3 min read

Scientist Discovered Why Most Traders Lose Money – 24 Surprising Statistics

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...

3 min read

Rolf

Sep 10, 2015 8:00:00 PM

Learning from losses is important as a trader and it’s a key component for trading success. On the other hand, amateur traders often learn the wrong things from their trades, especially from their winning trades. Unlearning negative trading behavior is very hard once you have adopted a certain pattern and that’s why being aware your behavior is very important. We have compiled a list with the 6 worst lessons that a winning trade can teach you.

Setting a stop loss further afar when price is moving against you is one of the major cardinal sins in trading. The thought process and motive behind widening a stop loss is that you believe that price might turn around any second, that you don’t want to realize a loss and be proven “wrong”.

What happens is, though, that you let losers get out of hand and a small loss turns in a major hit, wiping out all previous gains. Widening a stop loss is a reinforcing pattern and traders keep moving the stop further afar each time price moves against them, until they reach the point where it doesn’t make a difference if you lose 12% or 18% of your account and so you keep widening the stop.

The worst thing that can happen is that price eventually turns and you can avoid the loss because you won’t learn the real lesson. Then, some day you will be in a positions that won’t turn.

“If you can’t take a small loss, sooner or later you will take the mother of all losses.”

– Ed Seykota

Adding to a losing position can, potentially, enable you to get out of the trade faster because it brings down the average price of your entry. However, amateurs who average down do this without having any real plan behind it and purely follow their emotional responses and just try to get out of a losing position faster.

Adding to a losing position usually leads to large losses. Never ever add to a losing position if you don’t have a real plan behind it. Adding to a loss with the goal in mind to get out faster for a scratch-trade is one of the most insane things a trader can do – and it’s a sure sign that professional trading is not possible any time soon.

This one is somewhat similar to ‘adding to a loser’. Buying right after a loss is also called revenge-trading. To be clear, there is a big difference between emotional revenge-trading where you just try to prove that your trade idea is still correct and getting back into a trade because you SEE VALID signals that you should take another trade.

If you have a problem with revenge-trading, you should separate yourself from your trading platform after a loss. Go for a walk, listen to some music or just go and read a book for 30 to 60 minutes until you have cooled off.

Amateur traders often use a larger position size to make up for a losing trade. If you have lost 1% on 5 trades in a row and are down 5%, you only need one winning trade if you risk 5% on your next trade. But, what usually happens is that your next trade after 5 losers in a row is not as good because you are in the wrong mindset and you suddenly find yourself down 10%.

During a losing streak, don’t increase your position size. Analyze what caused your losses and don’t try to take shortcuts.

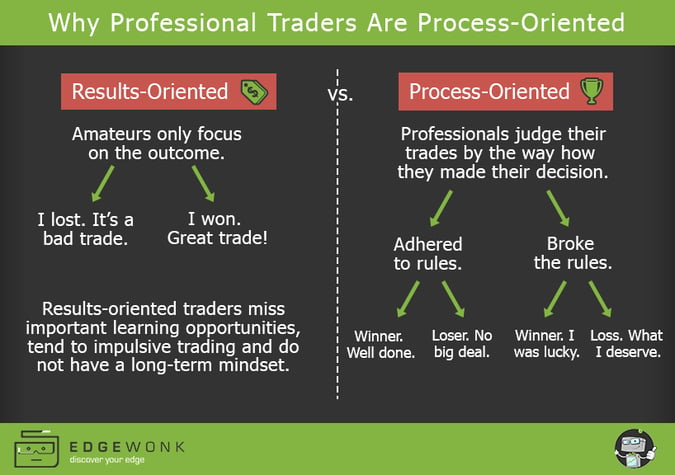

image source: Edgewonk.com

This one is among the most common reasons for trading failure. Traders often fear that they are going to miss the next big trade. They then try to outsmart the markets by entering prematurely without seeing all their entry criteria met – calling it gut-feel or intuition.

Having trading rules and following a trading method is pointless when you don’t have the patience to wait for the right time to pull the trigger. Traders who just can’t find the patience and don’t follow their rules are merely gambling and they depend on luck and chance.

This doesn’t sound like a bad problem to have but it is a big performance killer. Traders who get too greedy with their winning trades often try to squeeze out a few extra points by widening their profit order and hope to make a few extra bucks. What then often happens is that price reverses and eats up some of their unrealized profits.

Traders should usually stick to their initial trade idea and follow their profit and stop loss orders. Our views and ideas can get clouded when we are in a trade and we then stop the rational thinking and just focus on our P&L.

3 min read

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this...

3 min read

Trendlines can be great trading tools if used correctly and in this post, I am going to share three powerful trendline strategies with you.

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...