3 min read

Best Trading Journals of 2024: Which One Should You Choose?

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

Professional and profitable trading strategies have to be SIMPLE. Trading is already very hard and dealing with emotions, controlling risk management and responding to changing markt cycles is not easy and that is why your trading strategy has to be simple to avoid mental clutter.

Of course, simple does not mean that it is going to be easy, but a simple trading strategy allows you to understand your charts in an effective and efficient way. You have to be able to look at a chart and see instantly if there is a trade or not. In my trading, if I have to spend more than 30 seconds looking at a chart, wondering if there is a trade, it’s a clear sign that I am forcing something that isn’t there. The best trades will jump at you.

The best trading pattern is the Head and Shoulders and even literature suggests that the Head and Shoulders provides high predictive value (read Schabaker’s book about technical analysis). But why is it that the Head and Shoulders works so well? For that, we have to look at the individual parts and components of this pattern and see how much information such a chart really provides. You’ll be surprised to learn the depth of market information one can gain by looking very closely at the Head and Shoulders.

Let me walk you through it from left to right (starting just before the Head and Shoulders) to see what we can learn from it:

It’s important to understand the rationale behind the patterns you use because it allows you to trade them with more confidence. In the case of the Head and Shoulders, it’s very obvious and straight forward what it tells us about the market and the trade.

You see, the head and shoulders is not just a random signal that shows us when to buy or to sell, but it describes the rhythm of the market. I enjoy watching the markets from such a perspective because it really feels like you are following the buyers and sellers and wait for that moment when the powers shift.

The Head and Shoulders is a universal principle that works on all timeframes and all markets.

There is a little more to the Head and Shoulders than just looking at a neckline break and the quality of such a setup can be improved significantly if you know what you are looking for.

