Supply and Demand Trading in 2026

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

Risk management usually ranks very low on the priorities list of most traders. Typically, way behind finding a better indicator, more accurate entry signals or worrying about stop hunting and unfair algo-trading practices.

However, without proper knowledge about risk management, profitable trading is impossible. A trader needs to understand how to manage his risk, size his positions, create a positive outlook for his performance, and set his orders correctly, if he wants to become a profitable and professional trader.

Here are 9 tips that will help you improve your risk management instantly and avoid the most common problems that cause traders to lose money.

When you spot an entry signal, think where you’d place your stop loss and take profit order FIRST. Once you’ve identified reasonable price levels for your orders, measure the risk:reward ratio. If it doesn’t match your requirements, skip the trade. Don’t try to widen your take profit order or tighten your stop loss to achieve a higher reward:risk ratio.

The reward of a trade is always uncertain and potential. The risk is the only think you can control about your trade.

Most amateur traders do this the opposite way: they come up with a random reward:risk ratio and then manipulate their stop and profit orders to achieve their ratio.

Moving the stop loss to the point of the entry and so creating a “no risk” trade is a very dangerous and often unprofitable maneuver. Whereas it’s good and advisable to protect your position, the break-even strategy often leads to a variety of problems.

Especially if you are trading based on common technical analysis (support/resistance, chart patterns, highs and lows, or moving averages), your point of entry is usually very obvious and many traders will have a very similar entry. Of course, the pros know that and you can often see that price retraces back and squeezes the amateurs at the very obvious price levels, just before price then turns back into the original direction. A break-even stop will get out of potentially profitable trades if you move your stop too soon.

Many trading strategies tell you to use a fixed amount of points/pips on your stop loss and take profit orders across different instruments and even markets. Those “shortcuts” and generalizations completely neglect how price moves naturally and how financial markets work.

Volatility and momentum are constantly changing and, therefore, how much price moves in any given day and how much it fluctuates changes all the time. In times of higher volatility, you should set your stop loss and take profit orders wider to avoid premature stop runs and to maximize profits when price swings more. And in times of low volatility you have to set your orders closer to your entry and not be overly optimistic.

Secondly, trading with fixed distances doesn’t let you chose reasonable price levels and it also takes away all the flexibility you need to have as a trader. Always be aware of important price levels and barriers such as round numbers, big moving averages, Fibonacci levels or just plain support and resistance.

Many traders claim that the figure winrate is useless. But those traders miss a very important point. While observing the winrate alone will provide you with no valuable insights, combining winrate and risk:reward ratio can be seen as the holy grail in trading.

It’s so important to understand that you neither need an insanely high winrate, or have to ride your trades for a very long time. For example, a system with a winrate of 40% (which is what many professional traders average) only requires a reward:risk ratio of greater than 1.6 to trade profitably.

Trying to achieve an astronomical high winrate or believing that you have to ride trades for a long time often create wrong expectations and then leads to wrong assumptions and, finally, to mistakes in how traders approach their trading.

Many traders will randomly set daily or weekly performance targets. Such an approach is very dangerous and you have to stop thinking in terms of daily or weekly returns. Setting yourself daily goals creates a lot of pressure and it usually also creates a “need to trade”. Instead, here are some ideas on how to set trading goals the right way:

When it comes to position sizing, traders usually pick a random number such as 1%, 2% or 3%, and then apply it to all their trades without ever thinking about position sizing again.

Trading is an activity of chance, such as professional betting or poker. In those activities, it’s common practice to vary the amount you wager, based on the likelihood of the outcome. If you hold a very strong hand in poker, you’d bet more than when you see almost no chances of winning, right?

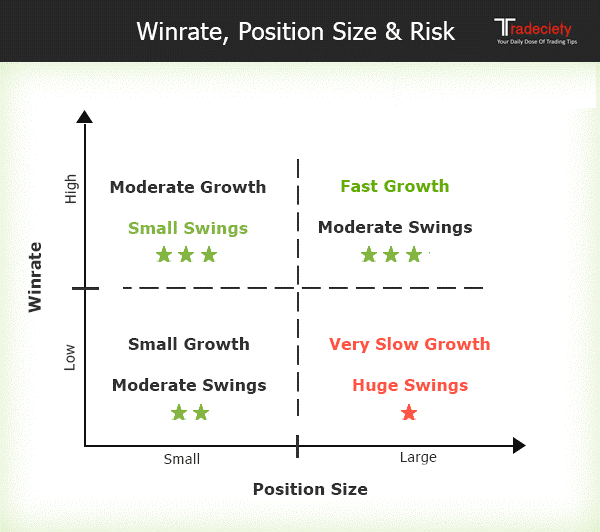

The same holds true for trading. If you trade multiple setups or strategies, you will see that each setup and strategy has a different winrate and also that the reward:risk ratios on different strategies vary. Thus, you should reduce your position size on setups with a lower winrate and increase the position size when your winrate is higher.

Following the approach of dynamic position sizing will help you reduce your account volatility and potentially help you improve account growth.

Whereas the reward:risk ratio is more of a potential metric where you measure the distances to your stop and profit target when you enter the trade, the R-multiple is a performance measurement and it describes the final outcome of your trades.

When entering trades, traders are often too optimistic and set profit targets too far or close their profitable trades too early which will then decrease their initial reward:risk ratio. By analyzing how your R-multiple compares to your reward:risk ratio, you can get new insights into your trading. If you see major deviations, you should look deeper and try to find what it causing the differences.

For the most liquid instruments, spreads are usually just a few pips and, therefore, traders view them as they weren’t even existent.

Research shows that only about 1% of all day traders are able to profit net of fees.

The average day trader usually holds his trades for anywhere between 5 and 200 pips. If the spread on your instrument is 2 pips, this will mean that you pay a fee of 10% on trades with a profit of 20 pips. And even if you hold your trade for 50 pips, the spread amounts to almost 5%. Those costs can result in significant drawbacks for your trading system and even turn a winning into a losing system. Therefore, start monitoring spread closely and avoid instruments or times where spreads are high.

If you are a forex trader, you can often see a very strong correlation between certain forex pairs. If you are a stock trader, you will notice that companies within the same industries and sectors, or which are based in the same country, often move together over long periods.

When it comes to money- and risk management this means that trading instruments which are positively correlated lead to increased risk. Let’s illustrate this with an example:

Let’s say you bought the EUR/USD and the GBP/USD, and you are risked 1.5% on each trade; the correlation between those 2 instruments is highly positive (close to +0.90). This means that if the EUR/USD goes up 1%, the GBP/USD goes up 0.90% as well. Having a long position in both the EUR/USD and the GBP/USD is then equal to having 1 position open and risking 2.7% on it [(1.5%+1.5%)*0.9=2.7%].

Of course, this is a very simplistic way of looking at correlations, but it gives you an idea of what to keep in mind when trading correlated instruments.

Taking your trading to the next level is usually very straight-forward because conventional trading wisdom solely focuses on blinking indicators and too-good-to-be-true trading strategies, whereas the things that could really make a difference are left out.

Money and risk management is a very ‘unsexy’ area in the world of traders and it’s only after months of losing money and endless frustrations that traders start focusing on this aspect of trading. You can usually shorten your learning curve, by being more mindful about risk management and it does not take that much.

We have been trading supply and demand strategies for over ten years, and they have stood the test of time remarkably well. Supply and demand is...

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...