Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

In the world of online trading, success does not just depend on market knowledge or technical analysis, but significantly on the trader's psychological resilience and mindset.

The following article explores a curated list of influential books that delve into the mental and emotional aspects of trading. These works, authored by esteemed experts in psychology and trading, offer invaluable insights into managing emotions, developing discipline, and understanding the psychological factors that influence trading decisions.

Whether you're a seasoned trader or just starting out, these books provide essential strategies for cultivating a mindset that can weather the volatility of the markets and enhance decision-making skills, ultimately leading to sustained success in your trading endeavors.

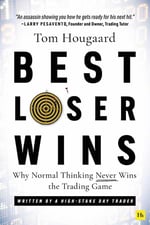

'Best Loser Wins' by Tom Hougaard presents a counterintuitive yet profound approach to trading, emphasizing the skill of managing losses effectively. Most traders exclusively focus on winning, but this book shifts the paradigm to understanding and embracing losses as a path to success. Readers will learn the psychological resilience required to deal with losses, strategies to minimize them, and the importance of a clear mindset in trading. Hougaard's insights help traders develop a healthier relationship with losses, improving their decision-making process and overall trading performance.

'Best Loser Wins' by Tom Hougaard presents a counterintuitive yet profound approach to trading, emphasizing the skill of managing losses effectively. Most traders exclusively focus on winning, but this book shifts the paradigm to understanding and embracing losses as a path to success. Readers will learn the psychological resilience required to deal with losses, strategies to minimize them, and the importance of a clear mindset in trading. Hougaard's insights help traders develop a healthier relationship with losses, improving their decision-making process and overall trading performance.

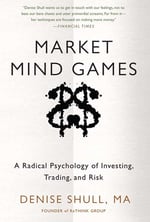

Denise Shull's 'Market Mind Games' delves into the psychological complexities of trading. It offers a neuropsychological perspective, helping traders understand the emotional and cognitive processes influencing their trading decisions. Readers gain insights into managing emotions, understanding market psychology, and making more informed decisions under pressure. This book is essential for traders looking to align their psychological state with their trading strategy, leading to more consistent and rational decision-making.

Denise Shull's 'Market Mind Games' delves into the psychological complexities of trading. It offers a neuropsychological perspective, helping traders understand the emotional and cognitive processes influencing their trading decisions. Readers gain insights into managing emotions, understanding market psychology, and making more informed decisions under pressure. This book is essential for traders looking to align their psychological state with their trading strategy, leading to more consistent and rational decision-making.

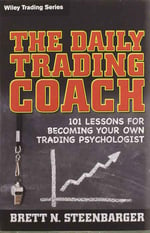

In 'The Daily Trading Coach', Dr. Brett Steenbarger provides traders with practical strategies for self-improvement. The book is structured as a series of lessons that guide traders in refining their approaches daily. It covers topics such as coping with stress, developing self-discipline, and learning from mistakes. Traders will learn to become their own coaches, enabling continuous personal and professional development essential for sustained success in the market.

In 'The Daily Trading Coach', Dr. Brett Steenbarger provides traders with practical strategies for self-improvement. The book is structured as a series of lessons that guide traders in refining their approaches daily. It covers topics such as coping with stress, developing self-discipline, and learning from mistakes. Traders will learn to become their own coaches, enabling continuous personal and professional development essential for sustained success in the market.

Morgan Housel's 'The Psychology of Money' offers insightful narratives about how people think about money and the peculiar ways they behave with it. Traders will benefit from understanding the psychological factors driving decisions when money is on the line. The book covers a broad range of topics, from risk management to the influence of ego in financial decisions, making it a vital read for anyone looking to develop a more thoughtful and disciplined approach to trading.

Morgan Housel's 'The Psychology of Money' offers insightful narratives about how people think about money and the peculiar ways they behave with it. Traders will benefit from understanding the psychological factors driving decisions when money is on the line. The book covers a broad range of topics, from risk management to the influence of ego in financial decisions, making it a vital read for anyone looking to develop a more thoughtful and disciplined approach to trading.

