Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

This is a very dangerous statement because, although it makes sense at first glance, it can ruin a trader slowly but steadily.

If you take profits too early, it will decrease the expectancy of your system and taking profits prematurely can even turn a winning into a losing strategy. Most traders start out with a fairly sound trading idea and they put their take profit orders where they would expect to earn enough to offset their losing trades over the long-term. However, exiting trades ahead of your target will decrease your profits and, if done repeatedly, will even reduce your profits to a point where they cannot offset your losses, even though your trading system would perform positively by evaluating your starting position.

Indicators and price is the EXACT same thing. Indicators just take what you see on your price charts, apply a formula to it and transform it into bars, graphs or other visual objects. A trader who thinks that price is superior to indicators has not understood this simple concept.

Indicators and price is the EXACT same thing. Indicators just take what you see on your price charts, apply a formula to it and transform it into bars, graphs or other visual objects. A trader who thinks that price is superior to indicators has not understood this simple concept.

Knowing this, you don’t need indicators if you understand how price action is transformed into indicators; but they can be used to quickly visualize what has been going on in the markets. But don’t be one of those ignorant traders who badmouth one or the other because, price and indicators are the exact same thing.

Leverage is often seen as the evil incarnate, whereas it has no influence whatsoever on trading performance. However, the problem with leverage is the mindset that it creates and the type of traders that it attracts. Leverage just makes it possible to start trading with a smaller account than you actually should have. Furthermore, leverage makes it possible to, potentially, realize profits that can have meaningful sizes, even with a trading account which is relatively small.

Leverage is often seen as the evil incarnate, whereas it has no influence whatsoever on trading performance. However, the problem with leverage is the mindset that it creates and the type of traders that it attracts. Leverage just makes it possible to start trading with a smaller account than you actually should have. Furthermore, leverage makes it possible to, potentially, realize profits that can have meaningful sizes, even with a trading account which is relatively small.

As we have stated in an earlier article, by analyzing brokerage statistics, the people who lose most in trading are the ones who have a gambling mindset, follow the get rich quick idea and who are young, have a smaller net worth and want to escape their living conditions. It is safe to assume that this type of traders often don’t follow a sophisticated trading approach, don’t adhere to sound risk and money management principles and trade relatively small trading accounts and, thus, are more prone to use higher leverage.

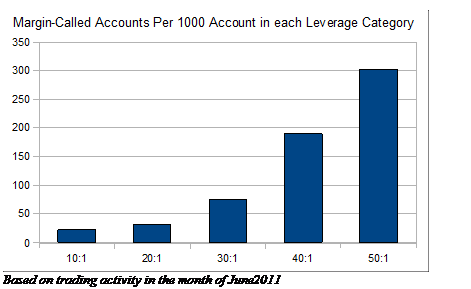

Consequently, the mix of a ‘wrong’ mindset and perceptions and the use of high leverage often results in margin calls. The following graphic of Oanda’s statistics confirms this idea. However, leverage should not be seen as the direct cause of the large number of margin calls for higher leverage. Leverage is, very probably, just the instrument which enables the existence and the participation of traders with a ‘wrong’ mindset and attitude.

Source: Oanda.com

At some point, most traders will start following the belief that just moving to a higher timeframe will make their life much easier, since there is, supposedly, less noise, more accurate signals and you have more time to plan your trades.

However, the skill set that is being required when trading higher time frames is completely different. It is as if you would tell an unsuccessful sprinter that he just has to start running marathons and everything will be fine.

If you have problems with patience on lower time frames, moving to daily time frames where you have to wait days and weeks for a trading signal can have devastating consequences. Furthermore, it has been confirmed that a main reason why traders lose money over the long-term is because they hold losers too long and sell winners too early. Moving to higher time frames will often reinforce the negative impacts of trade management influence.

This statement came up very frequently over the last years and it is being used as an excuse by people who believe that algorithmic and high frequency trading is making it impossible for the average trader to make money.

This statement came up very frequently over the last years and it is being used as an excuse by people who believe that algorithmic and high frequency trading is making it impossible for the average trader to make money.

The truth is, algorithmic trading is just a natural advancement and does not make it harder to earn money from trading, it just changes the way you have to approach trading. A few decades ago, people were scared that after the invention of the telephone, it would be impossible to make money trading because traders who have access to a telephone can place and execute orders much faster. The same happened when computers entered the game and traders with access to a computer could make trades within a mouse-click and suddenly had a significant advantage over people who did not have this possibility. As you can see, technological advancements are normal and they have happened and they will happen over and over again. As a trader, you have to adapt and constantly monitor the markets, how price behaves and what your performance metrics tell you. The moment you stand still and don’t adapt, you are out of the business.

The myth that you just have to be in front of your charts long enough and watch what price is doing to improve as a trader is causing a lot of wrong assumptions. ‘Screentime’ by itself is as useless as it gets and will have (almost) no impact on your trading performance.

The myth that you just have to be in front of your charts long enough and watch what price is doing to improve as a trader is causing a lot of wrong assumptions. ‘Screentime’ by itself is as useless as it gets and will have (almost) no impact on your trading performance.

The problem is that most traders do not actively observe and absorb what is going on on their charts, but randomly flip through timeframes and instruments over and over again, hunting for entry signals, instead of actually paying attention. If you want to get the most out of it, pay close attention to what is happening on your charts and take actual notes. These can be things such as:

By actively trying to make sense out of what you see and carefully observing your instruments, rather than passively consuming information, you can significantly increase the way you look at financial markets and trading.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...