3 min read

Scientist Discovered Why Most Traders Lose Money – 24 Surprising Statistics

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...

How do you find great trades? When it comes to being practical, most traders have a very wrong approach – if they have an approach at all. Especially as a technical trader, it is essential that you choose the right markets you are trading very wisely. Even more important, you constantly have to reevaluate whether the market you chose last week is still good or not for your trading today. This principle is called watchlist rotation (well, I just made that up so don’t bother googling 😉 ) and it means that you regularly screen and pre-select the markets you trade from a larger pool of markets.

Every trader will agree that there are different market cycles and that all instruments alternate between the different phases with varying degrees: ranging and consolidations are followed by trends that then sometimes turn into longer and strong trends, until the trend slows down and enters a range or reverses into a new trend. Of course, it’s not always that clear cut, but you get the idea.

Those individual periods (each circle) can last hours, days or weeks and a single trading system is usually only going to work during one of those periods: range strategies only work during ranges, momentum strategies only work during trends and reversal system work only during when momentum is fading during a trend.

A trader who just follows 1 or 2 instruments often ends up forcing trades because he can’t be selective enough with the general market environment. That’s why I use a larger market pool where I pick my pairs every week depending on the price environment and why having a watchlist is key.

If you are like most traders, you probably have a very specific trading approach and a trading method that focuses on one pattern or setup. Furthermore, your system most likely favors one type of market environment. Let me explain what this means with my trading and it will become obvious.

I am a pure reversal trader and my system works very well under certain and very specific conditions, but it fails miserably most of the time. When I created and improved my system, I became VERY clear what the optimal market looks like for me and what price behavior I need to avoid.

As a reversal trader, I don’t trade during: ranges, breakout scenarios, very early trends, trends with only one trend wave, very explosive trends, high volatility market, pre-news situations and around absolute highs and lows. This leaves only very few, very specific market conditions where I might look for trades: trends with very clear swings and with at least 2 trend waves, close to important key price levels, moderate volatility and where price hasn’t breached the 20 SMA on the 4H for quite some time. You can see that you won’t find such a market very often and even once I find such conditions, it does not mean that I get a trade – it’s just my first screening process.

Tip: Become VERY clear about your trading system, what defines a good trade, how does the chart have to look like to signal a good environment and when do you stay away from a market.

Once you know which market conditions don’t work and which ones do work for your trading method, we can move on to look into utilizing a watchlist and then see how I structure my whole approach.

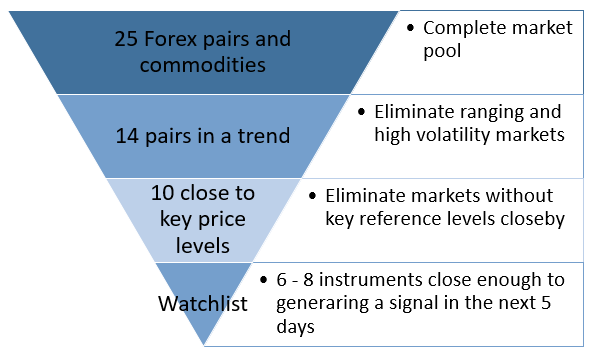

First, I always start with my larger ‘market-pool’ which includes roughly 25 selected Forex majors, Forex crosses and a few commodities and indexes. Every week, I will then go through those 25 markets one by one and first see which ones show the market conditions I need for my trading method. Usually, I can immediately eliminate 30/40% because they are not in a trend or have too much volatility. During the next step, I only keep those instruments that are trading close to important price levels – mainly support/resistance, supply/demand, swing highs/lows, double tops/bottoms. In the final step, I eliminate all those pairs that are still trending too strong and don’t show signs of fading momentum. At the end of my screening process, I have narrowed down my initial 25 instruments to 6 – 8 which I will then analyze closer and write trading plans for – those are the articles you find on Tradeciety.com every Sunday as market preparation.

Further reading: Forex resources and Forex trading tips

Once I have narrowed down my 25 instruments from my market pool into 6 – 8 instruments for the week, I will sit down to write a trading plan for each one. A trading plan consists of ‘if-then’ scenarios where I create potential trade scenarios and what I want to see before I enter a trade.

1) My Sunday routine

Although it takes me roughly 4/5 hours every Sunday from market pool to trading plan, I never miss my Sunday routine. Without a thorough analysis and well-prepared trading plans, I don’t even bother trading. With a trading plan, on the other hand, I can trade with full confidence because I know that I have done my preparation and that I am perfectly prepared for the week. I don’t miss trades, I am not chasing price, I know when to trade and what, noting surprises me and I just sit back and wait.

2) During the day

After I have done my Sunday preparation, I set my price alerts at the key price levels that I have identified and then wait until the alarm goes off. I don’t look at charts throughout the day and I don’t flip through timeframes – trading is then just waiting.

3) Mid-week update

After the Tuesday market close in the US, I will go through my watchlist pairs again and cross-check with my trading plan to see what has happened so far in the markets and what I expect next. Here I will update my trading plans, eliminate the instruments that don’t show interesting setups, write new trading plans for new potential setups and then set my price alerts again.

This is a very different approach when you compare it to the general (losing) trader who is glued to his screens all day long and does not really know what he is looking for until he stumbles over a trade or randomly enters bad setups. I highly recommend giving my approach a try if you are still struggling; it might sound like more work but, in fact, you can save a lot of time once you have done your preparation.

Every now and then, I stumble over a new market when doing my research and when something peaks my interest, I will start my screening process to evaluate whether it is worth having an instrument in my market pool. When I screen a new instrument, there are a few very specific things that I look for, especially when it comes to price action and price analysis. I included a video below that shows how I screened a new instrument, the USD/SGD, before I added it to my market pool.

Since I trade purely technical, it’s very important to see that price action is actually adhering to conventional concepts of technical analysis. I mainly analyze how trends and trend waves move, if supply/demand and support/resistance is applicable and if I can spot any other patterns.

Although an instrument may adhere to principles of technical analysis, the level of volatility is important for me. A market that moves back and forth too much, has wicks that can easily take you out or where whipsawing is a common behavior, make an instrument unattractive to me.

I don’t backtest or run simulations, but I briefly go through the most recent price history and try to find some signals based on my criteria. I try to see how price is reacting under such circumstances and whether it would be tradable or not. You’ll be surprised but different markets and instruments often follow very different patterns.

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...

3 min read

Trendlines can be great trading tools if used correctly and in this post, I am going to share three powerful trendline strategies with you.

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...