3 min read

Best Trading Journals of 2024: Which One Should You Choose?

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

9 min read

Rolf

May 8, 2016 8:00:00 PM

Over the past few weeks, we asked 17 trading professionals from all different areas of trading to answer one question:

And here are their answers:

Adjusting your stop and position size based on volatility

The very first rule we live by is: Never risk more than 1% of total equity on any trade. -Larry Hite (Market Wizard)

One of simplest lessons that a trader can learn to ensure long-term success is never risk more than 1% of your trading account on any one trade. This does not mean trading with 1% of your account capital, it means adjusting your stops and position sizes based on the volatility of your stock, currency, commodity, option, or future contract. This way, when you are wrong, the consequences are the loss of 1% of your trading capital. This not only eliminates your risk of ruin for a string of losing trades, but also decreases your stress level so you trade with a clear mind.

One of simplest lessons that a trader can learn to ensure long-term success is never risk more than 1% of your trading account on any one trade. This does not mean trading with 1% of your account capital, it means adjusting your stops and position sizes based on the volatility of your stock, currency, commodity, option, or future contract. This way, when you are wrong, the consequences are the loss of 1% of your trading capital. This not only eliminates your risk of ruin for a string of losing trades, but also decreases your stress level so you trade with a clear mind.

If you don’t understand the reality of losing streaks, then you haven’t been trading long enough to experience a volatile market, or an unexpected event that shakes a stock, commodity, currency or an entire market.

Take trades moving away from the medium-term base

As position traders, we are always looking to take trades moving away from a medium-term base. That way, if we are wrong, the underlying instrument will simply move back into the range and drift.

As position traders, we are always looking to take trades moving away from a medium-term base. That way, if we are wrong, the underlying instrument will simply move back into the range and drift.

Also, look to always trade high probability patterns such as a break from a medium-term base after it has bounced from a long-term trendline. That way, the stop can be placed beneath the trendline which more often than not eliminates whipsaw. You could almost reverse the position on the stop.

Early in your career, you want to survive the learning curve

For the new trader, your goal should be to make all your mistakes early in your developmental process when you are trading very small positions and risking a small amount of your capital. Early in your career, you want to survive your learning curve. Trading too large–putting on too much risk for your account size–exposes you to potentially ruinous drawdowns and can leave emotional scars that don’t readily heal. You want to start your career assuming you’ll make plenty of rookie mistakes and ensuring that those will not erode your capital. One of the great mistakes new traders make is to put pressure on themselves to make a living from their trading. Before you can make your living from trading, you first have to establish consistency and build confidence. Short circuiting your learning process is the greatest threat to learning.

You have to be able to step up and take the next trade without hesitation

Keep your risk small enough that a losing streak will have neither a detrimental financial or psychological effect on you. Assuming that you can even win 50% of the time, which many find they cannot at the outset, you have over an even chance of losing 6 trades in a row. Multiply that by a level of risk per trade and then actually imagine dropping that much financially. And remember it is not enough to still be standing but what is important is that the drawdown does not affect your ability to step up and take the next trade without fear or hesitation.

Keep your risk small enough that a losing streak will have neither a detrimental financial or psychological effect on you. Assuming that you can even win 50% of the time, which many find they cannot at the outset, you have over an even chance of losing 6 trades in a row. Multiply that by a level of risk per trade and then actually imagine dropping that much financially. And remember it is not enough to still be standing but what is important is that the drawdown does not affect your ability to step up and take the next trade without fear or hesitation.

Advice from dozens of interviews with the best traders

@ChatWithTraders | ChatWithTraders

“Never cancel a stop loss after you have placed the trade.” ~ William Gann

First things first, plan the trade. Because failing to plan, is planning to fail…

Regardless of how you determine your position size, know upfront what’s the maximum amount of capital you’re prepared to lose on any given trade. With that in mind, place a stop loss at a price that will ensure you don’t lose a penny more (unless there is a price gap, which is beyond your control).

Regardless of how you determine your position size, know upfront what’s the maximum amount of capital you’re prepared to lose on any given trade. With that in mind, place a stop loss at a price that will ensure you don’t lose a penny more (unless there is a price gap, which is beyond your control).

