Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

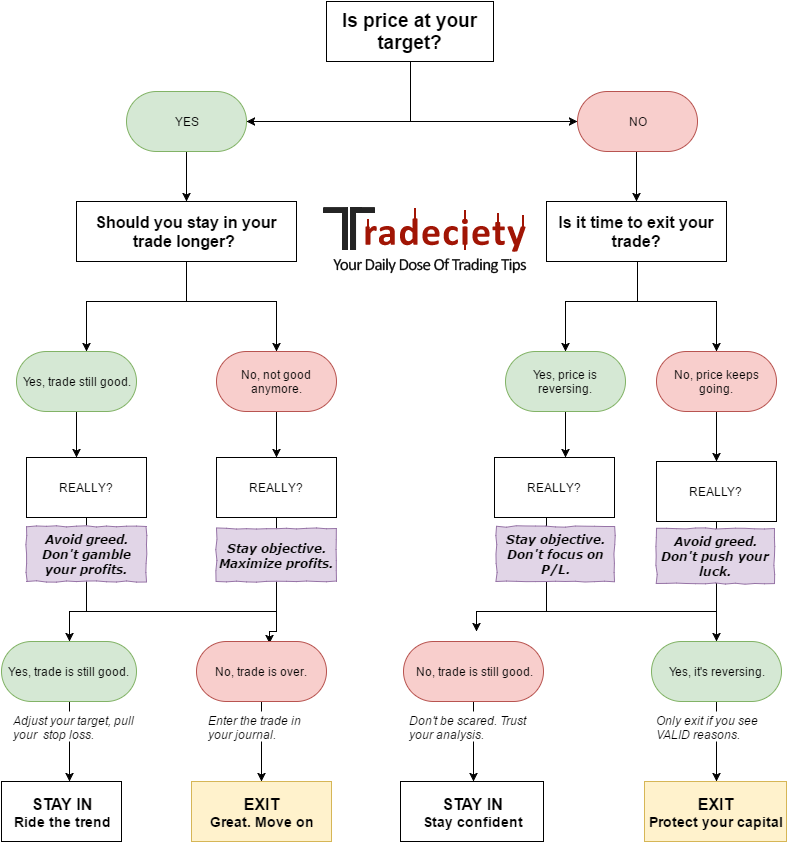

Trade exits are a tricky area and your exits determine the quality of your trades – usually, even more than your trade entries do. A good trade can quickly turn into a bad one if a trader mismanages his exit. Furthermore, exits can also have major impacts on the psychology and the emotions of a trader and then influence future trades and trading decisions.

In this article, we share tips so that you can improve your trade exits and trade management, no matter which trading style and the method you are following.

Everyone has a plan ’till they get punched in the mouth. Mike Tyson

There are 3 ways how traders exit their trades and it’s important to understand which category you belong to.

A trader using rigid exits uses pre-defined hard take profit orders that will automatically close his trade once a certain price level is reached. A trader who uses rigid exits can usually remove most emotional problems if he can avoid messing with his trades. However, most traders think that they are using rigid exits, but in reality, they belong to the second or third category…

The rigid exit trader sometimes lacks flexibility when he can’t/doesn’t react to changes in price behavior. The second category uses a more discretionary exit approach: usually, the flexible exit combines hard take profit orders with manual discretionary. Once a trader sees that price can’t reach his take profit anymore, he can manually exit his trades.

It’s very easy for the flexible exit trader to get too emotional and then stop listening to his rules – then he moves into the third category of emotional exits. Emotional exits are what many traders do, although they won’t admit it. Emotional exits are very impulsive, traders forget to take the whole chart into context and usually just focus on their P/L.

Rigid exit |

Flexible exit |

Emotional exit |

| – When traders use hard take profit orders and/or a trailing stop loss.

– Pre-planned trade exits.

– Exit their trades when price reaches the order without much manual influence/interaction. |

– Traders exit their trades manually.

