3 min read

Best Trading Journals of 2024: Which One Should You Choose?

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

6 min read

Rolf

Nov 3, 2015 7:00:00 PM

The following article is a guestpost by Yvan Byeajee. Yvan is a full-time trader. ; hloves travelling and spends his time doing so. When he is not trading he blogs at Trading Composure

Have you ever heard of the word “Atychiphobia?” This might strike you as a complex and strange sounding word (and it is), but in simple terms, it is defined as a crippling fear of failure. I’ve spent many years of my life trying to break free from this fear and along the way, I have learned certain truths about the reality of our experiences that I want to share with you in this article.

We’ve all heard platitudes such as, “it’s okay to be wrong”; “everybody makes mistakes”; “it’s by falling that we learn”, etc. These are very true, but they are shared so often these days – especially through social media – that I feel that such axioms are not as impactful anymore as they maybe once were. While we may understand their meaning, when it comes down to us as individuals, right here and right now, if we are proven wrong suddenly this goads frustration, discontentment, anger, exasperation… you name it.

Understanding something doesn’t automatically enable us to act on that which we understand. In other words, there is a huge difference between understanding something to be true and believing from a deeper core that something is true. The reason is because when you believe that something is true, usually your behaviors are aligned with that belief.

We know for a fact that most people do everything they can to avoid being wrong. I think this is a problem, not only for us as traders but also as individuals. Furthermore, it is a problem for all of us collectively as a culture. So what I want to do today is, first of all, talk about why we get stuck inside this need to be right and second, why it’s such a big problem. And finally, I hope to convince you that it is possible to step outside of that feeling – and if you do, it is the single greatest leap you can make forward, not only market success but also freedom as an individual.

The cause is rather insidious and goes to the core of the foundation of our society. Our current educational process came about not to really educate children but to develop good employees. These highly skilled workers have to be able to think and come up with new ideas, but they also have to be good employees and do what they’re told. This is achieved through our educational process where kids are taught to learn what they’re taught. They are fed with facts; they are tested on those facts, and the ones who make the least amount of mistakes are considered to be the smartest ones. The ones with the lowest scores suffer the pain of shame.

The educational system spends no time teaching us how to learn from our mistakes and how to rebound from failure, yet this is critical to real learning in the first place. Society as a whole marginalizes us if we don’t live up to its standards. It conditions us to a life of always striving for perfection – even when no such thing exists.

Early on we learn to avoid painful experiences that come as a result of being wrong – and failing – and we develop a passion for being right. For those of us who embark on a journey to become self-sufficient and self-directed traders, entrepreneurs, and innovators, we start our journey completely unprepared for the reality that awaits us.

Instead of flowing and adapting to uncertainty, we desperately try to create it even where it doesn’t – and cannot – exist! As traders, we crave the sense of certainty that analysis and the numerous indicators on our charts appear to give us, and our egos hang onto every trade we place.

Up and down moves in the markets make our moods swing like a pendulum. And when we are proven wrong, we freak out because according to what we have learned and grew to believe, getting something wrong means there is something wrong with us! So we naturally insist and try harder to be right because that is what we feel we must do. It makes us feel smart, responsible, virtuous, and safe. But it’s a fallacy and a never ending cycle unless we learn to break out of it.

Inflexibility breeds mediocrity and acknowledging this fact allows us to play the game differently. We have to learn to let go of our need to be right and instead embrace uncertainty. This is the only way to change our experience of trading to something that is truly fulfilling. A mind open like the sky allows us to see that:

These truths are important to know because they point out to the inefficacy of our inflexibility – which is really the cause of our inability to sustain positive trading results! Drop your need to be right, your whole experience of trading will change!

I cannot promise you a magic pill that you could take and instantly make you become more tolerant and compassionate towards yourself. And whatever I advocate will give you results only if you practice it regularly as I do.