Now here’s the point I’d like to stress; do not cancel the stop loss, or move it further away from the price it was originally set. Traders will often be tempted to “give it a little more room” as price approaches their stop loss. There are a few problems with this:

Develop a model to objectively grade our setups

@tradeciety

I think static risk and/or following general rules like “always risk 1%” won’t bring you far in trading. Each trade has to be assessed on its own and then the appropriate risk must be applied to it. Only because you can risk 300$ as you have a 30.000$ bankroll does not mean that you SHOULD risk 300$ as this might be too much for your psychological makeup even though it might not be much in relative numbers.

Additionally, we want to maximize returns while keeping account volatility at a minimum by using the correct risk model. Knowing the most important numbers of your strategy over a big enough sample size, which are win rate, longest losing streak, and average risk to reward ratio, it is possible for us to evaluate which position sizes would grant us the highest possible returns without passing our drawdown threshold.

Finally, coming from a gambler background, I think that betting the same fixed amount on every trade is a big mistake. We have to develop a model to objectively grade our setups and then bet more on the A+ setups when they come along while betting less on suboptimal setups. This will further smoothen our equity curve and allow us to plow forward with maximum momentum, because a smooth equity curve will mean increased motivation and a steeper learning curve as well.

Risk is a very multidimensional topic and is way underestimated by most traders. Playing with the risk model that you apply to your strategy will NOT turn you into a winning trader but it WILL increase your profits and steepen your learning curve if done correctly.

Size down during losing streaks to manage your emotions

@Rayner_Teo | TradingWithRayner

I risk 1% of my initial capital on each trade. This means that if I have a 100,000 account, each trade I put on will carry a maximum loss of $1000 (1% of 100,000), excluding slippages.

I risk 1% of my initial capital on each trade. This means that if I have a 100,000 account, each trade I put on will carry a maximum loss of $1000 (1% of 100,000), excluding slippages.

One thing to note is, if the account dips to 95,000, I’d still risk the same $1000, even though it may be more than 1% risk. This is to keep my risk management calculation easy.

Besides the 1% rule, I’ll also reduce my risk during a draw down. So, if I lose 10% (or 10R) of my account, I’ll start risking 0.8% of my initial capital, which is $800 per trade. And I will only increase back my size when I’ve recouped back my losses.

This reduces my risk during a drawdown and helps better manage my trading psychology.

My top 3 risk management tips for novice traders

Get out when you’re wrong and don’t rely on gut-feel only

@OptimusFutures | OptimusFutures

From the observation of our more successful traders, I would say that those who are successful never trade randomly or on gut-feel.

From the observation of our more successful traders, I would say that those who are successful never trade randomly or on gut-feel.

They apply a way of thinking that would allow them to stay in the game long-term, as oppose to thinking about the outcome of each individual trade. When it comes specifically to risk management:

Disclaimer: There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.

Focus on the things you do control

You have to accept the fact that you have very little control over what happens in the market and that “black swan” events will occur again and again in the future. Once you recognize and accept this truth your confidence explodes as a trader because you can now focus on the things you do control such as position size or trade size, strategy selection, overall portfolio diversification, etc. Find your edge and exploit it on a consistent basis. For options traders like me, it’s selling overpriced option volatility year after year.

You have to accept the fact that you have very little control over what happens in the market and that “black swan” events will occur again and again in the future. Once you recognize and accept this truth your confidence explodes as a trader because you can now focus on the things you do control such as position size or trade size, strategy selection, overall portfolio diversification, etc. Find your edge and exploit it on a consistent basis. For options traders like me, it’s selling overpriced option volatility year after year.

Slowly build your account and risk tolerance

@SMBcapital | Watch Seth’s video answer here: Seth F. about risk tolerance

Let the trade play out organically and slowly remove emotions

@DanShep55| AccessATrader Since new traders are mostly under-capitalized, this translates into being emotionally engulfed into every trade. Since lack of process is missing from their foundation, the risk aspect of the trade turns into a guessing game. Most enter the trade with the mentality of not to lose instead of to win because of a lack of education. New traders can’t handle the trade going against them even a few pennies despite the best setups. They translate this as failed setup instead of just organic order flow from both buyers and sellers.

