3 min read

Best Trading Journals of 2024: Which One Should You Choose?

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

Whenever you listen to the most successful traders and investors, they all tell you that they themselves as risk managers first – not traders. Without a doubt, managing risk is one of the most important tasks in the daily life of a trader, if not THE most important one.

But managing risk goes much deeper than just knowing how many contracts to buy and how to set a stop loss order. In trading, the term risk includes the expectancy of trades, the reward:risk ratio and its dynamic nature. The dynamic concept of risk is maybe the least talked about concept of risk management in today’s world of retail trading.

“It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.” – Stanley Druckenmiller

“Risk comes from not knowing what you’re doing.” – Warren Buffett

“Frankly, I don’t see markets; I see risks, rewards, and money.”- Larry Hite

“Don’t focus on making money; focus on protecting what you have.” – Paul Tudor Jones

Let’s start by looking at the entry point of a trade. Assume that we enter a long trade at $100 with a stop at $90 and a take profit at $120. The maximum loss is $10 and a potential profit of $20 gives the trade a reward:risk ratio of 2:1.

Entry long at $100. Stop loss at $90. Take profit at $ 120. Reward:risk ratio of 2:1

Now we take a look at what happens during a trade with regards to risk, how the dynamic reward:risk ratio influences the parameters, how risk changes when price moves and how trade management plays into this equation.

When price moves into your favor, the distance between your stop loss and your entry increases; and the distance to the take profit order decreases. Thus, the reward:risk ratio becomes smaller.

The price moves up to $110, your stop is still at $90 and the take profit is at $120. The reward:risk ratio is now only 1:2 – it has completely reversed.mic RRR

A smaller reward:risk ratio means that you have more to lose and less to gain. In our scenario the trader now risks $20 – $10 of which are unrealized profits – to make an additional $10.

As the price keeps moving in your favor, the risk parameters become worse.

You risk giving back all the unrealized profits and the additional amount you can make (based on your take profit level) becomes smaller with every tick. The worst moment in the lifespan of a trade is when price is about to hit the take profit order and you risk giving back everything, while the additional profits are very small.

Lesson 1: Treat unrealized profits as if they are already yours. Do not risk giving it all back just to make a little bit more.

Based on what we have just said, you probably think that when price moves against you, the conditions improve. But it is not entirely true.

Price falls to $95 with a stop still at $90 and the take profit at $120. The reward:risk ratio is now 5:1. But, at the same time, the price has to travel much further: $25 instead of the initial $20.

At this point, a trader has to make a decision whether he believes that his trade idea is still valid. The additional distance price has to travel is something most traders do not take into account but it impairs the conditions of the trade. The price will have a much harder time reaching the target now and the holding time will increase significantly.

The biggest mistake traders make in such a scenario is to wait to get out for break-even. Remember that your initial trade idea was based on price going to $120. If all you think about during a loss is to get out at $100, you better get out now and do not risk losing more.

When the price has moved into your favor, think about trailing your stop to protect profits and to improve the risk conditions of your trade.

When the price is at $110, you could trail your stop to $100 with your take profit still at $120. The reward:risk ratio increases to 1:1.

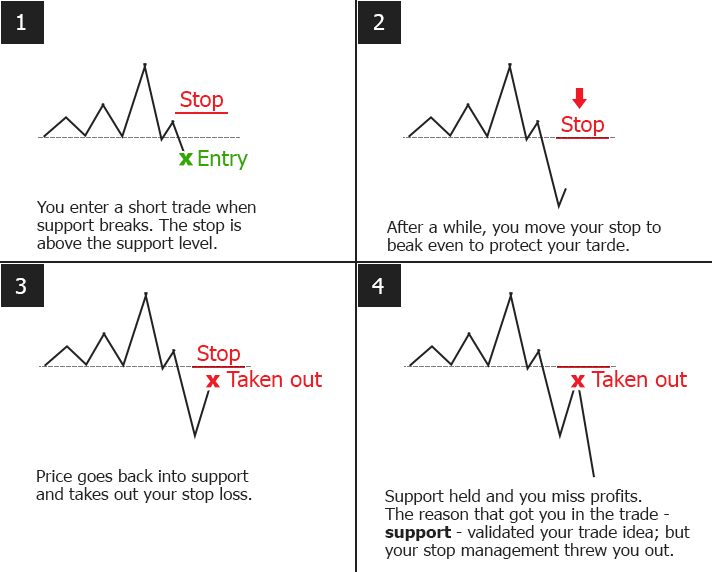

When trailing a stop, the most important aspect is to choose a reasonable approach. There is no benefit in trailing a stop too soon and too close and running the risk of experiencing a squeeze during a retracement.

Break-even stops are probably among the most misunderstood concept in trading. Traders believe that they have a “risk-free” trade because their stop is at the entry point.

I hope that by now you understand that there is nothing risk-free in trading!

If the price has gone up and your account shows unrealized profits, you can lose those profits. With a stop at break-even, you srill risk losing your unrealized profits! Especially if a trader moves his/her trade too close too soon, the dynmaic nature of the price will often hit the stop before moving on in the trade direction.

Thus, break even stops should be avoided if all you want to do is get a “risk-free” trade. Instead, move the stop behind the price at reasonable levels. Usually, natural support/resistance offer good spots for stop trailing.

daHow often do you close your trade ahead of the actual take profit order? If you are like most traders, you probably do it all the time.

If you close your trade at $110 you have reduced your initial reward:risk of 2:1 to 1:1. This is bad! You just cut the expectancy in half, while having the same initial risk.

The old saying “you can’t go broke taking profits” is not true and it is a myth that has been around for decades. If a trader regularly closes his trades too early, he reduces the expectancy of his system. You can turn a potentially profitable system into a losing one by cutting your profits too soon.

