3 min read

Best Trading Journals of 2024: Which One Should You Choose?

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

The end of the year is near and many people will start the new year with great resolutions, high ambitions, and big goals. But then once February comes around, everyone is back to normal and the good intentions are forgotten. And then, end of 2018, everything starts all over again and most will never see any progress. Quite pathetic.

One of the reasons why it’s so hard to follow through on your new year’s resolutions is because most people don’t have an action plan and they don’t know how to go from where they are to where they want to go.

In this article, I want to give you a few tips and specific steps on how you can turn your trading around, create a professional trading strategy and make the next 12 months YOUR year.

Whenever we look at a chart, we can identify specific scenarios and market phases. It does not matter which market or timeframe you follow, any market will show the same behavior over time.

Of course, it won’t always look the same and the sequence and the rhythm can vary, but the following market phases make up any price chart:

You might say that this is too theoretical and real charts look differently, but I disagree. Just take a look at the chart below and you can see how the market follows the exact same rhythm. With a little bit of knowledge about market selection, you can find such phases all the time.

A big mistake many traders make is that they pick one or two indicators or tools and then try to apply them to their charts all the time, regardless of which market phase is present.

It is important to understand that each indicator and tool is designed for a very specific situation.

For example, a moving average is best used during trends and if fails during consolidations; oscillating indicators are used during ranges and not during trends; momentum indicators can be used during trends and reversals but fail during consolidations and pullbacks.

Once you are clear which type of trader you want to be and which market phase, you want to specialize in, you can pick your tools.

I, for example, almost exclusively trade tops and breakouts. For that reason, I use a combination of trendlines, moving averages, support/resistance, and other tools. I will skip all other market phases and I do not try to use my indicators and tools in any other way.

You need to specialize if you want to trade successfully and you have to pick the right indicators and tools for your chosen field.

| Market Phase | Indicator & Tools To Use |

| Bottom / Consolidation | Support/Resistance, Oscillators (Stochastic, RSI etc) |

| Breakout | Support/Resistance, Momentum indicators (MACD etc) |

| Pullback | Support/Resistance, Moving averages, Trendlines |

| Early trends | Trendlines, Moving averages, Momentum indicators |

| Consolidations | Support/Resistance, Oscillators, Trendlines |

| Late trends | Moving averages, Momentum indicators, Trendlines |

| Market tops | Chart patterns (Head and Shoulders, etc), Support/Resistance, Trendlines, Oscillators |

| Reversals | Moving averages, Support/Resistance, Trendlines, … |

Whether you trade trends, pullbacks or breakouts, you can find them across all timeframes and it does not matter which timeframe you pick because the patterns will work across all timeframes.

No timeframe is better than the other.

But, every trader is different and you have to choose the timeframe that makes sense to YOU.

Do you like action and you can think quickly and emotions are not a big problem, then the lower time frames are better.

If you like strategic thinking, you can be patient and you are comfortable with staying in trades longer, then the higher timeframes can be a good fit.

Please never ask “which timeframe is the best” because it’s impossible to give an answer here. What is important is that you get to know yourself and then choose the right timeframe for your personality and your mindset.

Now comes the fun part. Once you are clear about which type of trader you want to become, which market phase(s) you want to trade, which tools you choose and the timeframes you want to trade, you need to create rules.

Only when you have rules, you can create a professional strategy. Without rules, your results are going to be all over the place. You need to come up with rules for:

Once you are clear about that, you have a trading strategy!

Now you need to start trading with your rules. You will quickly start seeing patterns in the markets. You will notice what works well and what doesn’t. Then you can make slight adjustments and steer your trading strategy in the right direction.

A good trading journal will help you with that as well.

I have taken thousands of trades using the exact same rules, following the same setups. I know my system by heart and I know what to expect from the different phases which I specialized in.

This process might take some time but it’s worth it and there is no way around it.

3 min read

Choosing the right trading journal is essential for traders wanting to analyze performance, refine strategies, and improve consistency. In this...

