3 min read

3 Trendline Strategies

Trendlines can be great trading tools if used correctly and in this post, I am going to share three powerful trendline strategies with you.

How often did you experience a situation where a trade looked so obvious but then immediately reversed on you and you had to realize that you were, once again, entering at a very wrrong spot?

A bull trap occurs when traders take a long position and then have price reverse and move lower very sharply.

The long-positioned trader is trapped and this pattern often follows a very similar rhythm of luring traders into “obvious” long trades, followed by a sudden move against the traders.

Bull traps often happen around previous highs where it looks as if the price is continuing the rally. Especially amateur traders often tend to enter too early around such key levels (read about FOMO here). It’s especially dangerous if price rallies for a bit in their favor ad the trapped traders feel too comfortable and too attached to their trade.

When price then reverses, they hold on to their loss too long and/or add to their existing position. As price keeps moving against them, the loss becomes larger and larger until it hurts so much that trapped traders are forced out of their trades – this accelerates the reversal even further.

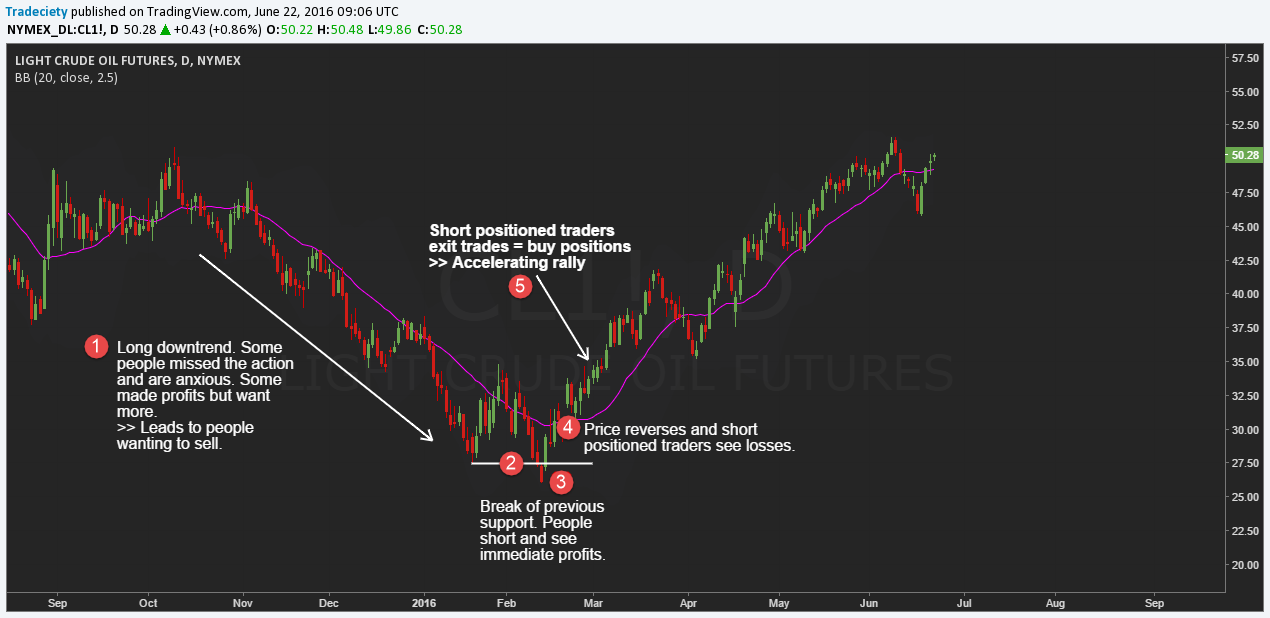

To fully understand the dynamics of the bull trap and then to use this information to our advantage, we have to look at the orderflow and the thought process behind a bull trap. Here are the individual phases:

1) Prelude: a long sell-off where people missed profit opportunities and/or are becoming too greedy and want more.

2) Price then sets up a new trend wave that lures people into entering new positions. It looks like the price is starting a new trend wave by breaking the previous lows.

3) Price goes a little in the favor of those ‘trapped’ traders, creating a feeling of confidence and security.

4) Price reverses to the upside. People in disbelieve hold on to their trades that are suddenly turning into a loss. Others add to their loss, hoping to average down.

The professionals are the ones who are aggressively buying and the amateurs are still happily selling, hoping that price turns again.

5) Price rallies further and the trapped short traders are now facing huge losses. Most are forced out of their long trades which means that they have to buy which accelerates the rally.

You can see, the bull or bear trap is more than just a pattern, but it’s a way of visualizing and understanding how the average trader approaches the markets and why the professionals usually always win.

I specialize in trading new trends and for me, it is essential to understand the dynamics of bull and bear traps because it is one of the most reliable and profitable types of reversal signals.

Once you can see where traders are trapped, how the average losing trader makes the same mistakes over and over again, and how the stops that get triggered accelerate price moves, you can make much better trading decisions and start trading against all the losing traders.

However, before we get into the types of bull traps, here are our two insurance concepts as reversal traders:

1) The late entry

For new and inexperienced traders, this is the hardest concept to follow and principle to internalize but it will make a huge difference in your trading. Never sell while price is going up and don’t buy when price is doing down. Only sell when price is already going down and only buy when price is going up.

Ever trade has 3 entries and whereas amateurs are either too early (entry 1 – predicting) or too late (entry 3 – chasing), professionals enter with confirmation.

2) A moving average

The easiest way to make the concept of ‘insurance’ work is by applying a moving average to your charts and only trade in the direction of it. Even popular and super successful market wizards like Marty Schwartz use this exact concept.

This means that you only trade short after a bull trap once price has broken the moving average to the downside and you only enter a long trade after a bear trap after price has broken the 20 SMA to the upside.

Of course, there is a little more to trading than just trading a break of the moving average, but using a moving average as your filter will automatically keep you from making the most common mistakes.

Now that you understand the dynamics of how traps and squeezes work, we can take a look at a few different examples because, after all, trading is a game of pattern recognition and one type of setup rarely only has one way of presenting itself. As you will see, the bull trap and the squeeze patterns come in different forms and it pays off to understand the little nuances and dynamics that drive price. I explain all trap and squeeze patterns in our strategy course.

Double top squeeze

This is the most classic pattern where you have two swing points where the second swing penetrates the prior high and then immediately gets rejected.

The second failed breakout attempt is a clear signal that the market doesn’t have the power to start a new trend. The following selling-momentum is creating a new downward trend.

Gap squeeze

During a gap-squeeze it looks like the price is gaining momentum on the gap and traders see themselves in profits longer. However, price just as fast gaps into the opposite direction and squeezes the trapped traders. The reversal on a gap trade is usually much faster since the squeeze happens suddenly and much stronger.

Engulfing bar squeeze – Range squeeze

The engulfing bar and range squeezes are not commonly discussed but they happen frequently. After a tight range or a slow trend, price suddenly makes a violent move and many orders will get triggered by the spike.

This type of squeeze works so well because it works in the complete opposite way how most losing trades think and you can exploit their weaknesses.

You can see, the bull trap is not a standalone trading system but it’s a MUST KNOW price and market dynamic because it is the type of market behavior that exploits the weakness of the consistently losing traders. There is always someone else on the other side of your trade and, thus, you should think twice who is buying from you and why do they want your trade.

3 min read

Trendlines can be great trading tools if used correctly and in this post, I am going to share three powerful trendline strategies with you.

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

4 min read

Trading successfully depends on recognizing market structures and patterns that indicate whether an existing trend will continue. Trend continuation...