We need moments of surprise, reversal, and “wrongness” to color our lives. And only insofar as we learn to detach ourselves from beliefs that are limiting in their nature, that we can find genuine fulfillment in anything that we do, more so in everything that we are. This truth, seen through the right angle, can prove to be quite liberating. Since we cannot control anything that is outside of ourselves, we ought to learn to be at peace with everything that escape our control. When we cultivate a sense of ease in the midst of uncertainty, we allow things to happen the way they want to. And this letting go of trying, wishing, and wanting to be right, has the potential to engineer for us not only consistent trading results but also emotional well-being. It is the single greatest moral, intellectual, and creative leap one can make.

If you want to read more on the subject, I recommend this articles: Traders, let go of control! Yvan is also the author of the amazon best selling title, Zero to Hero: How I went from being a losing trader to a consistently profitable one — a true story!

Image credit:

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

4 min read

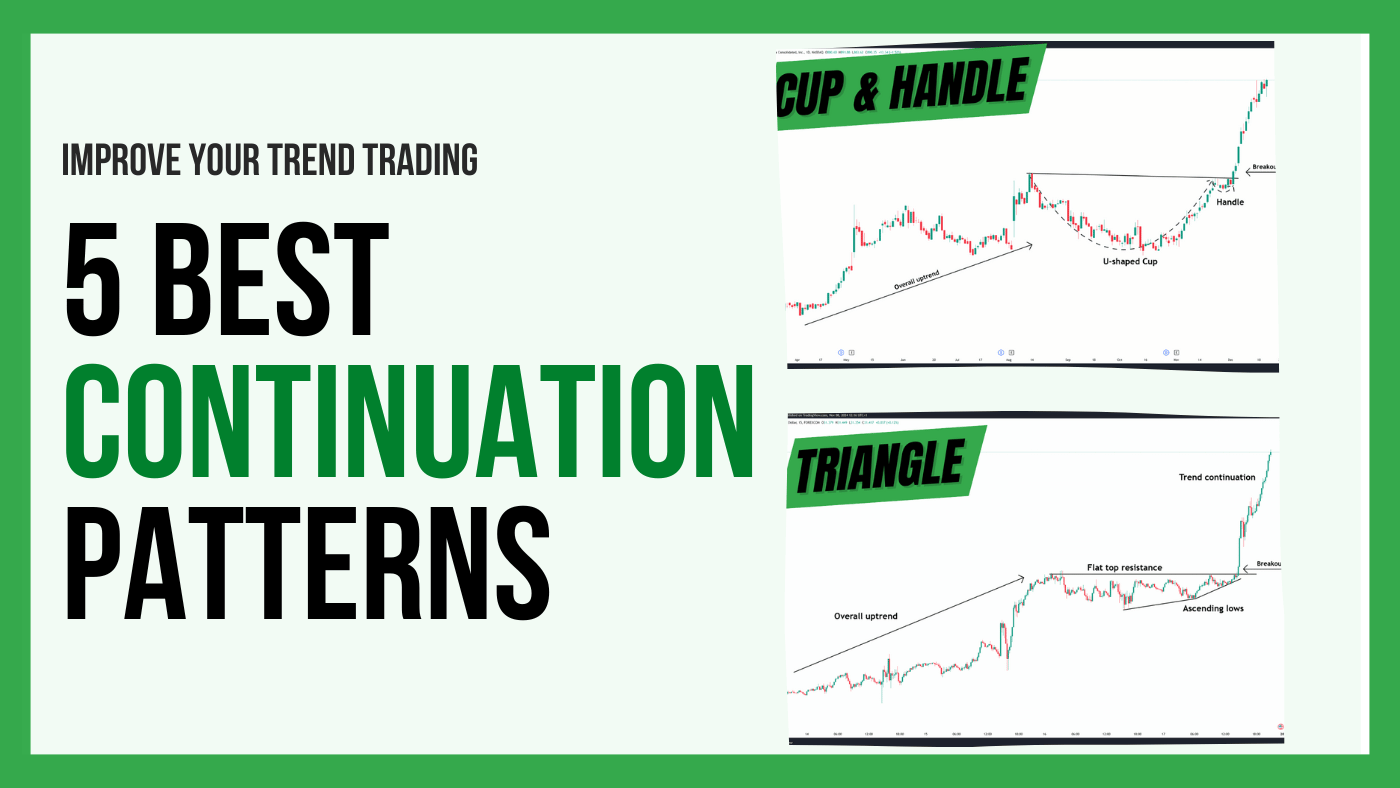

Trading successfully depends on recognizing market structures and patterns that indicate whether an existing trend will continue. Trend continuation...