4 min read

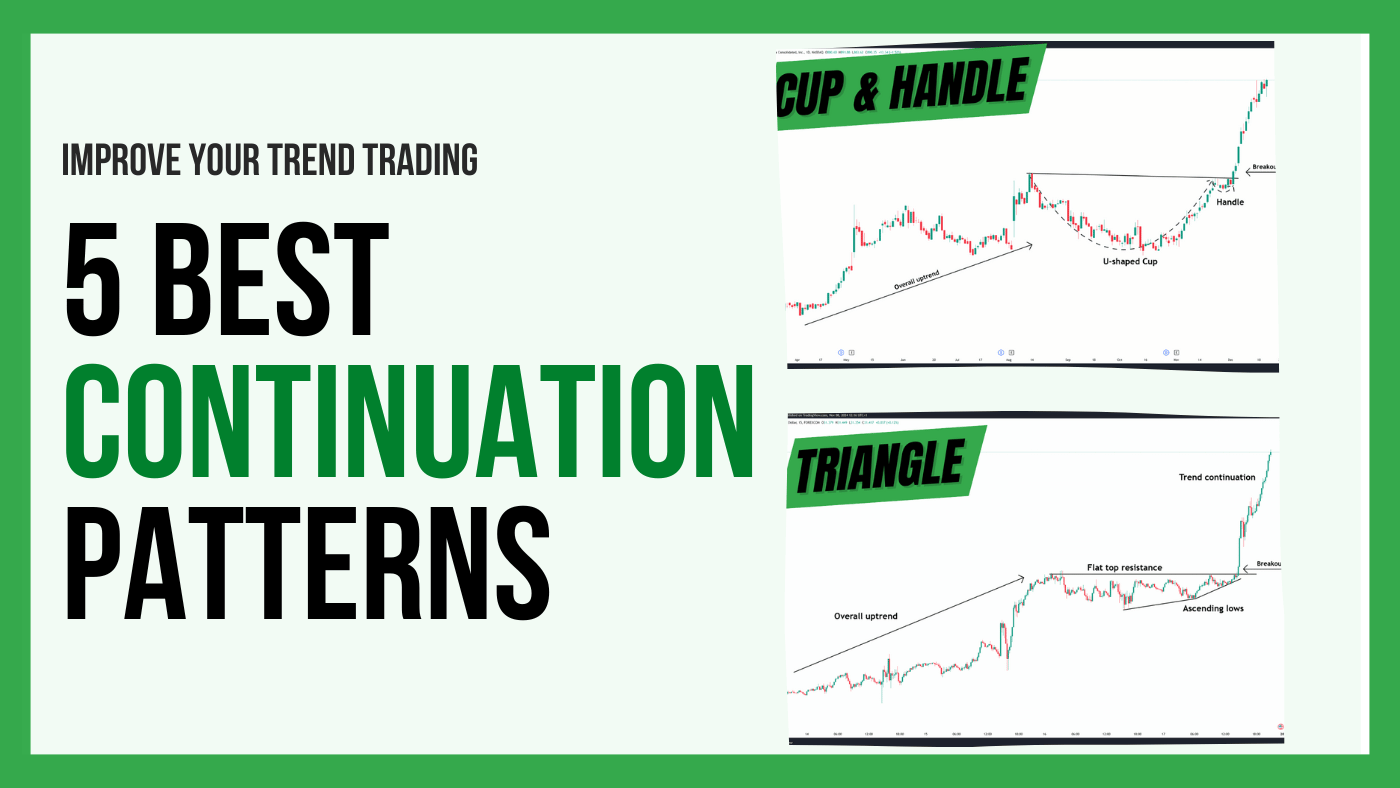

Trading successfully depends on recognizing market structures and patterns that indicate whether an existing trend will continue. Trend continuation...

3 min read

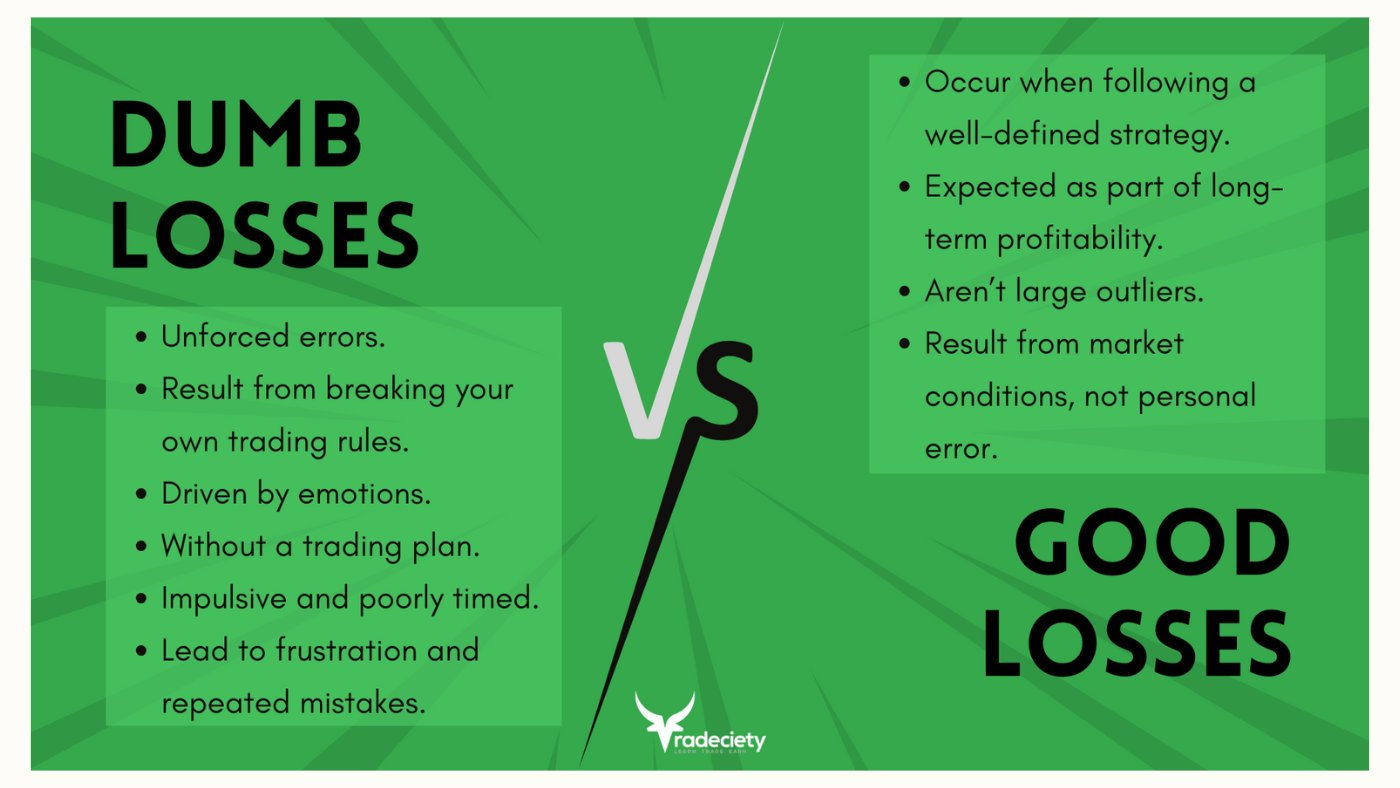

No matter how good you are as a trader and how great your trading strategy is performing, sooner or later, you will experience losing trades. What...