'Radical Renewal' by Dr. Brett Steenbarger addresses the psychological challenges traders face and provides tools for profound personal transformation. The book combines insights from psychology with practical trading applications. Traders will learn about the importance of mental health, adaptability, and the development of a growth mindset in achieving long-term success in trading.

The great thing about this book is that Dr. Steenbarger published this book as a series of freely accessible blog posts: Read Radical Renewal

Mark Douglas' 'Trading in the Zone' is a seminal work that addresses the mental state required to achieve consistent trading success. It teaches traders to think in probabilities, manage risks, and understand the psychological pitfalls that can impede decision-making. This book is crucial for traders aiming to develop a mindset that is free from emotional interference, enhancing their ability to make decisions based on market realities rather than personal biases.

Mark Douglas' 'Trading in the Zone' is a seminal work that addresses the mental state required to achieve consistent trading success. It teaches traders to think in probabilities, manage risks, and understand the psychological pitfalls that can impede decision-making. This book is crucial for traders aiming to develop a mindset that is free from emotional interference, enhancing their ability to make decisions based on market realities rather than personal biases.

'Trading for a Living' by Dr. Alexander Elder covers the essential aspects of trading psychology, risk management, and technical analysis. It offers a comprehensive guide for traders to develop disciplined trading habits, understand market dynamics, and manage their emotions. This book is particularly valuable for traders seeking to establish a solid foundation in their trading career, combining psychological strategies with practical trading techniques.

'Trading for a Living' by Dr. Alexander Elder covers the essential aspects of trading psychology, risk management, and technical analysis. It offers a comprehensive guide for traders to develop disciplined trading habits, understand market dynamics, and manage their emotions. This book is particularly valuable for traders seeking to establish a solid foundation in their trading career, combining psychological strategies with practical trading techniques.

In 'The Disciplined Trader', Mark Douglas explores the psychological challenges traders face and offers strategies to overcome them. The book emphasizes the importance of discipline, mental clarity, and emotional control in successful trading. It guides traders in developing a structured approach to the market, helping them avoid common psychological traps and make more rational trading decisions.

In 'The Disciplined Trader', Mark Douglas explores the psychological challenges traders face and offers strategies to overcome them. The book emphasizes the importance of discipline, mental clarity, and emotional control in successful trading. It guides traders in developing a structured approach to the market, helping them avoid common psychological traps and make more rational trading decisions.

James Clear's 'Atomic Habits' is not specifically about trading but offers invaluable insights into habit formation and improvement. Traders can apply these principles to develop consistent and effective trading routines, enhance discipline, and cultivate positive trading habits. This book is essential for traders looking to make incremental improvements that compound over time, leading to significant growth in their trading skills and strategies.

James Clear's 'Atomic Habits' is not specifically about trading but offers invaluable insights into habit formation and improvement. Traders can apply these principles to develop consistent and effective trading routines, enhance discipline, and cultivate positive trading habits. This book is essential for traders looking to make incremental improvements that compound over time, leading to significant growth in their trading skills and strategies.

Jared Tendler's 'The Mental Game of Trading' provides a comprehensive guide to mastering the psychological aspects of trading. It addresses common mental pitfalls traders encounter, such as fear, greed, and overconfidence. Readers will learn practical techniques for enhancing mental toughness, improving focus, and maintaining emotional equilibrium under pressure. This book is crucial for traders aiming to build a robust psychological framework, essential for navigating the volatile world of trading.

Jared Tendler's 'The Mental Game of Trading' provides a comprehensive guide to mastering the psychological aspects of trading. It addresses common mental pitfalls traders encounter, such as fear, greed, and overconfidence. Readers will learn practical techniques for enhancing mental toughness, improving focus, and maintaining emotional equilibrium under pressure. This book is crucial for traders aiming to build a robust psychological framework, essential for navigating the volatile world of trading.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...