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

4 min read

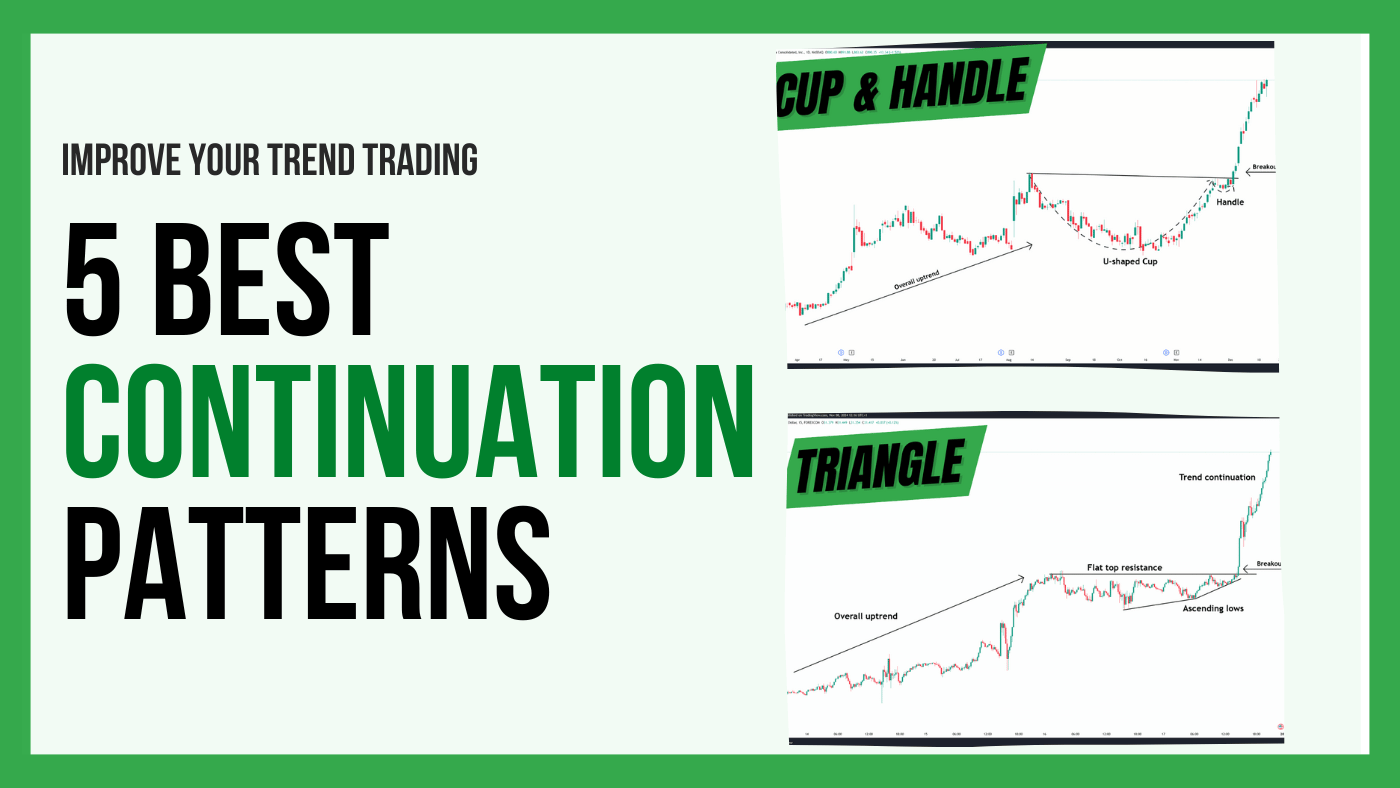

Trading successfully depends on recognizing market structures and patterns that indicate whether an existing trend will continue. Trend continuation...

3 min read

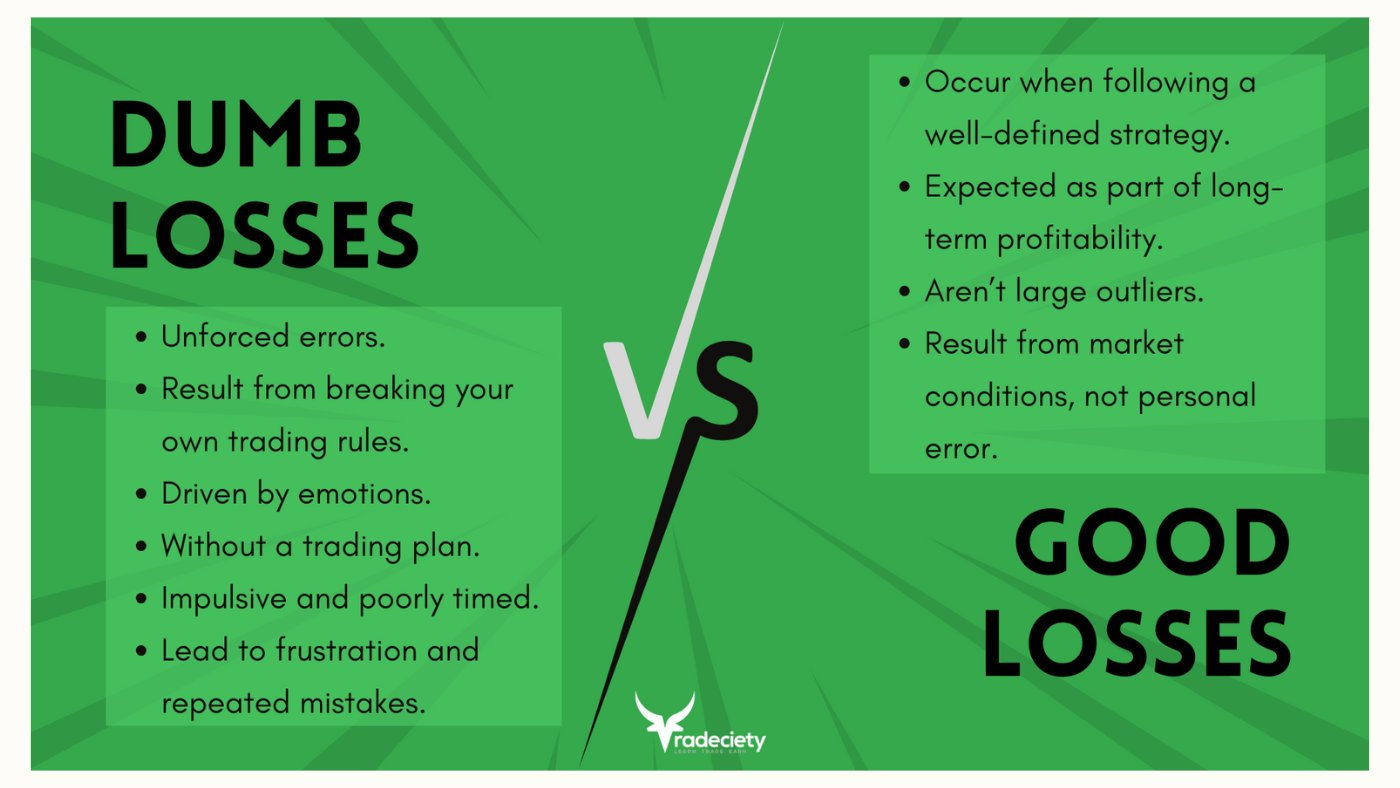

No matter how good you are as a trader and how great your trading strategy is performing, sooner or later, you will experience losing trades. What...