4 min read

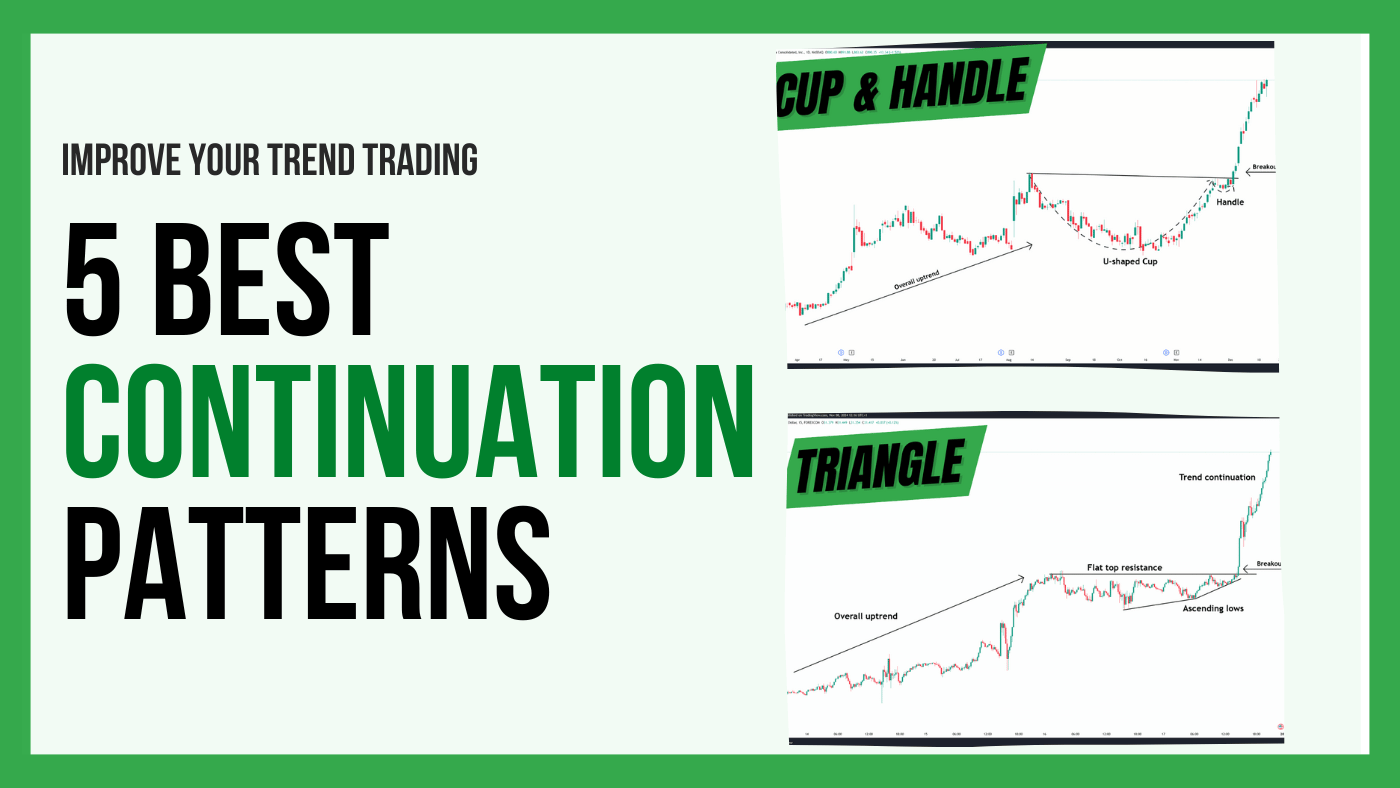

The Best Trend Continuation Chart Patterns

Trading successfully depends on recognizing market structures and patterns that indicate whether an existing trend will continue. Trend continuation...