Since new traders are mostly under-capitalized, this translates into being emotionally engulfed into every trade. Since lack of process is missing from their foundation, the risk aspect of the trade turns into a guessing game. Most enter the trade with the mentality of not to lose instead of to win because of a lack of education. New traders can’t handle the trade going against them even a few pennies despite the best setups. They translate this as failed setup instead of just organic order flow from both buyers and sellers.

The best advice I like to give new traders is to allocate 1% max pain to every trade of your total account value. If you have 30k account, then allocate only $300 per trade of max pain. This will accomplish several things:

#1 it will allow you to size up/down depending on your style of trading giving you the biggest bang for your buck

#2 it takes out the guess work where the trade can go.

Keep in mind we are not fortune tellers. We have to let the trade play out organically. This will slowly remove emotions from your trading. Most importantly, having a fixed max pain will start building confidence equity for trades to follow. Keep in mind, you can have the best money management, however if you are not trading with an advantages process then it’s all irrelevant. Chase your dreams and don’t be afraid to be great.

Only take the trades you love

Giving a new trader access to the market is much like giving a child the keys to the candy store. The child may know he shouldn’t be eating all the candy he has access to, and yet, it’s nearly impossible for him to avoid the temptation of doing so.

Giving a new trader access to the market is much like giving a child the keys to the candy store. The child may know he shouldn’t be eating all the candy he has access to, and yet, it’s nearly impossible for him to avoid the temptation of doing so.

The new trader is no different. All of a sudden, he is given the keys to trade markets whenever he wants. As much as he knows he shouldn’t be trading all the time, he simply can’t resist the urge to always have a position running, irrespective of whether the position makes sense or not.

My recommendation to new traders is that they should only take trades they love! There is always a trade you can convince yourself you ‘like.’ But if you only take trades you ‘love,’ you will find yourself trading a lot less frequently and far more effectively.

Fix your risk for your trades and be more selective

@BreakingOutBad | BreakingOutBad

The simplest thing in my opinion that a trader can do is fix their risk to between 1 – 2% of their initial account balance per trade. Then, size each position based on 1) the amount of capital risked (1% of initial account balance, for example) and 2) the stop loss location relative to the trade entry location for each trade. If you automatically maintain the same risk parameters per trade (which forces you to be more patient in waiting for only great quality setups, since the risk is distributed evenly for each trade), then you will be less likely to take huge losses since your risk is always predefined for each trade and it becomes second nature to use that same amount (1R). Make risk management as mechanical as possible so that you aren’t tempted to “size-up” and inevitably blow your account to bankrupt trader hell.

Cut your position size in half and keep your “tuition fees” low

@MichaelGLamothe | ChartYourTrade

Trade small, trade small, trade small! Trading is a business that we largely learn on the job. As we test out different strategies and get our trading education, sustaining losses along the way is inevitable. When we are first starting out, we call these losses “tuition fees.” The best way to keep our tuition as low as possible is to trade small. Whatever you think your account size should be, try cutting it in half. As an example, when I first started trading, I started with only $10k. Trading fees are so low now that you could start trading with far less.

Focus on the reward to risk ratio and you don’t need a high winrate

When putting on positions, the position sizing is a function of my objectives and overall investment process. I risk 3-4% of my equity per position because that’s what suits my investment process and my objectives, which are gains of 20% per year.

When putting on positions, the position sizing is a function of my objectives and overall investment process. I risk 3-4% of my equity per position because that’s what suits my investment process and my objectives, which are gains of 20% per year.

I have a concentrated portfolio now of 6-10 positions, and I am willing to hold those position for several months or more. I am looking to capture medium term reratings, which should generate significant gains. That means that I am looking to make 30-50% on positions that work. On the flip side, I will cut them if they are down 10%. That gives me an extremely favorable risk to reward on each position, and I only need one winner in four to be profitable overall. As such I can afford to risk 3-4% as that will get me to my goals.

