3 min read

Scientist Discovered Why Most Traders Lose Money – 24 Surprising Statistics

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...

Let me put it out there: It doesn’t matter which strategy or system you use. Any trading method can make you money. And by trading method, in this context, I mean the way you define entries and signals. This is a bold statement, but I stand by it. They way you read charts and the way you define entries has usually nothing to do with the quality of the system and whether or not it is profitable. This is especially true when it comes to technical analysis.

Technical analysis and price action analysis seems so easy and simple. The patterns look very clear and obvious to an inexperienced trader but the truth is, that technical analysis and price action trading is maybe one of the most subjective and difficult to master trading styles out there. You don’t believe me? Other ‘trading experts’ usually say the complete opposite but keep on reading and you will see how technical analysis is not what you think it is and why it is harder to master than traders believe

I can reassure you that this article isn’t going to badmouth technical analysis – in the end, I am a huge fan of technical analysis myself – but to serve as an eye opener and provide you with a whole new perspective on the way technical analysis and trading works. We have talked about system hopping frequently before and one of my main goals over the past years on Tradeciety has been to make sure that traders stop system hopping as much as possible. Your trading shouldn’t be about hunting new and ‘better’ entry methods, but building a robust trading approach that looks and combines all concepts of trading and here are a few thoughts of mine…

This is a statement no technical trader wants to hear. Traders choose to become technicians because they don’t want to deal with the uncertainty and the subjectivity fundamental traders have to face, right? Isn’t the advantage of being a technical trader that you can easily draw some horizontal lines, channels or identify pre-defined price action patterns?

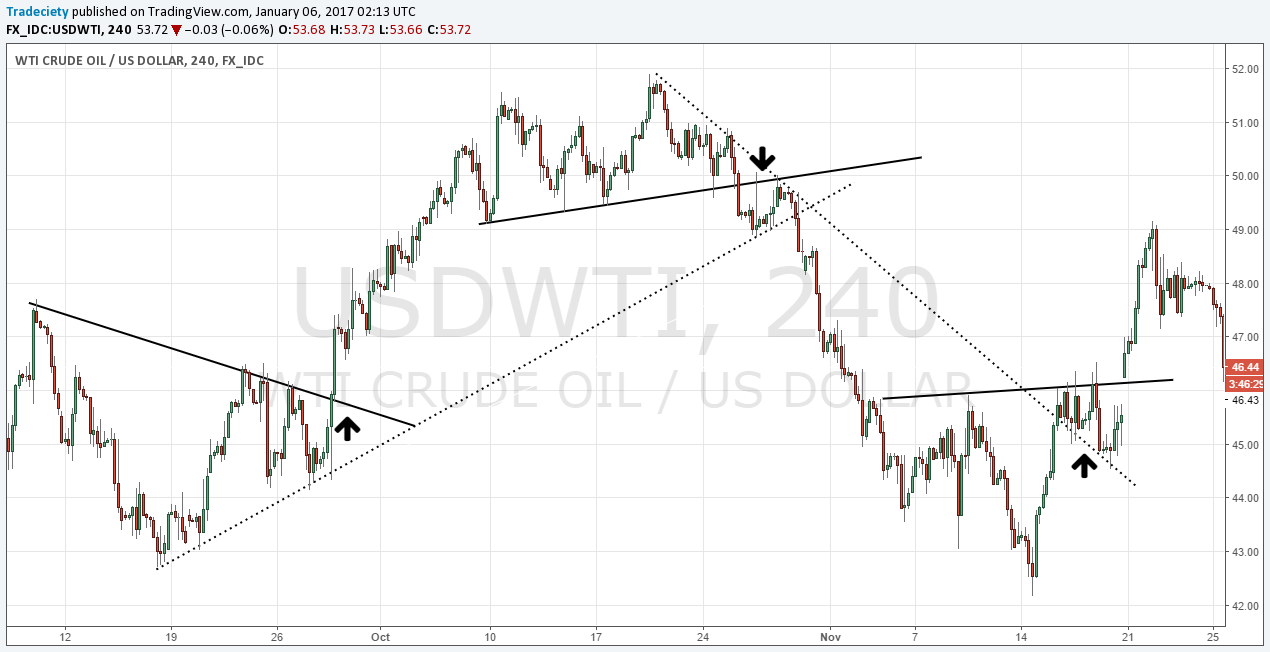

To start off, let’s observe the following charts. They all show the same instrument with the same timeframe over the same time horizon, but with different price action patterns and tools. The point is, as I mentioned before, it does not matter which system or method you choose. A profitable trader is not characterized through his way of choosing entries, but it goes much deeper.

We start by just looking at trendlines and trendline breaks. The signals look good and very clean for the most part.

But not all traders like trendlines and so another trade might choose to look for head and shoulders patterns which could have given the same trade signals basically.

Moving averages are also very popular and they are used to identify cross-overs and then get into longer term trend-following trades. The signals look very good as well and a trader could probably improve the quality of the signals by adding another moving average to create a moving average crossover system.

The Stochastic indicator analyses momentum and momentum shifts. In its purest form, the trader looks for a cross of the two Stochastic lines between 80/70 and 30/20. Looking at the screenshot below, we can see that the Stochastic indicator could also have been used to identify good trading opportunities and catch some longer term trends as well as trade some of the shorter term ranges in between.

Of course, we cannot go without horizontal support and resistance and local swing highs and lows. You can see that we can nicely explain the same chart using those classic technical analysis concepts as well. We look for bounces at the levels or breakouts of levels.