4 min read

Rolf

Nov 7, 2016 7:00:00 PM

Over-trading and micro-management (continuously fiddling around with your trades and orders) are among the main reasons why traders fail and very few understand why they are over-trading and even fewer know how they could stop this bad and expensive habit.

In this article we take a look at the most common problems many traders face, how they could eliminate a lot of the problems that come with over-trading and micro-management and how to become a better trader by trading less.

The 80/20 rule says that 80% of your results come from 20% of your actions – this is a widely accepted principle in many areas of our daily lives and in business. Famous examples are: 80% of your sales come from 20% of your customers; 20% of your sales reps close 80% of the deals; 80% of the complaints come from 20% of your customers; 80% of wealth is owned by 20% of people, and so on…

In trading, the same applies and 80% of your results come from 20% of your actions. However, most traders don’t fully understand that the things they attribute the least importance to will actually make the real difference in their trading.

What you should be doing more of:

Things that don’t add much value and should be avoided:

The 5 last points are huge time wasters (I know that because I have been there myself), but most traders approach trading in the complete opposite way of what they should be doing and they spend the majority of their time on things that don’t help them become better traders.

Micro-management is a HUGE performance killer for most (read: all) traders. Here are things traders do when they micro-manage their trades:

The set-and-forget approach is the complete opposite: after you have done your analysis and placed your trade, you set your stop loss and profit orders and then don’t look at your trade again. You let price do what it will do anyways and wait for price to either reach your profit or stop order. No manual interaction with your trade anymore!

I have seen first-hand that such an approach not only improves the quality of one’s trading, but it also boosts the performance when traders stop micro-managing their trades. The main reason why traders can’t stop this habit is because they don’t trust their system, they only think about the money involved, they haven’t validated their edge or don’t have any trading rules at all.

Screen-time can be a good thing if you know what you are looking for. But if you just flip through time frames, hunt for signals, without really knowing what to expect, you are setting yourself up for failure.

Boredom is a dangerous emotion and it always leads to bad trading decisions, especially if it is combined with excessive screen-time. Here are some tips on how to create a better trading routine and eliminate boredom:

Most traders approach their trading very differently and often follow the same, old and generic advice that eventually brings them all very similar results. Maybe it’s time to do things differently and follow a new path if what you have been doing did not make you a better trader…

The need to trade is often what breaks the amateur trader. Having a trading edge means that you have a way of identifying very specific situations and price constellations that provide a positive long-term expectancy. Most traders make the mistake of believing that they have to be in the market all the time.

[bctt tweet=”You may have a bias, but this does not automatically mean that you should be in a trade.” username=”tradeciety”]

It’s so important to understand the premise of your system and know under which conditions you have an edge and when you don’t. Traders have to be more selective and only enter when their system tells them to do so. Although this is very obvious, it’s hard to find amateur traders who follow this approach – this is where common sense isn’t so common in trading.

Focus on making 1 good trade a week – that’s really all you need.

Take a look at pilots, physicians and other professions where little errors can end very badly. In all those fields, it’s common to use checklists to ensure that their standard procedures don’t get messed up. Traders can and should do the same. Trading is a game of pattern recognition and the process of scanning for and entering trades usually does not change. Thus, it’s very easy to implement a checklist that you go through before entering a potential trade. First, a checklist makes sure that you don’t forget anything, it also makes you more aware of your decisions and it holds you accountable.

Do you want to become a trader because you want to trade or because you want to make money? In a recent interview, Jack Schwager described the importance of trading less to trade better nicely when he talked about Kevin Daly whom he interviewed in his book “Hedge Fund Wizards”:

Although Daly’s stock selection contributed to his success, being out of the market when the environment was highly averse to his strategy was the key factor underlying his superior performance. Or, in other words, the trades not taken were more important than the trades taken.

With the help of this article you should step back and audit your overall approach to trading. Here are the key take away messages from this article:

4 min read

Trading successfully depends on recognizing market structures and patterns that indicate whether an existing trend will continue. Trend continuation...

