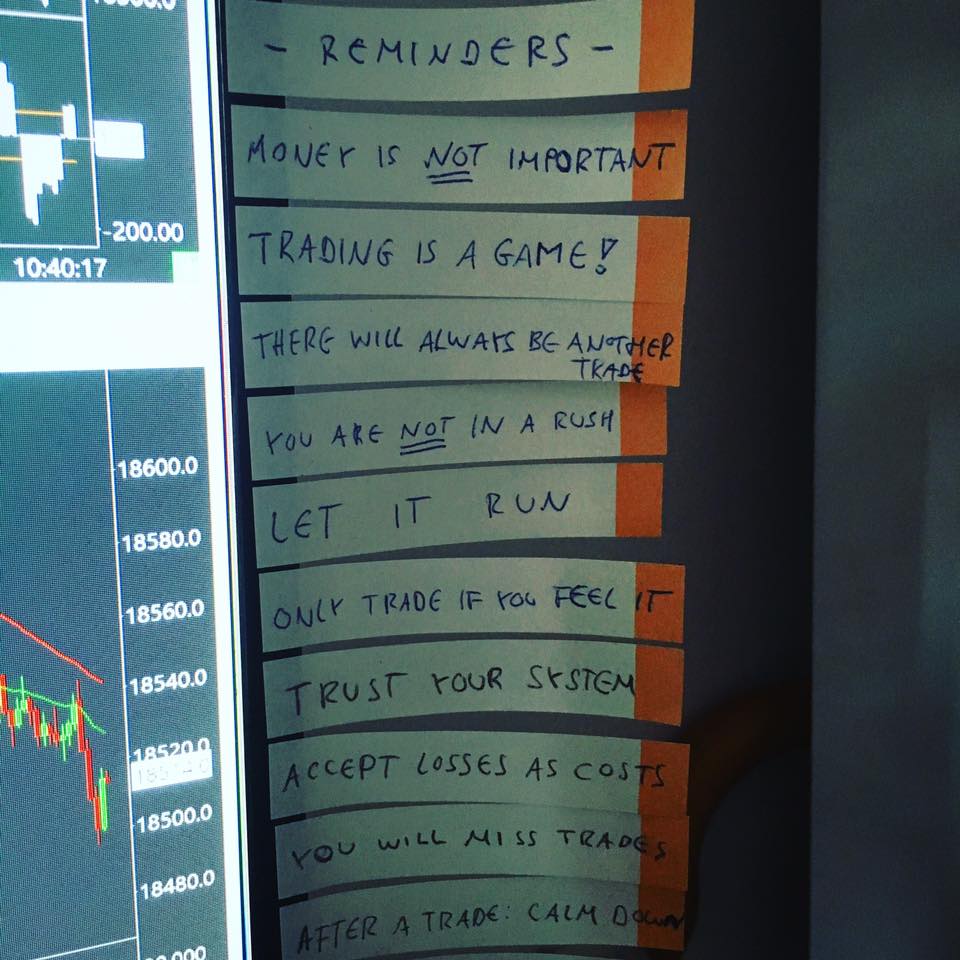

My daily mantra, stuck to the side of my monitor. This helped me SO MUCH. I never start trading without repeating this a dozen times mentally. On the other side I got my trade checklist and on the wall behind the monitor I printed charts of the textbook trades/setups I am looking for. This is all I need to trade profitably, and I follow it like a religion. If you truly want to trade profitably, you have to be in a relationship with the markets, and it will seem a little bit insane to outsiders. Don’t let that trouble you, we need a bit of mad obsession for the game to become world class, as in every discipline. Go the extra mile and start printing money. Want to learn how I trade?

So that’s usually my trading day. This goes from Monday to Friday, 16-17 hours of total dedication. On the weekend, I usually take off completely unless something important is going down with TC/EW. Sometimes, I also take Fridays off because there is something special going on like the birthday of a friend. But usually, I will trade 5 days per week (and then still go out on Fridays after 11pm). The important lesson to take away from here is not that you should structure your day like me, but that you should know yourself very well.

If I neglect any of my daily tasks, like pushing Tradeciety by writing articles, or playing video games, or doing sports, I will end up with a less than mediocre trading session. Everything I do, is aimed at increasing my performance in the markets. Even playing video games. And that is the important thing to understand: working more does not automatically mean making more money. That is just not true. Creativity and productivity are only achieved through relaxed phases during which your brain can develop and your synapses can epxand. The more money I make with my businesses, the more happiness I can spread in my relationships, the more relaxation I can gain through sports and video games, the more focus and concentration I can gain through nutrition and what I eat, the more money I will make.

My trading system is me and myself. Everything I do is aimed at increasing my performance in the markets, be it relaxing through video games (I only play relaxing games that don’t involve a lot of decision making like ego-shooters), or eating certain foods, or working hard for my other businesses. Everything I do, EVERYTHING aims at increasing my trading performance. And it will pay off. And it does pay off.

In the featured picture of this article I have pinned a picture of the things I read during my pre-session routine. I will post an article on this later down the road. The important thing to take away for now is: Be extraordinary, be smart, be vigilant, be smart, be patient, and you will eventually start making money in this game.

So don’t try to fit your daily routine to my daily routine. It won’t work. Try to find out what makes you tick, what makes you happe, what makes you intense and exhausted, and what makes you relaxed. And then align all that knowledge to one purpose: giving you all the power and confidence you need during your daily trading session. This is how you will start changing life for yourself, your loved ones, and everyone else around you, and there is no other way. This is the only way. Give it your best!

P.S.: When I travel or live in a different time zone, then, of course, this whole schedule will change, as I ALWAYS trade the U.S. session and I will fit my day around that time span, no matter when it is.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...