And finally, we can even spot a ‘puking camel‘ pattern 😉

The message is clear: you can take any chart, pull up a random timeframe and apply any price action pattern or indicator to it and find (potentially) great entry spots and ways to ride trends for hundreds of pips. This called the hindsight error and a trader needs to be aware of that to make the right decisions.

If you look closely at each individual chart above, you can see that, although the entry signals look very clear and the trades seem profitable, in real-time trading, this would have been much harder because we haven’t looked at what is really important: emotions, execution, orders risk management and trade management.

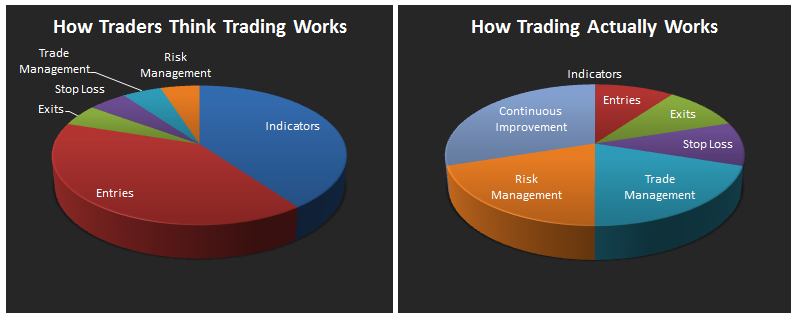

Again, I want to highlight the point that a trading method cannot be reduced to how you pick your entries alone. Only amateurs think this way. Let’s go over each point and see how it impacts a trading system.

Emotions

Obviously, emotions are a big deal in trading and they impact all our trading decisions. From FOMO when we enter a trade, to risk management, trade management, dealing with drawdowns during a trade and exiting trades. Thus, the first thing you need to do is to make sure that emotions are influencing your trading decisions as little as possible. This is far more important than the question which pattern or indicator to use.

Execution and orders

How do you really define an entry and where do you place stop loss and take profit orders? Even the best entry is totally worthless if your stop and profit placement are off because you will run into stop runs, take profits too early or too late and give back money.

Trade management

Micro-management is a big deal and we have talked about it before. Many traders mismanage their trades when they let their emotions take over, or when they don’t have a real trading plan and know what to expect.

Risk management

A trader with inconsistent money and risk management can easily destroy the best entry method. Being clear how much you risk, what your minimum reward : risk ratio is and how to apply leverage are fundamental concepts and a trader has to master them before looking at entries.

The role of entries and spotting patterns is totally overrated in today’s world of trading and entries should have a very small role in your trading. I say it again: it does not matter which system you follow, any method can make money and any method can lose money. Entries are not relevant to the profitability of the system. Instead, focus on the other things to build a robust trading method. Once a trader is aware of the other components of his trading method, he will be able to look at his way of trading in a completely different way.

Let’s come back to the hindsight error and something most traders miss when it comes to technical analysis. Most traders look for those textbook patterns and very clear moves but those same traders are usually always the ones who are left behind, wondering how they could have lost money on seemingly profitable patterns.

Price action patterns and price moves are ‘imperfect’ which means that they don’t follow your textbook rules. Price is a very dynamic concept and it’s important to understand how other traders are out to get you. At the same time, it’s important to internalize the imperfection and get a feeling for volatility and natural price movements to be able to manage stops and trades in general.

On the left site, you can see the textbook patterns which traders expect and try to trade. However, what really happens is that you see stop runs, squeezes, back and forth and lots of volatility.

Again, entries and finding patterns is overrated and it’s not about how you time your entry, but everything that follows: stop placement, reward:risk ratios, trade management, exit taking, risk management, etc.

One of the main reasons why traders are unable to make money by following technical analysis is the lack of knowledge about the importance of discretion in trading. Especially patterns such as Head and Shoulders, support and resistance, trendlines, Cup and Handle, Elliot Wave, Triangles, Wedges, Flags and Pennants are very discretionary when it comes to entries, stop loss and take profit placement.

Technical traders face dozens of difficult and very subjective questions each and every day: where do I draw my second shoulder? Is this the neckline? Do I connect the wicks or the bodies? Is this the candle where my triangle starts? Is it an actual wedge? Which candle do I use to connect the tops for my trendline? Should the handle of the cup be a little higher? Is the divergence from my MACD already confirmed? Did price successfully re-test my moving average, or do I wait another candle? Is this a strong enough breakout or do I need to wait more? How likely is a retest of my neckline and what does it mean for my stop loss? Is this a retest or a failed breakout? etc.

I urge you to stop putting all your time and energy into finding better ways to enter a trade or exploring different ways to time entries and instead focus on the other parameters of your trading system. I have never seen a profitable and successful trader who spends the majority of his time looking at entries. The best traders obsess about developing a robust system and spend most of their time looking at risk management, order placement, trade management, profit taking, managing reward:risk scenarios, etc.

The single most important point about this article is: stop obsessing about entries, stop hunting for better ways to time trades. Pick ONE method and make it work instead of jumping from one thing to the next. If you are losing money right now, it’s not because your entries suck. We have seen it with hundreds of traders when working with Edgework: what keeps traders from reaching profitability is not because they pick the wrong entries, but because they neglect everything else.

The following tips will help you structure your trading approach and add some objectivity to the subjective world of technical analysis.

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...

3 min read

Trendlines can be great trading tools if used correctly and in this post, I am going to share three powerful trendline strategies with you.

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...