3 min read

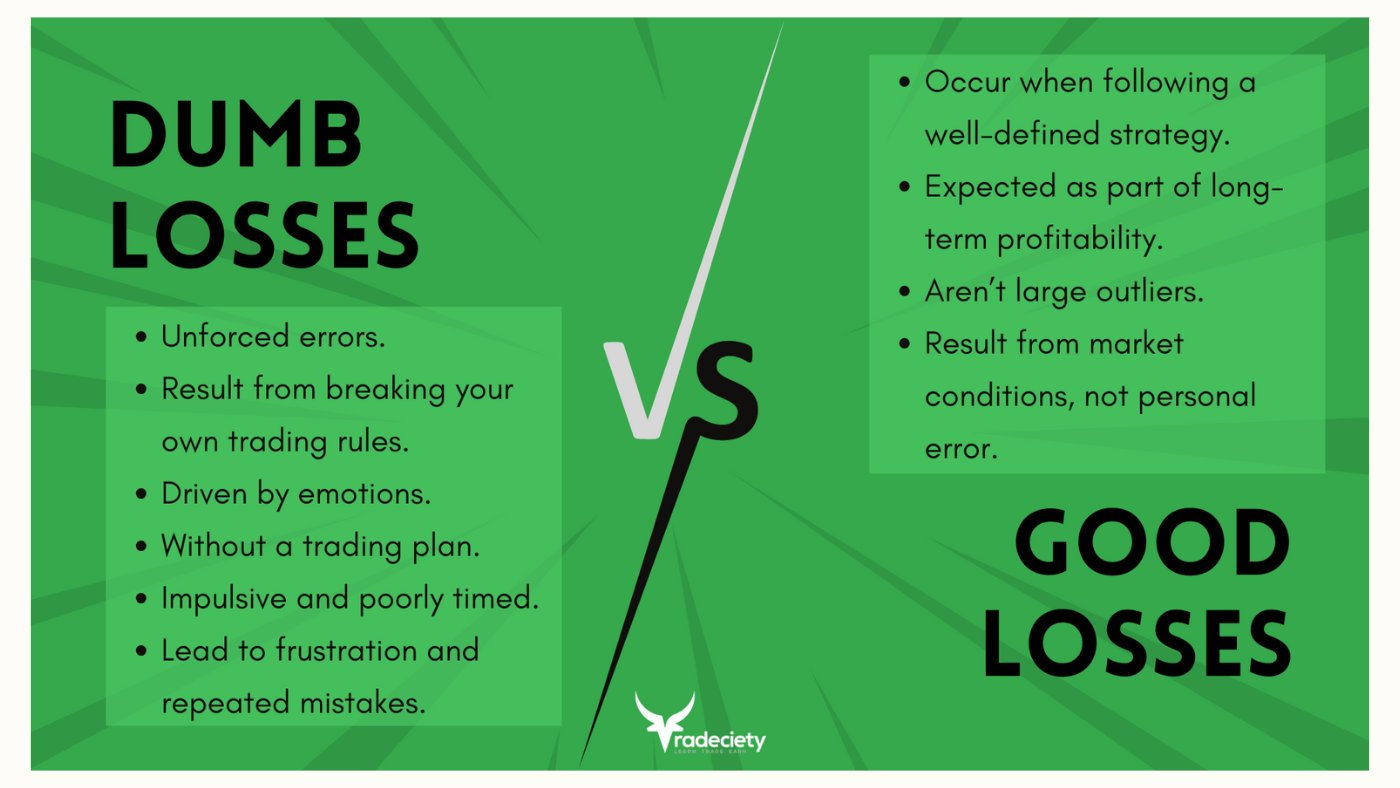

No matter how good you are as a trader and how great your trading strategy is performing, sooner or later, you will experience losing trades. What...

7 min read

Forex trading, also known as foreign exchange or FX trading, is one of the most popular financial markets in the world. With over $6 trillion traded...