3 min read

Scientist Discovered Why Most Traders Lose Money – 24 Surprising Statistics

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...

Everywhere in the web, in trading books or when you listen to traders talk in person you will eventually hear that they suggest trading higher timeframes because of ‘all the advantages’ they offer. The advice to trade daily timeframe is usually given to new and inexperienced traders with the rationale that higher timeframes are less ‘noisy’, offer more reliable setups and grant more time to think about your trading decisions. We’ve taken a closer look at this old trading myth and show you why trading daily timeframes is not easier and even challenges traders more than trading on the lower time frames.

If you have been trading for a while, you will know that patience and waiting for the things to line up before you take a trade is one of the hardest things in a trader’s daily life. How often did impatience make you pull the trigger too early without the confirmation of your trading strategy just to find yourself in another losing trade?

If you trade the hourly timeframes, most traders will get, depending on the system, two to three trades per week per instrument. If we translate this to trading daily timeframes, you will get two to three trades per month, which means that you will have to wait several days and sometimes weeks for a single trade.

Even though you will have more time to monitor multiple instruments, trading daily timeframes will test your patience like never before. If you see an “almost-setup”, but have to wait another day or two, most traders will jump in early and screw it all up, whereas waiting just one more hour is something most traders can deal with.

Money management is one of the main pillars of a successful trader and the timeframe has a direct impact on your money management approach. We’ll shed some light of the fact that trading daily timeframes is especially hard for new and under-capitalized traders.

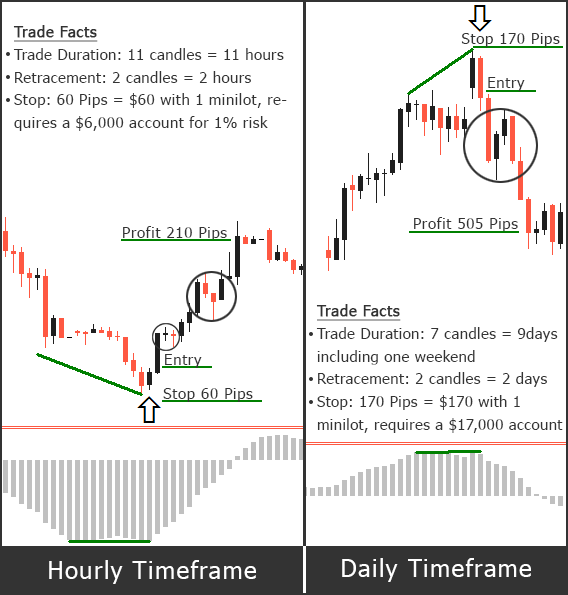

An average stop loss on an hourly timeframe will be around 30 pips which means that if your position size is even just 1 minilot, you risk $30. If you use a reasonable risk management approach and risk 1% per trade, you can trade hourly timeframes with an account as small as $3,000 (1% of $3,000 is $30). In contrast, the average stop loss distance on a daily timeframe will be around 150 pips which means that you will risk $150 if you use 1 minilot; and it would require a $15,000 account to use the 1% risk management approach. If you just have the minimum required trading account, you can’t take advantage of advanced money and risk management techniques such as scaling into a position or scaling out of a position and lack general flexibility.

Although some brokers offer micro lots which would allow you to trade daily timeframes with even less capital, it is very questionable whether it makes sense to wait for several days/weeks for a single trade and then walk away with a potential profit of less than $100 after a holding period of another one or two week. Not only doesn’t it make sense from a money/time perspective, but trading a small account, especially on the daily timeframes is a main reason why novice traders shouldn’t trade higher timeframes. We discussed the effects on your psychology when trading a small account earlier.

If we assume that you waited for several weeks to enter a trade and have a big enough account to use a reasonable risk management approach, you are now faced with the third problem when it comes to trading daily timeframes: keeping yourself from messing it all up. In a different article we showed with a case study that a bad trade management approach can even turn a profitable into a losing trading strategy.

If you trade the hourly chart and hold trades for only one or two days, drawdowns can last a few hours, which is usually already enough to scare most traders out of their trades or make them pull stop loss orders so close to current price that a minor retracement takes them out. If you trade the daily timeframes and hold your trades for two or three weeks, drawdowns will last for several days. You then have plenty of time to move stop loss or take profit orders around, take profits prematurely or close your trade too early because you mistake a retracement with a reversal, not based on sound trade management principles, but on fear and greed responses.

One of the reasons experienced traders and ‘trading-gurus’ suggest trading daily timeframes is because of less danger of sudden price moves and smaller impacts of news releases, but how true is this?

News releases will have a significant impact on trades taken on an hourly timeframe and held for a few hours– the small stop loss and take profit distances mean that short lived, but strong news triggered price moves can take you out of your trade within minutes and close monitoring of upcoming news events is essential being a day trader.

But will moving to higher timeframes free you from the never ending stream of news events? Unfortunately not, but the way news will impact your trading changes if you take your trades on a daily timeframe and hold them for several days/weeks. One of the biggest risks exists because you will have to hold trades over the weekend and unexpected political or geopolitical events can cause prices to move hundreds of pips and create gaps that can easily wipe out a big portion of your trading account – this is especially important to be aware of if you are a forex or commodities trader. A less than optimal solution is to close out trades before markets close on Friday night and re-open them on Monday morning, paying twice as much for spread.

The following graph shows you two trades, the left taken on the hourly timeframe and on the right from the daily timeframe. Whereas the setup looks almost identical (disclaimer: the screenshot should not serve as trading strategy illustration, but to emphasize the concept of the article), the parameters are completely different. As we described above, trading daily timeframes requires a very different mindset and we can sum up the main issues as follows:

Whereas it is true that trading daily timeframes can be less noisy and you will have more time to think about a trade, trading higher timeframes brings a lot of problems that most traders are not even aware of, but significantly impact trading performance. To conclude, we can say that it doesn’t matter whether you trade hourly or daily timeframes, but it depends on your daily lifestyle and your mentality to find a timeframe and a trading horizon that works best for you.

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...

3 min read

Trendlines can be great trading tools if used correctly and in this post, I am going to share three powerful trendline strategies with you.

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...