– A trade exit happens when traders see signs that price is turning on them.

– Usually based on rules but emotions can get in the way easily. |

– Traders don’t have a plan and their actions are impulsive.

– They don’t evaluate their overall charts but react to changes in their P/L.

– Usually very bad exits with lots of psychological problems later on. |

When it comes to analyzing your past performance and your trade exiting, there is a very simple way how you can get completely new insights into your trading.

By combining conventional Reward:Risk principles (the outlook when you opened your trade) and the concept of R-Multiple (the performance in terms of risk when you exited your trade), you can evaluate your trading in a new light.

There are usually only 3 things a trader needs to be aware of:

1) When your final R-Multiple is much smaller than the planned Reward:Risk ratio, you have to check if your earlier trade exit was really the best possible decision and what drove you to exit earlier.

2) When the final R-Multiple is larger than the RRR, ask yourself what caused you to let your profits run: was it a rational or emotional decision? Although such a trade looks good at first glance, when done for the wrong reasons, it can easily lead to problems later on when traders are too greedy on their exits.

3) When your final R-Multiple is smaller than -1 (-1.5, -2, … for example) it means that you allowed your losing trade run past your stop loss. Such trades have to be avoided at all costs.

| Planned RRR vs. Realized R-Multiple | Ask yourself |

| Smaller than RRR | Why did I close my trade earlier? |

| Larger than RRR | Why did I let price run longer? |

| Smaller than -1 | Why didn’t I close my trade at my stop loss? |

A common problem I see very often is that traders misinterpret price information when they are in a trade. Imagine you are entering a buy/long trade, then you expect price to go up, or you wouldn’t have entered the trade in the first place (hopefully). Of course, price doesn’t always do what you expect it to do and here is where the concept of time-stop comes in.

When you enter a trade and the real price action does not match your expectations, you have to get out of your trade – fast! Staying in a trade that does not confirm your analysis and hypothesis is a gamble and it usually isn’t a high probability trade. I see so many traders stay in trades that don’t go anywhere and then they end up hoping that somehow price will still make it to their target. This is amateur trading in its purest form.

A trade is a hypothesis that you want to bet money on. If the hypothesis doesn’t work out at the very beginning, take your money and run.

Another mistake many people do is that they move to a lower timeframe once they are in a trade. They will then argue that they can react faster to changing price behavior and can cut trades earlier. Trust me, moving to a lower timeframe once you are in a trade will always cost you money. Lower timeframes move faster, small retracements can look like huge reversals and you will immediately start doubting your trade.

Never never never move to a lower timeframe once you are in a trade. If anything, you should consider moving to a higher timeframe to reduce the noise, but ideally, you stay on the timeframe that you used to enter your trade.

Even without knowing or being aware of it, your last trades have a major influence on your current trading decisions. That’s why it is so important to briefly go over your last 5-10 trades before you start your trading day.

| What happened on your last trades | How it influences your trading now |

| Took profits too early | You let your trades run too long |

| Took profits too late | You are scared and exit trades too early |

| Price hit your SL and then went back to profits | You are tempted to widen your stop loss next time |

Doubts are a major influencing factor when it comes to exits and the optimal exit. Whenever new traders ask me how they can eliminate doubt and fear, I give them the exact same advice: start collecting 3 screenshots for every trade:

1) The entry

Ask yourself: Have I taken trades based on my rules?

2) The exit

Ask: Was my exit emotional or reasonable and rule-based?

3) A few hours (days if you are a swing trader) after your exit

Ask: Is there more profit potential? Do I take profits too early or too late?

This way you’ll quickly be able to analyze you how well you manage your trades, how good you are at picking exits and whether or not you should let your trades run. It’s the easiest and most efficient way to reduce doubt and get to learn your trading system and behavior better.

You don’t have to get too fancy in the beginning when your own goal should be understanding your method and yourself as a trader better. With time and expertise, you can then move on to more advanced forms of record keeping and journaling.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...