Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

Becoming a good trader while having a 9-5 job is very challenging. I have been there myself and it wasn’t until I implemented certain tools and routines in my own trading that I saw improvements. The best part: I now only spend 30 – 60 minutes each day on my own trading, so make sure to read the full article if you are looking for a better approach to trading 🙂

The main problems part-time traders have are:

Most traders make the mistake of believing that their method isn’t working or they need a better way to find entries whereas, in reality, it’s their process (or a lack of process) that is causing most of their problems. I fully understand that this is not “sexy” and you’d prefer if I give you another entry trick, but this is not how trading works and if you are honest with yourself, you probably know that you are not approaching trading with the seriousness it deserves.

But don’t worry. My routine and the tips which I am going to share with you won’t take up much of your time and, if anything, they will help you reduce the time you need to spend on your trading. Again, 60 minutes a day is all you really need.

Every Sunday, I sit down and go through 29 Forex pairs. I analyze the Daily, 4H and 1H timeframe and narrow down the pairs which I consider trading for the next week.

I always follow the same approach and eliminate the Forex pairs that are untradable to me – narrow range markets, too much or not enough volatility, and other bad conditions.

The goal is to find the 10 – 15 best Forex pairs and timeframes for the next few days. I start out with 87 possible combinations (29 Forex pairs and 3 timeframes each) and I usually have 10-15 really good possibilities by the end.

This screening process usually takes 60-90 minutes max and it has transformed my whole trading. I rarely miss trades, I know exactly which timeframes I need to trade the next week and which pairs have the best setups.

If you have a 9-5 job and struggle with finding good trades, I highly recommend you try it out. You don’t have to copy my exact routine, but try to find a process that works for you. 90 minutes of doing your trading homework on the weekend will save you hours during the week.

Pro: And if you don’t want to do this, you can get my own personal watchlist in 30-40 minutes video format every Sunday in our pro area.

Then, after I have narrowed down my list, I get more specific. I create very specific trading ideas and I map out my potential trades.

I define where I want to enter, what has to happen before I enter a trade, what cancels my trade idea and which other factors I need to be aware of.

Tip: always create trading plans for long AND short directions. This will help you stay open-minded and open to new ideas or developments.

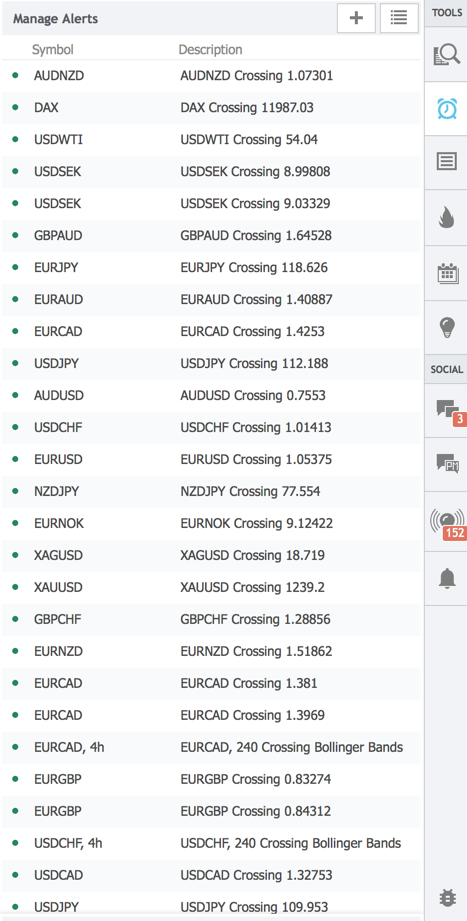

My most favorite tool here are price alerts and I joined Tradingview Pro Plus just for the unlimited price alerts feature. I set them everywhere and my screenshot below shows my typical alerts list.

The way I use price alerts is that I set them at important support/resistance levels, potential transition points or at the moving average I use to time entries.

Price alerts help me stay on top of everything and I don’t need to watch charts all day long. In fact, I rarely watch charts for more than 30 minutes per day, during the week. I only look at charts when a price alerts goes off, when a big news event comes up or first thing in the morning.

Now you know how to screen markets and prepare trading plans. The final step is trade execution.

Years ago, I read the book “Pitbull Champion Trader” from Marty Schwartz (it’s a must read!) and I was surprised to read that he still uses a physical checklist for every trade he takes. He said that it helps him to avoid bad trades, stay more objective and not fool himself so easily.

I decided to give it a try and it has worked wonders for me as well. I now have a checklist with my own personal trading setups, a list with all individual entry criteria and I differentiate between must-have an optional entry triggers. With that I can group my trades by quality which also helps with position sizing.

Before each trade, I compare the entry with my checklist and it shows me exactly if I can take the trade or not. In our pro area, many traders have done the same and made their own trading checklist.

If you want to take this even a step further, you can track the type of trade and the quality of the entry in your trading journal.

You see, this doesn’t sound too bad and trading well and successfully doesn’t have to be complicated. My process is very simple and I would never start my trading week without having done my watchlist and trading plans. It helps me to stay organized and it has improved the quality of my trading significantly.

At the same time, it frees up so much time that I can spend working on other projects or just use for my travels.

For you, I recommend that you do not copy my exact approach. Instead, try to see what works for you, what adds value and then make slight adjustments along the way. It probably won’t work right from the start but if you give it time and work on it, it will make a difference. I promise that.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...