3 min read

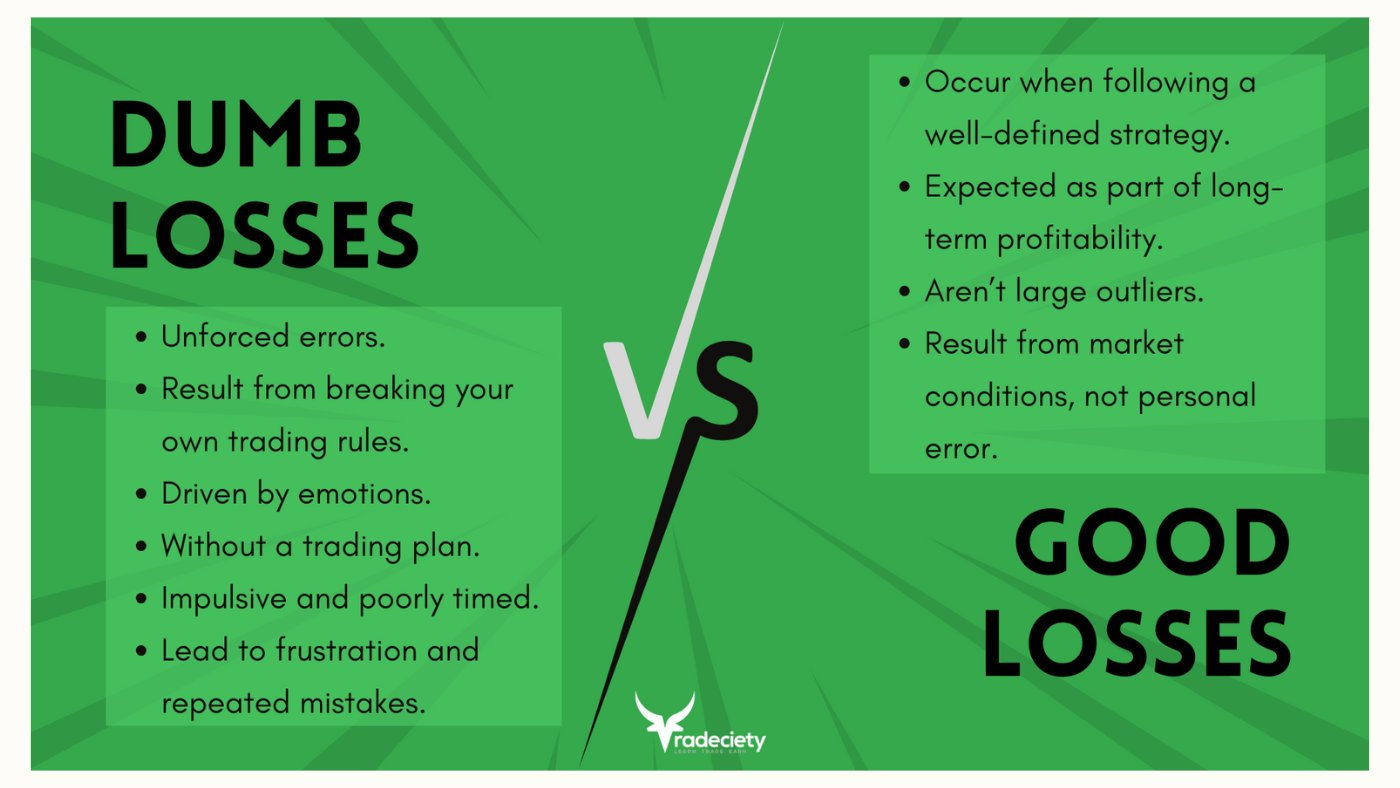

No matter how good you are as a trader and how great your trading strategy is performing, sooner or later, you will experience losing trades. What...