Some of you may think- if he has 6-10 positions, and stops out at 10%, then how does he risk 3-4 of his equity? The quick answer is leverage. I usually have well over 100% gross exposure, so my average position is 25%+ of my equity.

Never take a trade only to make up for a recent loss

@OptionTradingIQ | OptionsTradingIQ

Never revenge trade. Losses happen to everyone and the sooner you can accept that loss as part of the business of trading a move on the better. Never make a trade purely to try and make up for a recent loss.

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

4 min read

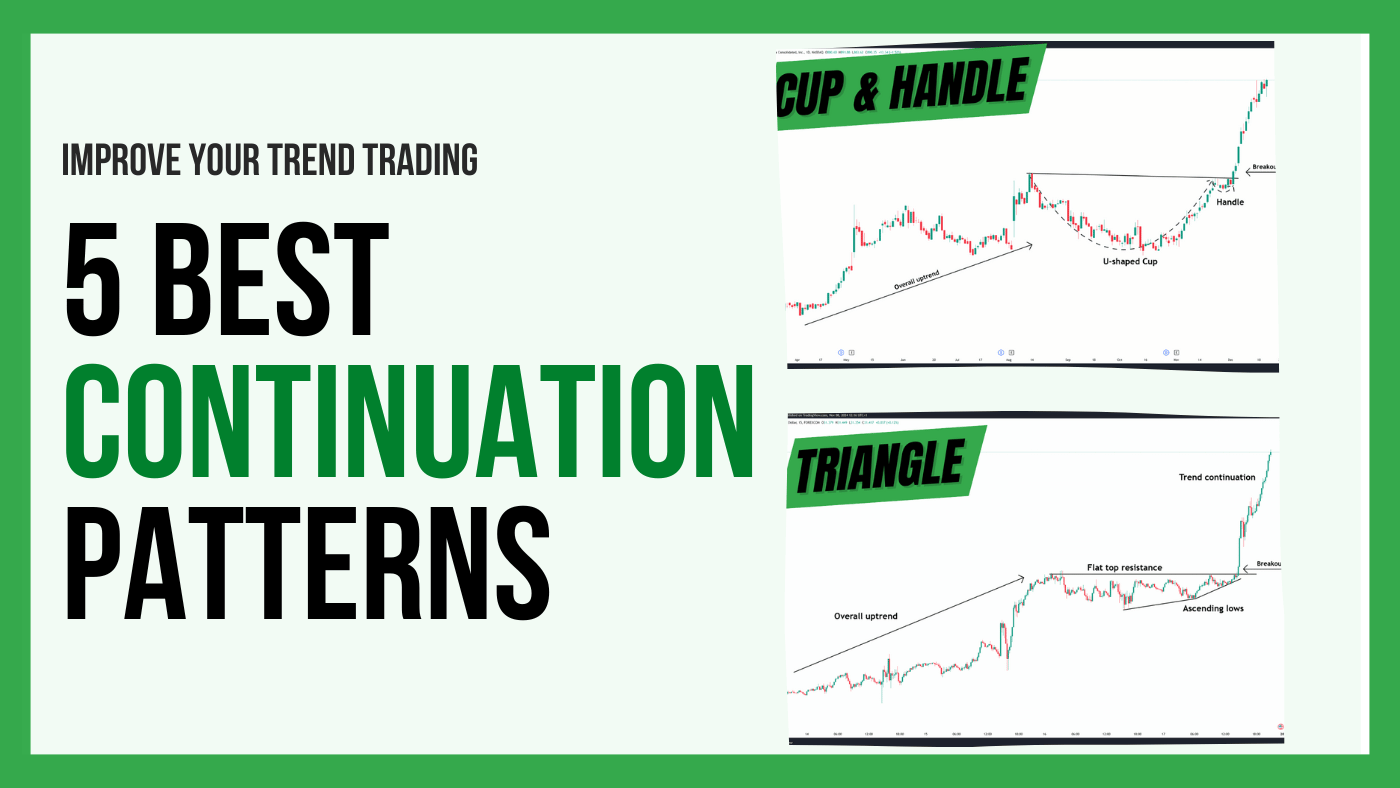

Trading successfully depends on recognizing market structures and patterns that indicate whether an existing trend will continue. Trend continuation...