You can go broke taking profits.

Cutting a loss ahead of your stop is something traders don’t do often enough. The reason is that once the price has moved against you, the need to exit a trade is not obvious. If you are down already, losing a little bit more does not seem like a big deal.

A trader who closes his loss at $95 instead of waiting to see price hit his stop at $90 has cut his potential loss in half.

In the previous example, we said that taking profits too early can ruin a trading system. In this case, taking losses early can improve a trading system.

“Learn to take losses. The most important thing in making money is not letting your losses get out of hand.” – Marty Schwartz

This is something that should be avoided in 99% of all situations. Although adding to a losing trade looks good on paper, it can destroy emotional capital and wipe out whole trading accounts.

Adding to a losing trade increases the reward:risk ratio.

But – and this is a very big but – as we have said previously, the price has to travel a much larger distance once the price has moved against a trader. Adding to a losing trade does not really improve the situation as the trader now has two positions which have to travel a much larger distance to the take profit.

Traders often lose focus when adding to losses and forget their original long-biased trade idea.

Opening a new position with the same stop loss and take profit order, after the price has moved into your favor, reduces the expectancy of the trade. The reward:risk ratio of the second trade is smaller compared to the first one.

Adding to a winner reduces the overall reward:risk ratio and also the expectancy.

However, scaling into a winning trade can be a good strategy if it is done with care and planned ahead. On the other hand, a trader who is not aware that he is worsening his so far profitable trade should avoid scaling in.

Traders who add to an already profitable trade can end up with a loss much faster because price has to reverse only a little bit to wipe out their profits.

The purpose of this article is to illustrate the concepts of the dynamic reward:risk ratio while linking it to the often misunderstood concept of unrealized profits. Don’t see yourself as a trader – start seeing yourself as a risk manager because that’s what you are.

To make better trading decisions, always keep the following points in mind:

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

4 min read

Trading successfully depends on recognizing market structures and patterns that indicate whether an existing trend will continue. Trend continuation...

3 min read

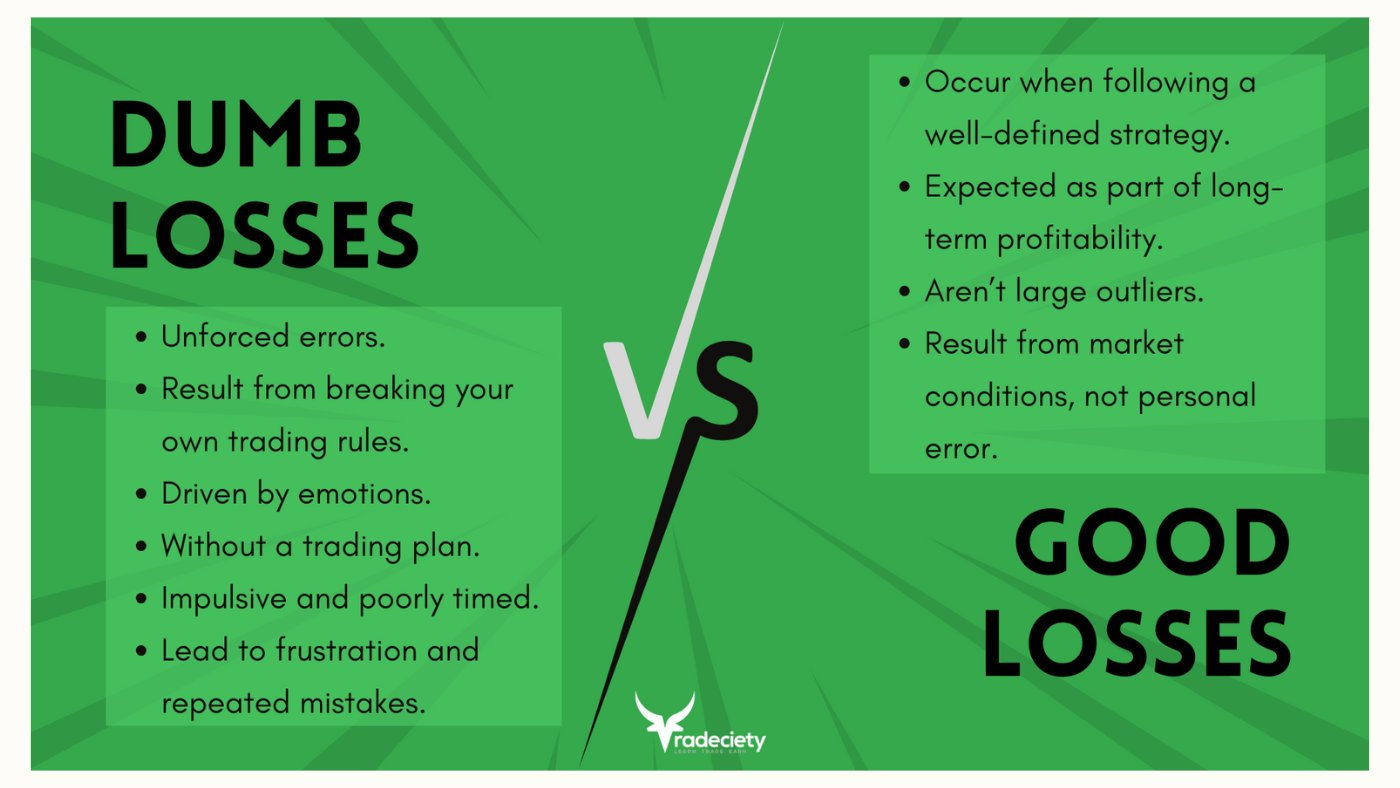

No matter how good you are as a trader and how great your trading strategy is performing, sooner or later, you will experience losing trades. What...