Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

4 min read

Rolf

May 14, 2017 8:00:00 PM

In the end, trading is nothing but managing risk. Every trade you take is a risk and every decision you make as a trader means risk:

…you see, risk is a constant companion as a trader and every decision and move mean risk – even doing nothing is a risk.

In this article, I want to help you understand risk in a more efficient way and also point out a few things that many traders oversee or do not even see as a risk.

Depending on your stop loss distance, your position size and how many contracts you have to buy/sell has to change for every trade.

Setting a wider stop loss means that you can lose more per individual contract and to keep risk constant you need to factor that in. In contrast, a closer stop loss means that you can buy/sell more contracts to achieve the same risk (video here).

It’s important to keep your risk constant to achieve a stable account growth. By adjusting how many lots you buy/sell, depending in the stop distance, you can control the risk.

When you enter your trade you set the stop and target. This then allows you to compute the reward:risk ratio. The RRR can then be used as a filter to stay away from trades where the risk is not worth the reward.

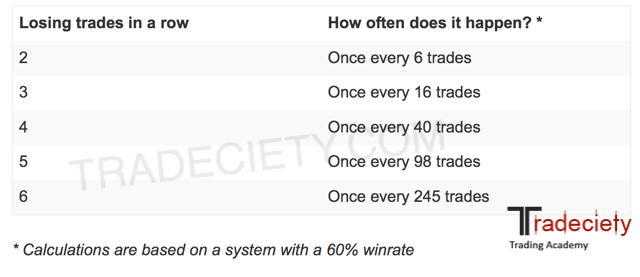

Let’s say, for example, that your winrate is 60%. This means that you win, on average, 6 out of 10 trades and those 6 winners must be large enough to offset the 4 losses. This means that your minimum RRR needs to be at least 0.67 to trade profitably over the long term.

By staying away from trades with a low RRR you can significantly minimize the risk for your trading.

The problem with taking partial profits is that it can ruin your performance. Let’s say for example that you are in a great trade with a 3R but you decide to take profit partial profits at 1R, at 2R and then close the rest at the final target at 3R. Suddenly, instead of having a 3R trade, you reduced it to 2R by taking partial profits along the way which is a 33% loss and this is a big deal.

Taking partial profits is often done without a plan and just because traders react emotionally. However, it can significantly increase the risk for your trading if you keep cutting trades short without a plan!

Break even (BE) trades are free trades, right? This statement couldn’t be further from the truth.

The problem with a BE stop is that they are done for the wrong reasons and traders usually move their stop way too soon to break even.

Upon entering a trade, you acknowledge the risk and you know that price can go to your stop. If your winrate is 50%, this will happen in 5 out of 10 trades. When you then have a better-looking trade and price moves in your favor you have to give it room to play out – price moves in waves back and forth. Moving a stop loss on a potentially profitable trade is like suffocating a fire which is just about to getting started. Remember, 5 out of 10 trade will be losses, but suddenly you will also see a major increase in BE trades when you move the stop too fast. A system with a winrate of 50% can easily become a 30% winrate system. If you then also partially take profits too often, you are killing your system.

Do you want to become a professional trader, trade for a living and do this for 20 or 30 years? If yes, then you will probably take thousands of trades over your career. And once you start looking at trading this way, you have to understand that 1 trade is absolutely meaningless. Many amateur traders give way too much importance to a single trade and they cannot detach themselves from the outcome. It is essential that you cut your losses and never let them get out of hand. In 6 weeks, 6 months or 6 years you will not even remember it so do not let one trade ruin your account.

Let’s continue with our previous point… Trading capital is important (obviously) but emotional capital is even more important. After you lose a trade, you can keep trading; after you lose a whole account, you can fund a new one. But if you let a loss (or an account blow up) hurt you so much that you’ll keep remembering it and you lose money to such an extent that it scares you and makes you lose interest in trading, then it’s game over.

Keep your risk small, walk away after a loss and understand that you are in it for the long term.

Even the best systems and traders will have drawdown. It’s just inevitable that you, sooner or later, hit a string of losses. The most important thing is that: (1) you never change the system during a drawdown and (2) always understand why you are losing: is it YOU who is making the mistakes or are the setups just failing?

Below you see a screenshot from a performance simulation done in our Edgewonk trading journal and you can see that even a system with a winrate of 40% had 23 consecutive losing trades during the simulation. But every drawdown will end and if you manage to preserve your monetary and emotional capital, while trading with a large enough RRR, you will recover if you let statistics play out.

Below you see a screenshot from a performance simulation done in our Edgewonk trading journal and you can see that even a system with a winrate of 40% had 23 consecutive losing trades during the simulation. But every drawdown will end and if you manage to preserve your monetary and emotional capital, while trading with a large enough RRR, you will recover if you let statistics play out.

Thos are just a few tips when it comes to risk management. I recommend that you start paying a little more attention to your surroundings and your daily decisions and how they affect your trading instead of just looking for better signals, indicators or tricks. In the end, trading is ONLY managing risk.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...