3 min read

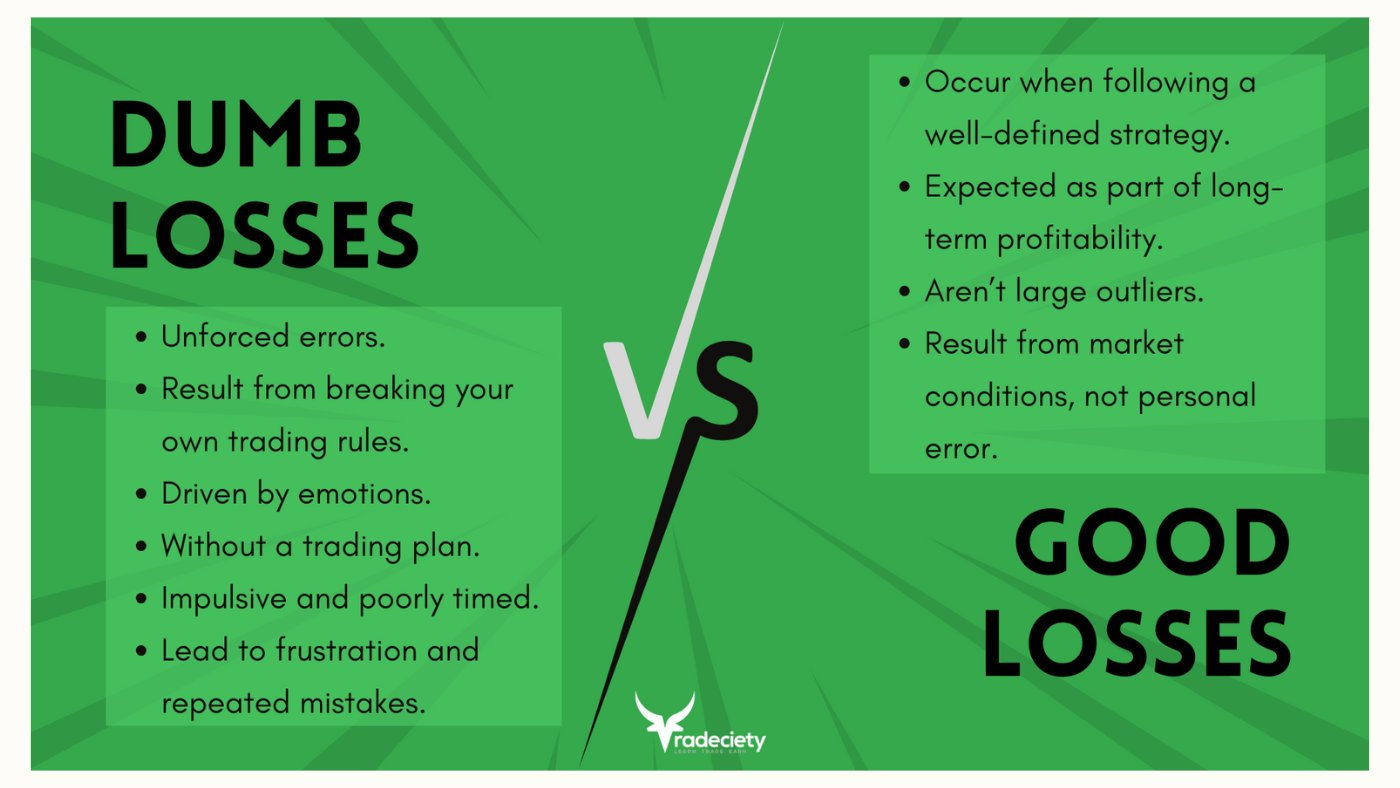

No matter how good you are as a trader and how great your trading strategy is performing, sooner or later, you will experience losing trades. What...